Table of Contents

Key components of payroll software contribute to changing the business landscape in India, such as streamlining operations and achieving compliance in intricate domains of regulatory supervision and employee anticipation. Payroll management is one of many functions that every business needs to get right. Such software ensures that payroll processing runs like a well-oiled machine, from paying employees to adhering to tax ordinances.

Indian companies rely heavily on payroll management software because they guarantee flawless computation of salaries and absolute observance of compliance rules. The platform automatically updates to reflect changes in tax laws, ensuring compliance with EPF, ESI, TDS, and other statutory requirements. It also simplifies complex calculations, automates salaries, taxes, and deductions with precision, and keeps businesses aligned with ever-evolving labor laws and tax regulations.

Selecting the right business payroll management software is crucial for ensuring efficient HR operations in any organization. As we approach 2025, the payroll software market offers a wide range of options, each with unique features and pricing.

11 Best Payroll Software in India for Businesses of All Sizes

The competitive sector of payroll management software in Indian market demands much contemplation when choosing the best one. To help budding and flourishing businesses in India scout for the right fit for their business, we have come up with a carefully researched list of the best 10 payroll software in 2025.

- factoHR

- Pocket HRMS

- Wisemonk

- RazorpayX Payroll

- Zoho Payroll

- sumHR

- SuperPayroll (by Superworks)

- SumoPayroll

- Paybooks

- Keka

- greytHR

Let’s explore each of these options in detail to understand what they offer and which solution best suits your needs.

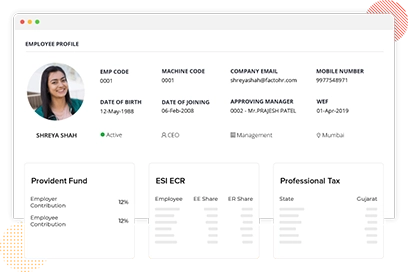

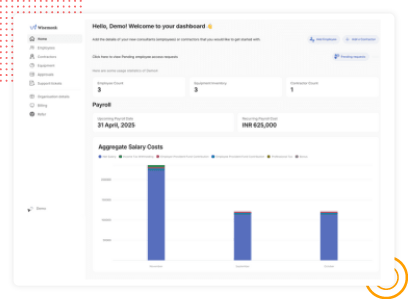

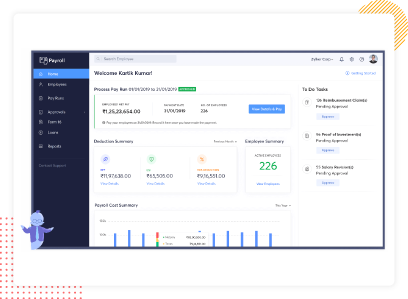

1. factoHR

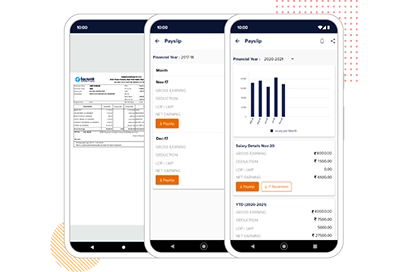

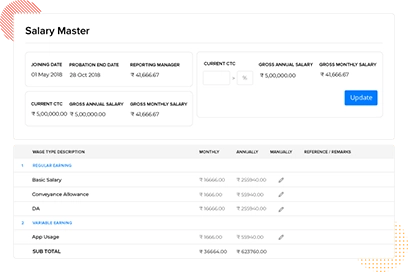

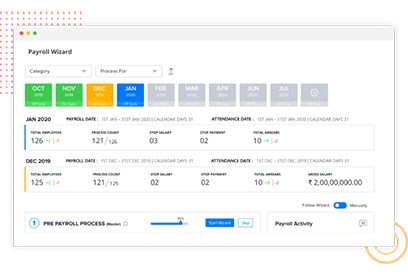

factoHR is best HR payroll software completely automates and simplifies payroll processing for Indian businesses. It is a platform mainly focused on accuracy and compliance and is designed to be easy to use, irrespective of the size or complexity of organizations. factoHR is carefully maneuvering its way, not only to manage payroll all by itself but also to empower HR teams and to provide a great employee experience.

