Salary Certificate Format in India 2026: Free Word & PDF Download Templates

Grab your free salary certificate template now and edit in minutes.

Table of Contents

Issuing a salary certificate is more than just a paperwork formality—it is a critical document that validates your employee’s financial credibility.

Whether your employee is applying for a home loan, planning a trip abroad (Visa), or filing income tax, a pay certificate serves as the primary proof of employment and repayment capacity. Unlike a standard salary slip, which shows a monthly payout, this certificate is a comprehensive statement of tenure, designation, and gross annual income (CTC) issued on the company’s letterhead.

In this guide, we provide standardized, bank-compliant salary certificate formats (in Word & PDF) that you can download and use immediately.

Quick Summary: How to Generate a Salary Certificate?

- Gather details such as the employer’s name, logo, address, and employee details, including designation, date of joining, and ID/employee code.

- List salary components such as deductions, CTC, net salary, DA, other allowances, and bonuses.

- Add the issuing date and signature to the given salary certificate format before sending it via email.

- Store issued salary certificates digitally for easy access and record-keeping.

What is Salary Certificate?

A salary certificate is a document issued by an employer. It confirms an employee’s employment and salary details.

When issuing the certificate, employers need to include employee details such as their designation, name, and address, employee ID/code, joining date, and employment type. As an employer, you must ensure you provide the correct figures for deductions, CTC, and net/in-hand salary.

The salary certificate is printed on a company’s official letterhead and is requested by employees when they apply for loans, visas, housing allowances, or other benefits. Employees also use the certificate when filing tax returns.

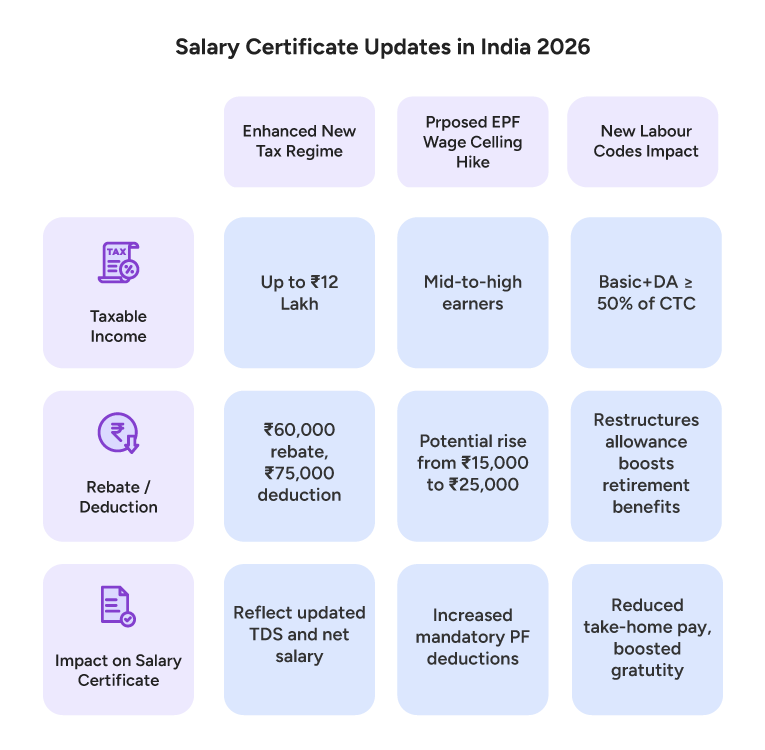

Salary Certificate Updates in India 2026: Key Changes to Know

As of 2026, India’s Union Budget 2025 and ongoing labour code reforms have introduced significant updates to salary structures, directly affecting salary certificate formats in India. While no direct law mandates changes to the certificate itself, accurate breakdowns are crucial for bank loans, visas, and compliance.

Key 2026 highlights for salary certificates:

Enhanced New Tax Regime (FY 2025-26)

Increased Section 87A rebate (up to ₹60,000) for taxable income up to ₹12 lakh, plus ₹75,000 standard deduction, makes salaries up to ₹12.75 lakh effectively tax-free. Reflect updated TDS and net salary accurately.

Proposed EPF Wage Ceiling Hike

Potential rise from ₹15,000 to ₹25,000 (expected April 2026), increasing mandatory PF deductions for mid-to-high earners.

New Labour Codes Impact

The 50% basic pay rule (basic + DA ≥ 50% of CTC) restructures allowances, potentially reducing take-home pay while boosting retirement benefits such as gratuity.

