A Complete Payroll Compliance At Your Hands With factoHR

factoHR offers you a online payroll software that handles all your payroll scenarios and guarantees accurate compliance for all the payment options.

Peace Of Mind

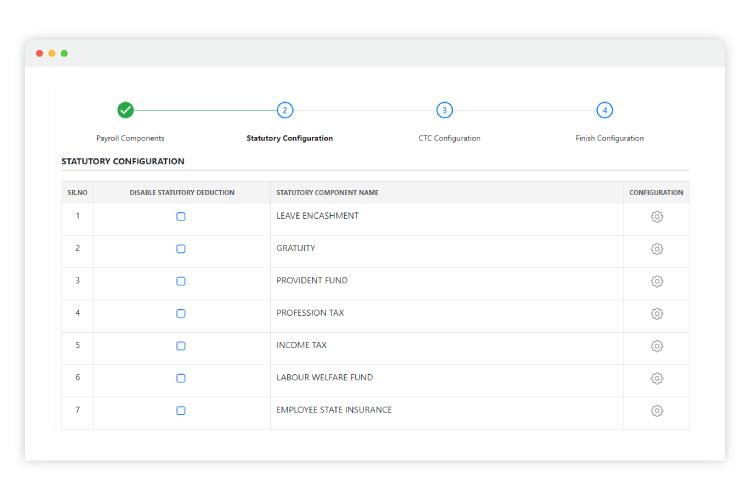

With factoHR’s comprehensive solution, you no longer have to check statutory compliance at every level, as once you have configured the rules, compliance will be automatically guaranteed.

Zero Penalty Costs

The system’s accuracy allows you to be legally compliant in all matters and minimizes the risk of penalty and legal invasion.

In-house Management

No requirements to assign your compliance control to an outsourcing agency or any third-party software, as factoHR can do it in-system for you.

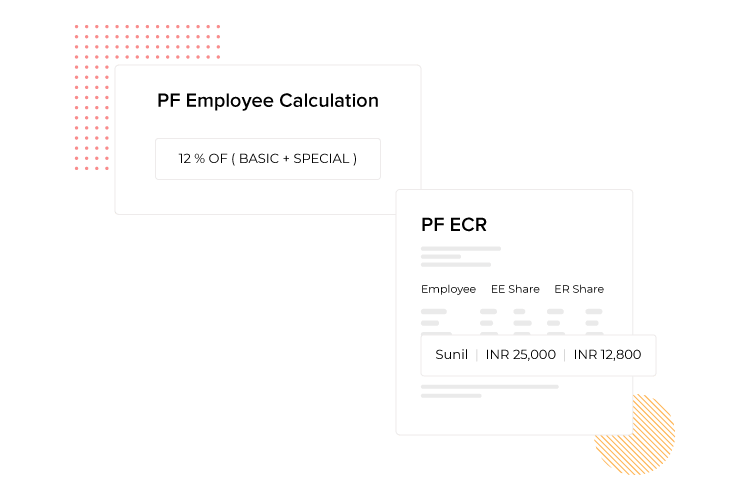

Provident Fund Compliance

With factoHR, configure your provident fund rules and select the PF wage components for employees’ salary calculation just as you want. The solution also allows you to run PF arrears calculation and generate PF JV as proof of your accounting transactions.

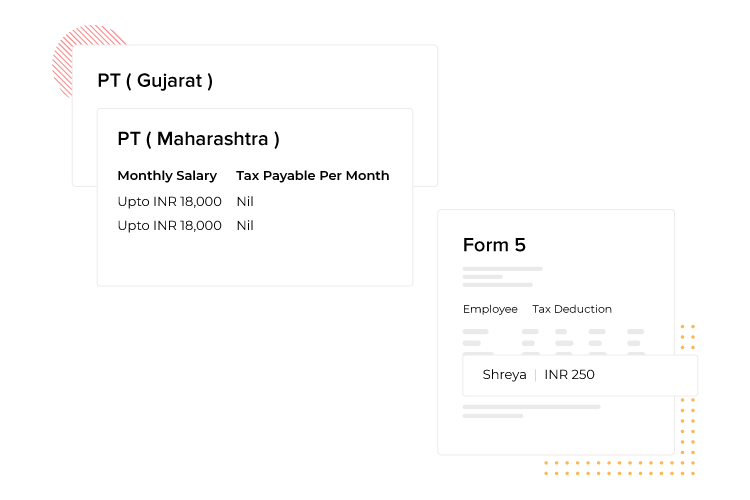

Professional Tax Compliance

factoHR’s complete professional tax compliance takes away your burden, lets you compute it for different state-wise rules, and allows you to generate the legal Form 5. You can also handle complex situations with customized options where it is easy to set up a base location(for smooth calculation) for an employee who has joined at a different location but is working from a different one.