Features

| Security-First Design: Protecting sensitive employee data is a priority, with encryption in rest, comprehensive audit trails, and fine-grained access controls. | Scalable adaptability: The platform offers a formula-driven rule engine that permits businesses to build unlimited earning and deduction components, tailor salary structures, and evolve as business needs change. |

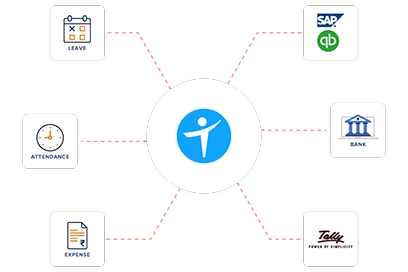

| Fully Integrated System: Seamlessly integrates with other HR modules, such as attendance and leave management, external systems, such as banks, ERP systems, such as SAP and Oracle, and accounting applications, such as Tally and Quickbooks, to ensure the fluid flow of data. | Mobile-First Approach: An AI-powered mobile app and employee self-service portal allow employees to view salary info, download payslips, modify tax declarations, and view other relevant data on the go. |

| Seamless Payroll Process: A user-centered wizard interface that would not let the user miss any necessary entry during the payroll process, and ease the payroll running. | Automatic Arrears Calculation: The system tracks clerical changes and automatically computes statutory and other payments for arrears, creating statements to ensure proper record documentation. |

| Entirely Compliant: Easily complies with PF, ESIC, Professional Tax in India, TDS, and other relevant statutory requirements through automated calculations, giving ready-to-file reports, challans, and forms. | Performance-Linked Payroll: Link employee performance data (goals, KPIs) with compensation to motivate performance and track the impact of various compensation strategies. |

| Automated Loan and Advance Management: On the platform, borrowers can oversee every stage of their loans, including policy creation, eligibility assessment, and automatic EMI deductions and recovery. | Customizable Reports and Analytics: Use 200 standard reports with the ability to build your own custom report in order to gain visibility into payroll data and make informed decisions. |

Benefits of factoHR

- Protects sensitive employee data with a secure software application.

- Allows for business scaling.

- Complete automation eliminates manual errors and human intervention.

- Reduces payroll processing time.

- Integrates smoothly into the existing HR and accounting systems.

- Ensures compliance with changes in tax laws and regulations.

- Enhances employee experience through a self-access point for payroll information.

- Empowers data-driven insight, offering extensive reporting and analytical tools.

Pricing

factoHR has various pricing plans based on the number of employees and specific functionality used. Communicate with factoHR regarding your organization’s requirements to get a customized pricing quote.

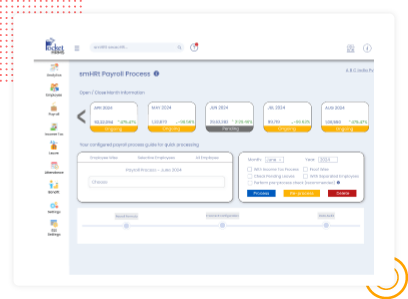

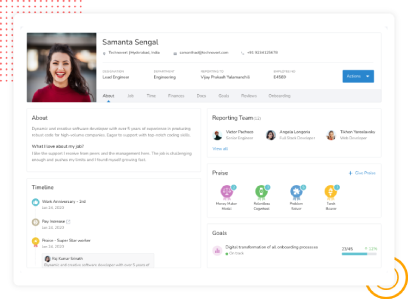

2. Pocket HRMS

Pocket HRMS comes with cloud-based, AI-powered features designed to streamline HR processes for businesses of all sizes. It automates payroll, attendance, recruitment, performance appraisals, and more, by employing advanced technologies like Generative AI and Machine Learning. Innovative modules such as smHRty® (AI chatbot), smHRt Payroll® (ML-based payroll), smHRt searcHR, make it a good choice that offers user experience with interactive and intelligent features.

