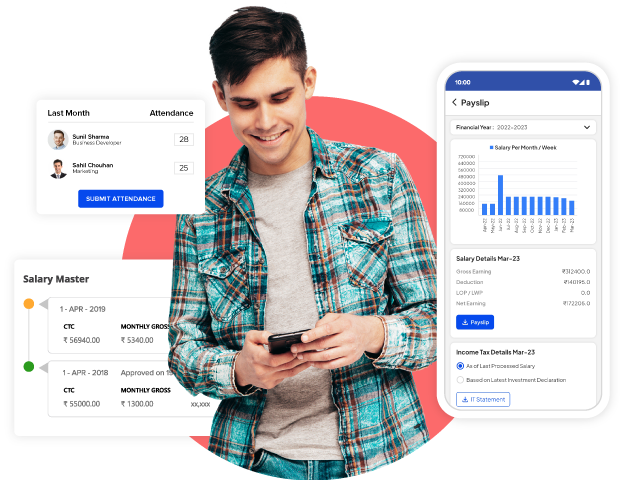

Mobile App & Ess Portal

Self-Service for the Mobile Workforce

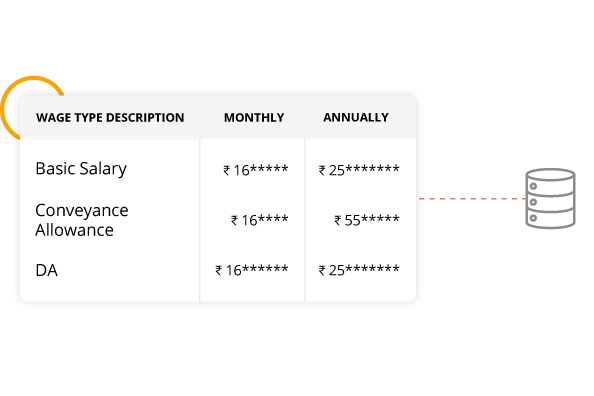

The next-generation mobile app and employee self-service portal allow employees to view compensation, income tax, and other relevant information on their mobile devices and desktops at all times.