Update your salary certificate templates to include these components for rejection-proof documents. Download our free 2026-compliant Word & PDF formats above!

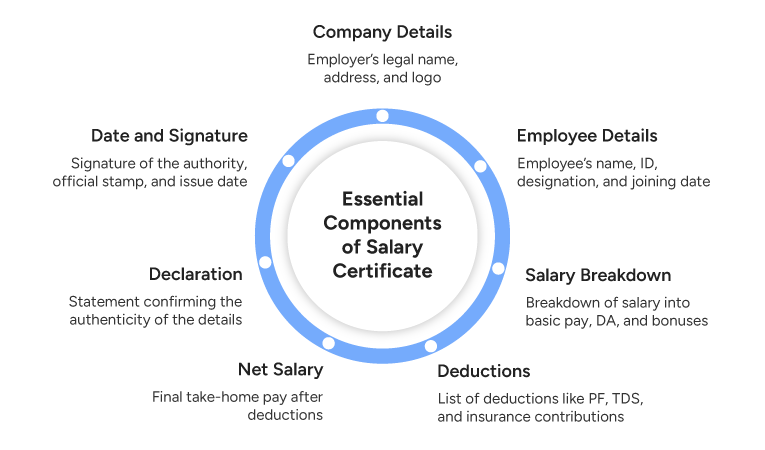

7 Key Components every Salary Certificate Must have

There is a structured process to follow when an employee requests a salary certificate letter. The process should include:

Company Details

The salary certificate or pay certificate must include the employer’s legal name, address, contact details, and official logo. This will increase the letter’s authenticity and serve as proof of stable income.

Employee Details

This section must explicitly include the employee’s details for whom the certificate of employment with salary is being issued. It must include the employee’s name and address, employee ID (if applicable), designation, department, and date of joining.

Salary Breakdown

The employer must clearly provide a breakdown of the employee’s salary into payroll components such as basic pay, DA, allowances, and bonuses.

Deductions

The employer must also state all the deductions, such as Provident fund, professional tax, TDS, or employee contribution for insurance, that apply to the employee’s salary.

Net Salary

The final take-home pay for the month, which is the total salary after calculating payroll deductions, should be included in the pay certificate as well.

Declaration

This section must include a statement confirming the authenticity of the details provided in the salary slip certificate.

Date and Signature

It is essential to include the signature of the relevant authority (Employer, HR, or Finance head), the official stamp, and the certificate’s issue date.

Legal Validity of Salary Certificate in India

In India, a salary certificate is not strictly mandatory under any central law, such as the Income Tax Act, 1961, but it has significant evidentiary value. It serves as official proof of employment and income, often required by banks, visa authorities, and courts.

Under state-specific Shops and Establishments Acts, employers must maintain wage records and provide proof of employment on request; a salary certificate indirectly fulfills this. The new Labour Codes (effective 2025-26) emphasize transparent wage documentation, reinforcing its importance.

For legal validity:

- Issue on the company letterhead with authorized signature, seal, and date.

- Include accurate details (CTC, deductions like PF/TDS).

- Digital signatures (e-Aadhaar compliant) are increasingly accepted.

Banks (SBI, HDFC, ICICI) and embassies treat it as primary income proof for loans/visas, but norms vary – always check specific requirements. While not a statutory document like Form 16, a properly formatted salary certificate is legally binding as an employer declaration. Consult HR/legal experts for compliance.