Features

- Complete Digitalization of HR Operations with Encrypted Data Storage

- Machine Learning-based smHRt® Payroll, ensuring accurate salary processing

- Smart Recruitment with Microsoft OpenAI, ensuring effective and efficient hiring

- smHRt searcHR® enabling quick searches for streamlined processes

- Seamless Integration with 25+ popular enterprise applications.

Pricing

Pocket HRMS offers a free trial with 3 different pricing plans, starting at ₹60/month/employee for the Standard Plan, and ₹90/month/employee for the Professional Plan. They have a Premium plan, with its pricing being decided according to the client’s requirements. All their plans are billed quarterly, half-yearly, and annually.

3. Wisemonk

Wisemonk offers a comprehensive payroll management solution for global businesses hiring in India. From salary calculations and statutory deductions to compliance and timely disbursements, it ensures the team is always paid accurately and on time. With its Employer of Record (EOR) feature, it also enables you to hire, pay, and manage employees or contractors in India, without the need to set up a local entity, providing full support as your workforce grows.

Features

- End-to-end payroll processing with accurate salary calculations, statutory deductions (PF, ESI, TDS), and timely disbursements.

- Robust compliance management, covering all Indian labor laws and regulatory filings to eliminate risks of penalties.

- Employee self-service portal for payslips, tax documents, leave management, and reimbursement claims.

- Tax optimization strategies and administration of statutory and flexible employee benefits.

- Flexible contractor and full-time employee management, including INR payments and compliance for both categories.

Pricing

Wisemonk offers payroll services for full-time employees at $20 per employee per month, while contractor management starts at $9 per contractor per month.

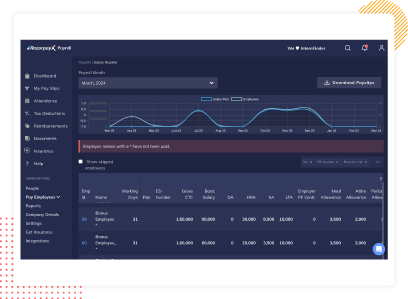

4. RazorpayX Payroll

RazorpayX Payroll is a fully automated payroll and compliance management software that makes the payroll process simplified yet calculative. With that, you can easily pay the salary and file and remit TDS, PF, PT, and ESIC from one dashboard. RazorpayX has earned the admiration of over 10,000 companies for having all-inclusive features.

Features

- Automation of TDS, PF, PT, and ESIC payments alongside tax filing.

- Enable direct salary deposits to employees, freelancers, or contractors.

- Self-service dashboard availability for payslips and Form 16.

- Smoothly interconnects with 25+ HRMS partners.

- Streamlines leave and attendance management, automatically synced with salary payouts.

Pricing

RazorpayX plans start at ₹2,499 per month for 20 employees, but if your business needs specific adjustments, you can contact RazorpayX for a customized pricing plan.

5. Zoho Payroll

Zoho Payroll is a simple, full-fledged payroll solution that is preferred by many famous startups, not just in India but also globally. With regard to regionally complex and distinctly focused compliance regulations across India, Zoho Payroll would handle these matters for you quite well.

Features

- Automate TDS, PF, PT, and ESIC payments and tax filing in total.

- Transfer salaries to employees’ bank accounts in a jiffy.

- Easy access to compliance reports such as TDS, PF, and ESIC.

- Attendances are synced to your HRMS for error-free disbursals.

- Employees can easily access payslips and file reimbursements.

Pricing

Zoho Payroll has a Free plan for a maximum of 10 employees. The paid plan begins at ₹40/employee/month (annual billing) or ₹50/employee/month (monthly billing).

6. sumHR

sumHR’s cloud-based payroll software automates payroll processes to eliminate payroll chaos and facilitate prompt salary payments for all-sized businesses. sumHR best understands payroll processing, enabling you to process pay in minutes, not days, with timely paychecks month after month.