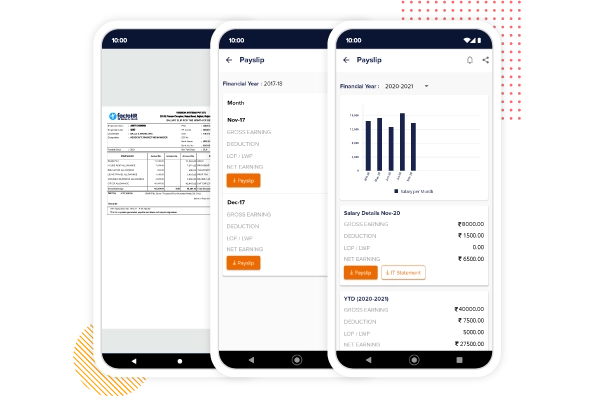

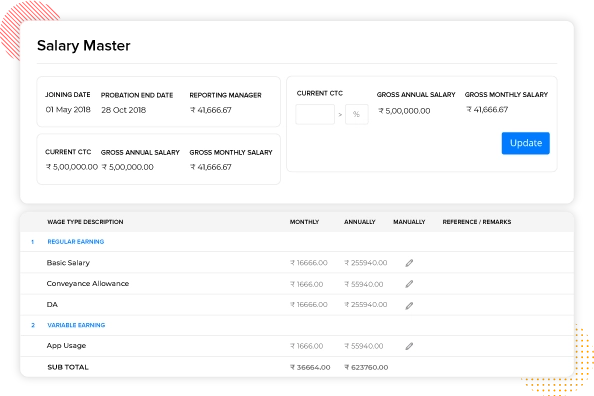

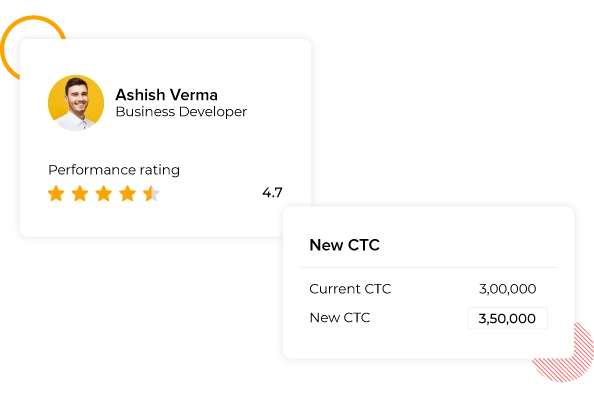

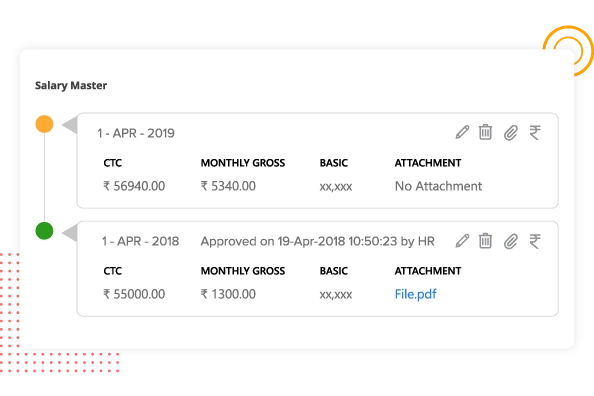

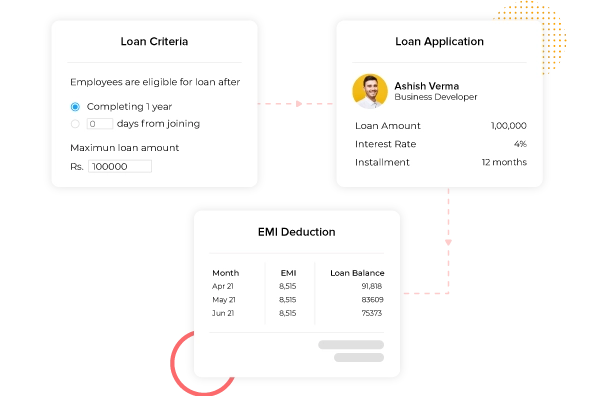

View Salary and YTD Earnings

Employees can easily access and view their salary and get a summary of their gross earnings deductions with monthly net income. Also, employees can view their year-to-date earnings in the form of graphs along with the monthly breakup. All this can be done just by logging in to the factoHR’s mobile app or self-service portal in a self-service way.

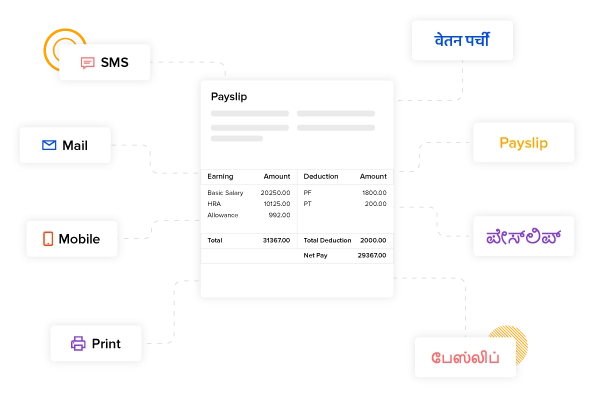

Download Payslips

Employees can not only view but also download past-year and month payslips in PDF format. factoHR’s payroll software also supports payslips in vernacular language so that your employees do not face any linguistic obstacles in understanding their salary calculation.

Declarations and Exemptions

Employees can choose an old or new regime, view their projected income tax and compare it with the actual deductions, and download statutory forms like 12BB and Form 16 using factoHR’s self-service portal or mobile app.