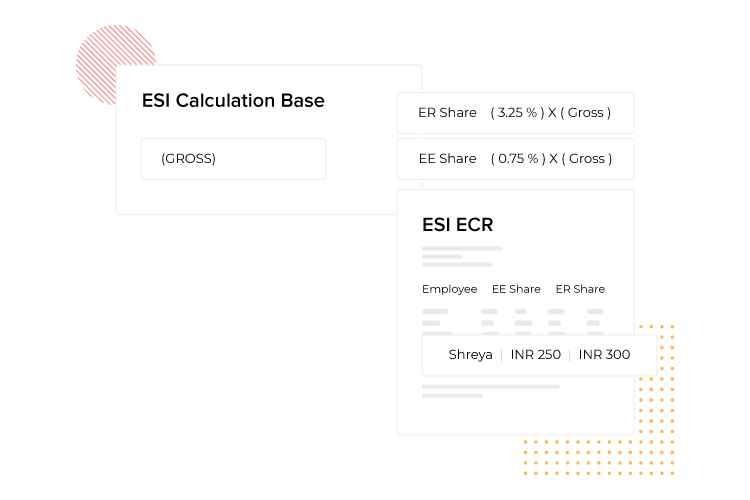

ESI Compliance

factoHR allows you to compute ESI wages for employees for a block of 6 months, in addition to the calculation of arrears. Similar to the PF calculator, you can choose particular ESI wage components to run the calculation.

Maintain your organizational legality with factoHR

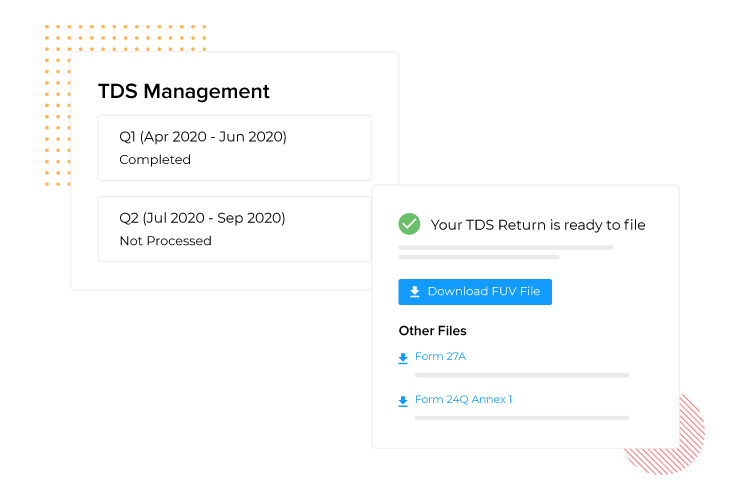

IT Return Filings

The solution enables end-users to generate Form 24Q. Users can also file income tax returns and ensure data validates while maintaining income tax compliance.

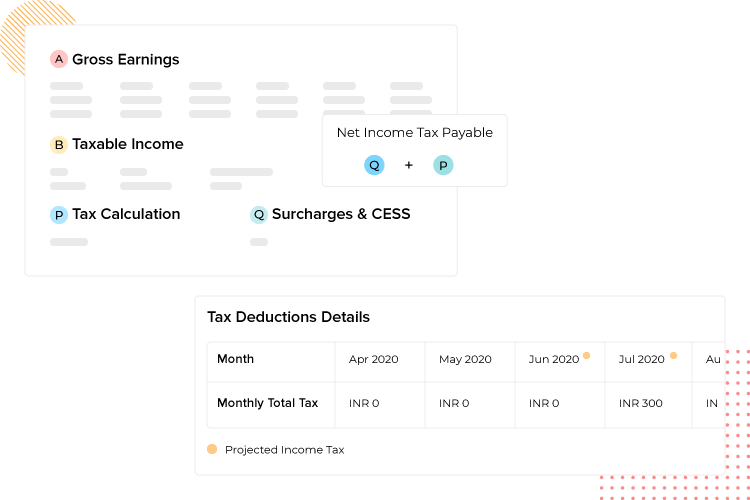

Income Tax Adjustments

Carry out TDS adjustments for various salary components falling under the prorated and lumpsum income heads. This allows you to handle monthly salary payments and tax deductions along with one-time payments like incentives, leave encashments, and other ad-hoc components easily.

Income Tax Compliance

factoHR simplifies income tax computations during the salary processing and lets you deduct the TDS amount for different sections. You can also ask employees to submit their investment declaration proofs through the system, which can be considered during the calculation.

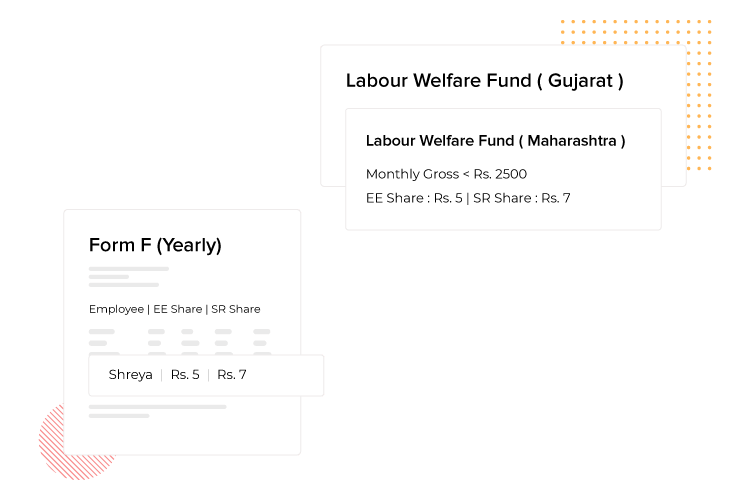

Labour Welfare Fund Compliance

factoHR allows you to consider the labour welfare fund component within the CTC structure and lets you deduct the necessary amount under the fund during the salary processing.

Make your processes more compliant with factoHR today

Ensure compliance at every organizational stage with factoHR’s payroll compliance and leave your payroll calculation worries behind.

© 2024 Copyright factoHR