Features

- Ensures tax compliance and timely payment dispensation.

- Recognizes all kinds of income and deductions.

- Facilitates investment declarations by employees for income tax savings.

- Tidy management of loan/advances and part payment due.

- Has a proper definition in the exit case for payroll processing.

Pricing

sumHR startup plan costs ₹49 per employee monthly, and their most expensive advanced plan costs ₹119 per user per month. All their plans are billed annually.

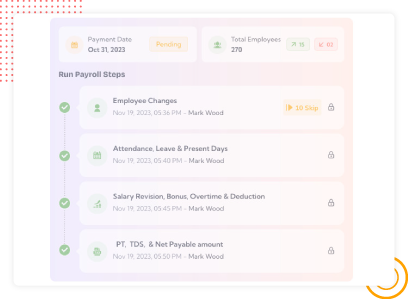

7. SuperPayroll (by Superworks)

SuperPayroll from Superworks introduces a new concept of simple and accurate payroll computation that can simplify compliance management beyond all other solutions. It allows HR managers to compute, review, and process payroll with a tap, and all payroll-related information is stored centrally.

Features

- Offers customizable salary structures and auto-calculates CTC

- Provides for meticulous and accurate payroll and statutory compliance through real-time reporting.

- Makes it seamless when applying for bonuses and viewing past bonuses.

- Funds employees directly into their bank accounts for salary payment.

- Allows loan management with auto-deductions.

Pricing

Superworks pricing starts at ₹3,499 per month for 50 employees. Other pricing options are available, and you can request a customized quote based on your business needs.

8. SumoPayroll

SumoPayroll is a modern payroll management system for small and midsize companies. It offers hassle-free payroll processing that ensures compliance and effortless reporting. This cloud-based solution simplifies payroll and HR processes so you can focus on your business’s growth.

Features

- Easily manage payroll in a single click.

- Automatic time management through mobile and web time clocks.

- Employees can claim expenses, which are paid back during payroll.

- Offers online salary credits to take digital payment methods into account.

- Handles employees’ IT relief investments and computes the income tax automatically.

Pricing

SumoPayroll works for up to 10 employees, free of cost. For anything beyond that, they have multiple pricing plans starting from ₹25 per employee monthly.

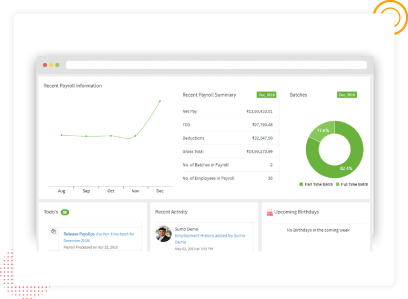

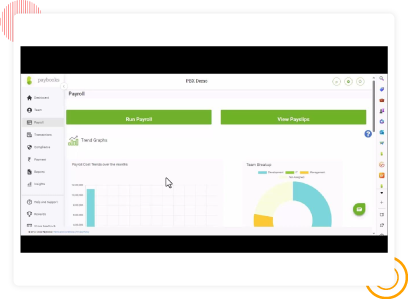

9. Paybooks

Paybooks is the easiest and stress-free way to manage payroll and compliance, ensuring accurate, secure, and disciplined payroll. This is completely automated and integrated with the entire payroll cycle, providing a straightforward calculation system and making the employees happy.

Features

- Automated payroll calculations with zero error.

- Automate PF and ESI calculations and filing of returns.

- One-click generation of Form 16 for employees.

- Manage employee time and attendance in terms of clock-in, clock-out, and timesheets.

- Simplify reimbursements through expense management.

Pricing

Their essential plan starts from ₹2,499 monthly for 30 employees and ₹50 for each additional employee. They also offer a regular and premium plan, plus a plan that outsources payroll.

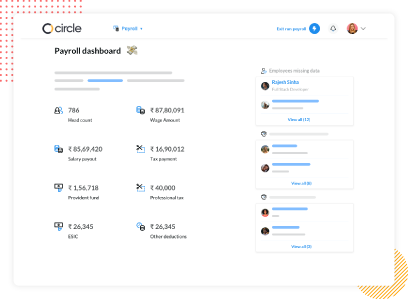

10. Keka

Keka payroll software has redefined the Indian payroll sphere entirely. It reinvented and set a benchmark for how an organization should operate its payroll management by completely getting rid of the month-end mayhem for the HR and finance departments. By doing so, they enhance efficiency and compliance.

Features

- Offers configurable rules-based salary components, offering complete customization.

- Enables easy participation of non-finance roles in salary operations.

- Allows previewing payroll before finalizing and releasing.

- Provides guided payroll processing with intuitive wizards.

- Combined payroll and time tracking software.

Pricing

There are three different subscription packages with lots of extra features offered by Keka. The foundation package starts off at ₹9,999 monthly for up to 100 employees. For further clarification about the prices, please visit their website.

11. greytHR

Say goodbye to those huge, intimidating spreadsheets and payroll calculation errors because greytHR is the one-stop software for all HR functions. Attend to 100% statutory compliance, on-time salary dispersals, hassle-free month ends, improved employee satisfaction, and the upliftment of your employer brand.

Features

- It manages everything from payroll inputs to payouts, claims to compliances, and from self-service to settlements.

- greytHR PayNow enables the salary to be directly debited from the application.

- The Employee Self-Service (ESS) portal reduces administrative work by at least 80 percent.

- YTD statements, IT statements, payslips, and Form 16s.

- Reports and analytics were provided in great detail.

Pricing

greytHR offers free services for organizations with less than 25 employees. Its Essential Plan starts from ₹3,495 monthly for 50 employees. For more information, please reach out to greytHR for detailed pricing plans.

Compare Our Top Recommendations for Your Business

| factoHR | Pocket HRMS | Wisemonk | RazorpayX Payroll | Zoho Payroll | sumHR | SuperPayroll | SumoPayroll | Keka | Paybooks | greytHR | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Payroll Automation | |||||||||||

| Compliance Management | |||||||||||

| Employee Self-Service | |||||||||||

| Integrations | |||||||||||

| Reporting & Analytics | |||||||||||

| Mobile App | |||||||||||

| G2 Rating | 4.9 | 4.6 | 4.8/5 | 4.2 | 4.4 | 4.5 | 4.8 | 3.8 | 4.5 | 4.8 | 4.6 |

| Capterra Rating | 5.0 | 4.0 | 5.0/5 | 3.8 | 4.0 | 3.8 | 4.4 | 4.5 | 4.3 | 4.4 | 4.5 |

Bonus Best Payroll Management Software Options in India to Consider

Zimyo

With its top-notch compliant, error-free payroll software, Zimyo helps you end all your worries regarding the monthly payrolls. It simplifies the entire payroll process in just five simple clicks, be it tax, compliance, law updates, or accurate expense management, ensuring seamless integration and improving employee satisfaction.

Features

- Automates the tax filing process and ensures compliance with PF, ESIC, Professional Tax, TDS, and EDLI.

- Syncs with HRMS for accurate salary calculation and quick disbursement, all while providing complete transparency.

Paychex

Paychex can quickly and efficiently pay employees in just a few clicks via online payroll software. It can flexibly enter data for processing and do automated tax administration. Paychex will adapt to your increasing needs.

Features

- Automated payroll tax computations and payments.

- Data visibility for key payroll reports assisting better business decisions.

Open Money

Open Money’s unique feature is integrated payments, which thereby enhances HR and payroll management and helps in compliant and timely salary disbursements directly to your existing bank account.

Features

- Direct salaries through your bank account.

- Automation of payroll calculations and payment file uploads streamlined.

BambooHR

BambooHR’s payroll solution allows companies to streamline HR tasks into a payroll processing system, providing fast, easy, and accurate paydays. The system uses a single source of data for time tracking, time off, and benefits.

Features

- Fully integrated automatic data flow that eliminates double data entry.

- Instant reports for cash requirements and payroll summaries.

HR Pearls

HR Pearls by Webtel simplifies organizational architecture, payroll operations, and compliance. It guarantees a secure and accountable HR function that handles all HR-related operations in one location.

Features

- Guarantees timely payroll processing with exception-free legitimate deductions.

- Enables an Employee Self-Service module with access to information.

Gusto

Gusto is known for its fast, accurate, and easy payroll processing that helps organizations pay their employees in a matter of a few clicks after an effortless onboarding process.

Features

- Automatic tax filing.

- Ability to offer benefits and track time directly.

- Unlimited payroll runs each month.

Rippling

Rippling payroll runs 100% error-free in three minutes while automating compliance both in the U.S. and India. It takes care of your tax and compliance work, from TDS to labor laws, making sure you are compliant with the needed regulations.

Features

- Run error-free payroll in less than 3 minutes.

- Automate compliance, providing tax and legal requirements.

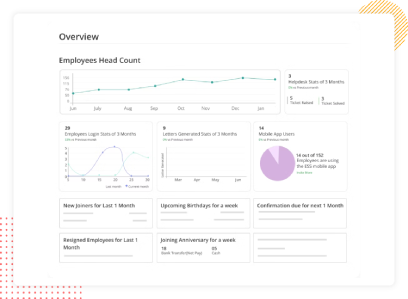

Personio

Personio automates payrolls, streamlines workflows, and goes on for a great task for HR personnel in freeing up precious time. It maintains accurate records and runs smooth payroll cycles to reduce errors.

Features

- Generate payroll data exports.

- Integrate with Xero and Sage 50.

EmployeeVibes

EmployeeVibes simplifies payroll processing and pays salaries accurately with a customizable, all-encompassing solution to meet unique compliance needs. Get easy access to an efficient payroll system with unmatched customer service.

Features

- Ability to configure complex salary structures with custom formulas.

- Automate loan/advance deductions and approvals.

Officenet

The Officenet is designed to minimize errors and reduce the time spent processing paychecks. It will manage the entire HR function, processing salaries accurately and on time. Simple dashboards and proper reporting make workforce management straightforward.

Features

- Automated processing of payroll, computation of tax amounts, and compliance.

- An ESS portal is available for payslips and leave requests.

PionHR

PionHR provides several features, all wrapped in one software, such as leave, attendance, and ESS, ensuring the accuracy and automation of processes. You are assured that client support is always available 24/7, and the security of their company data is state-of-the-art.

Features

- One-click access through employee self-service.

- Comprehensive payroll with compliance and TDS management.

Enspire HR

Enspire HR is a global HR management solution with great practices and extraordinary user experience. It is designed for the most efficient management of HR needs, automation of personnel activities, and enhancement of business competitiveness.

Features

- Self-service portals to Manage Leave and Attendance.

- Tweak timesheets for easily manageable Payroll Automation.

Kredily

Kredily is a free forever payroll software trusted by over 20,000 companies. It streamlines payroll operations with automated tax calculations and seamless salary transfers. This solution is extremely user-friendly and cloud-based.

Features

- Instant salary transfer directly into the employees’ account

- Automated tax calculations, including PF, TDS, ESI, and PT.

UBS App

The UBS App has an automated payroll process, setting any HR manager’s heart at ease. Owing to this one-dashboard system, payroll errors are close to zero, and there will be no chance to incur compliance fines.

Features

- Accurate payroll processing and maintained compliance with various laws

- Provides a bird’s eye view of payroll distributions and analytics.

Saral PayPack

Saral PayPack provides payroll software on the cloud or desktop that manages the details of over 400 employees. It also offers easy salary computation, statutory compliance, and ESS powered by the Saral Intelligent Assistant (SIA).

Features

- Auto report generation and accurate compliance with PF, ESIC, PT, and TDS regulations.

- Supports desktop and cloud-based deployment.

Simple Steps to Understand Payroll Processing in India

In India, payroll is the process where the net pay is determined to arrive at the salaries and wages, factoring in taxes and deductions. Different processes followed in payroll to optimize your payroll process differ depending on the type of business, level of the employee, regional labor laws, and his/her employment type. For an easy understanding:

Step 1: Pre-Payroll

Align company policy with labor law. Clarify policies regarding attendance, leave, and holidays. Collect employee data, including bank details and PAN.

Step 2: How Pay is to be Calculated

Calculate gross salary, including allowances and deductions to be made, such as PF, ESI, and PT. Withhold income tax according to applicable tax slabs for different employees.

Step 3: Post-Payroll

The deductions are confirmed, the payments are finalized, and cash will be directly transferred to employee bank accounts. Payslips detailing the components of the salary are issued.

Step 4: Compliance

Deposit statutory deductions (PF, ESI, PT, TDS) to respective departments and file necessary forms. Annual Form 16 is to be generated.

Step 5: Automation

Use payroll software to automate calculations, generate compliance documents, create reports, and simplify the overall process.

Thus, automated payroll software should ensure total compliance. Smart calculations are key to accuracy in monthly payouts.

What are the Criteria for Selecting the Best Payroll Management Software in India?

When choosing the best payroll management software in India, it is necessary to weigh efficiency, accuracy, and compliance in all respects. There are many different types and brands of payroll solutions available and in various price ranges. You must analyze your own unique requirements and prioritize each one of them appropriately. Some of the criteria that you must keep in mind include the following:

Assess Your Business Requirements

When selecting payroll software, it’s crucial to analyze the features that the solution must possess, such as leave management, performance management, recruitment management, and attendance management. Ideally, you want a comprehensive solution that addresses all your HR challenges.

Be realistic about what you must expect as one-time and recurring costs, and evaluate the long-term return on investment. Make sure that the software conforms to Indian tax and employment laws to avoid legal liabilities. Never forget to try a demo or a free trial to get a feel for its feature set and ease of use. Finally, customer reviews and testimonials provide essential information about the vendor’s reputation and customer satisfaction, further aiding selection.

User-Friendly Model

Go for software that is characterized by an extremely user-friendly interface and navigation features that minimize the time spent on training and maximize user adoption. A mobile app that employees can conveniently use for self-service tasks is an added advantage.

Accuracy and Compliance

Careful consideration must be applied to calculating accurate salaries and necessary automatic deductions, such as tax, PF, ESI, and other mandatory contributions.

Compatibility

The software should not pose a headache in terms of data migration if it is directly integrated with the present HR, accounting, or time-attendance software systems.

Data Security

This ensures that the program holds much security against unauthorized access and cyber-attacks on sensitive employee data.

Benefits of Using Payroll Software in India

Both big and small companies in India are reaching out to payroll software for efficient and compliant payroll management. One of the major benefits of payroll software is that it is a strategic asset that helps streamline processes and provide valuable insights. Here is how it helps Indian businesses:

- Ensures accurate and timely salary payment.

- Enables HR to prioritize employee engagement and strategy.

- Keeps statutory compliance updated.

- Protects sensitive data using advanced protective measures.

- Provides employee self-service portals for spreading transparency.

- Scales easily with business growth.

- Generates insightful analytics for informed decisions.

- Lessens the risk of costly errors in payroll creation.

- Provides control over multi-user access for business workflow.

- Offers safe and cloud-computable data access and storage.

These are just a few advantages of implementing a payroll management system. Our comprehensive article on the benefits of payroll software can help shed more light on how this advanced technology can save time and reduce errors while keeping your business compliant.

Challenges in Implementing Payroll Software

Using new software for payroll management can be one of the hardest things for Indian businesses. It can surely help overcome common challenges, and the advantage of automation is indisputable; however, the implementation phase can be tricky and may somehow upset existing operatives and resources.

A few of the challenges anticipated are as follows:

- Employee resistance to changing to a new system.

- Difficult data migration provides opportunities for errors.

- Integration of other existing business systems.

- Continuous compliance with changing regulations.

- Insufficient employee training will hinder its practical use.

- Unforeseen expenses will crop up during the implementation.

- Breach of confidentiality with sensitive data.

- Dependency on vendors in support and updating.

- Customs, which add complexity.

- Unrealistic expectations could potentially push the project into trouble.

Understanding these challenges in-depth is crucial for a smoother transition. Our detailed guide on common payroll challenges and solutions provides insights into overcoming key obstacles in payroll management.

Future Trends in Payroll Management

Once considered primarily a transactional function, payroll is becoming a more strategic and key asset to the business value chain. New trends towards the end of 2025 provide insight into some of the major shifts being experienced with payroll management, primarily driven through updated technology and shifting workforce dynamics. Therefore, remaining vigilant may enable businesses to improve efficiencies, stay compliant, and keep employees happy.

The automation and insights driven by AI will be expanded in the 2025 Payroll, with a strong focus on employee self-service. Cloud computing will introduce new flexibility and scalability, while payroll integration with other systems like leave and attendance will also improve efficiency. The focus is on data security, as implementing global payroll in an era of remote working will be very demanding.

Wrapping up

Choosing the right payroll software in India is a very important decision and one that should not be underrated, as it directly affects the efficiency, compliance, and morale of your organization. As it has been noted, the solutions offered in the Indian market vary tremendously, and with that, each has its distinct strengths and peculiar features.

The right choice boils down to a meticulous evaluation of your definite specifications, such as needs, budget, and long-term goals. Different platforms will ease your payroll, so do not hesitate to optimize free trials and demos that allow you to view them in action and see how they can assist you in running a smooth payroll.

factoHR is a frontrunner amongst all the other options for any organization that needs a highly customizable, all-in-one solution for the Indian market. This complete, cloud-based solution has an easy-to-use mobile application that allows it to manage complex payroll requirements and empower employees. The choice of apt payroll solutions and software will transform payroll from mundane exercises into strategic assets.

Which is the Top Payroll Software in India?

Top Payroll Software in India with inclusive payroll and HR functionalities at competitive prices includes:

- factoHR

- Zoho Payroll

- BambooHR

- RazorpayX Payroll

- Keka HR

The perfect solution will depend on individual business requirements; however, factoHR offers among the best options for an advanced,multi-configurable, all-in-one cloud-based platform designed for Indian SMBs.

How Much does Payroll Software Cost in India?

The typical price for payroll software in India varies from ₹25 to ₹100 for each employee per month, depending on the business size and features. Many major providers offer tiered pricing, and some are free to a limited number of users. Expect to pay more for more advanced features or an extensive set of users. In the end, the prices are decided entirely on your payroll needs.

What are the Government Payroll Compliance Rules in India?

Compliance with rules by the government with regard to payroll in India insists on adherence by companies to labor and tax laws, which are necessary for fair treatment and correct payment of its workers. Relevant payroll compliance includes the Payment of Wages Act, Minimum Wages Act, PF, ESI, and Income Tax deductions. Non-compliance may invite penalties, fines, and even legal challenges.

Can Payroll Software Handle Multi-Location Payroll Processing?

Payroll software, particularly cloud-based solutions, can effectively handle multi-location payroll processing, centralize data, and automate compliance from different regions. Traditional offline or on-premise systems lack such capabilities, making cloud-based solutions a better alternative for companies with a multi-location presence.

How Secure is Payroll Data on Cloud-Based Software?

Yes, cloud-based payroll software is more secure than traditional payroll systems. Providers use encryption and rigorous authentication methods. Your data gets protected in secure servers behind really powerful information security protocols. It is safeguarded against cyber threats with regular updates and security audits. Although there are some concerns, reputable providers usually put data security first.

© 2025 Copyright factoHR