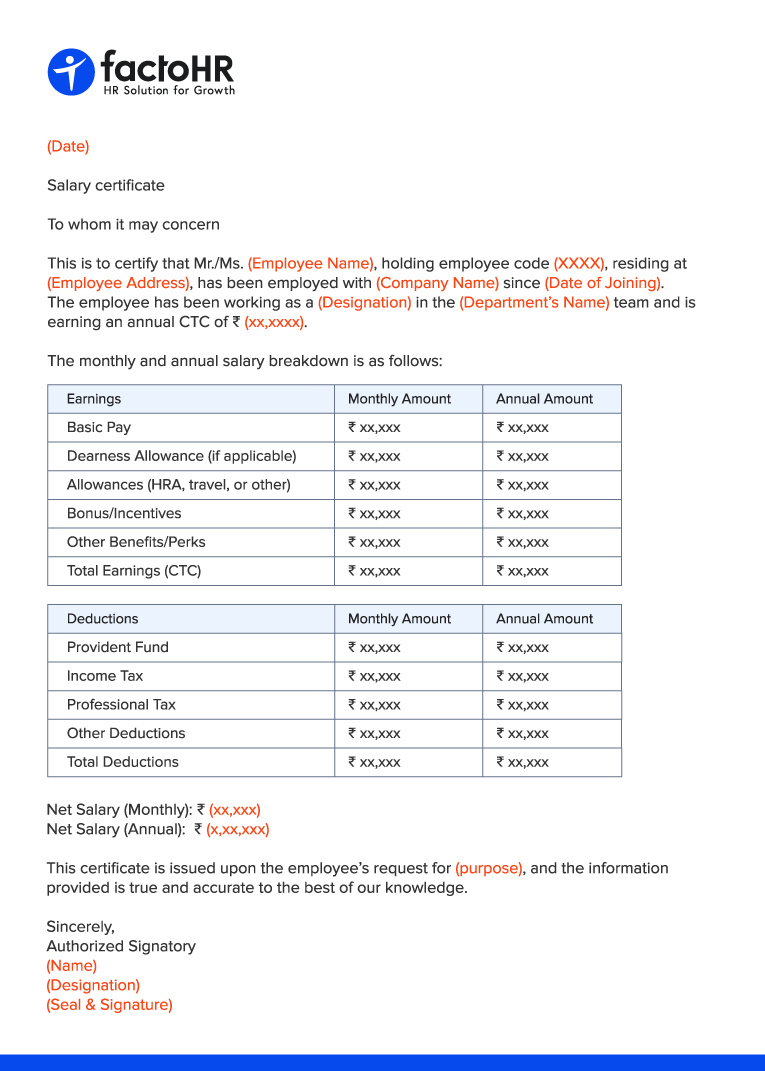

Salary Certificate Format in India

It often happens that employees ask for a pay certificate, and HR cannot issue it on time due to a hectic schedule. Additionally, banks may reject the issued certificate if it does not follow the standard salary certificate format. So, it’s best to use a standard salary certificate format rather than getting stuck in an endless cycle of errors and corrections.

Note: Replace the gaps (such as employee names and amounts) with the correct details, and save the employee certificate Word template to preserve the layout for sharing or printing.

Simple Salary Certificate Letter for Employee

(Company Letterhead)

Date: 11 August 2025

Employment income certificate

To whom it may concern

This is to certify that Mr. Rajesh Sharma, with employee code EMP2457 and residing at 123, Greenview Residency, Sector 18, Andheri East, Mumbai – 400069, Maharashtra, has been employed with ABC Technologies Pvt. Ltd. since 15 March 2020. The employee has been working as a Senior Software Engineer on the Product Development team and earns an annual CTC of ₹12,00,000.

The monthly and yearly salary breakdown is as follows:

| Earnings | Monthly Amount | Annual Amount |

|---|---|---|

| Basic Pay | ₹50,000 | ₹6,00,000 |

| Dearness Allowance (if applicable) | ₹5,000 | ₹60,000 |

| Allowances (HRA, travel, or other) | ₹25,000 | ₹3,00,000 |

| Bonus/Incentives | ₹10,000 | ₹1,20,000 |

| Other Benefits/Perks | ₹2,000 | ₹24,000 |

| Total Earnings (CTC) | ₹92,000 | ₹12,00,000 |

| Deductions | Monthly Amount | Annual Amount |

|---|---|---|

| Provident Fund | ₹6,000 | ₹72,000 |

| Income Tax | ₹5,000 | ₹60,000 |

| Professional Tax | ₹200 | ₹2,400 |

| Other Deductions | ₹300 | ₹3,600 |

| Total Deductions | ₹11,500 | ₹1,38,000 |

Net Salary (Monthly): ₹ 11,500

Net Salary (Annual): ₹ 1,38,000

This certificate is issued upon the employee’s request for a home loan application, and the information provided is true and accurate to the best of our knowledge.

Sincerely,

Authorized Signatory

Mr. Anil Verma

HR Manager

(Seal & Signature)

Sample 1: Salary Certificate Format in Word for Bank Loan

Below is a draft for a pay certificate for bank loan purposes:

(Company Letterhead)

Date:

Salary Certificate

To whom it may concern

This is to certify that (Employee Name), holding employee code (XXXX), residing at (Employee Address), has been employed with (Company Name) since (Date of Joining). The employee has been working as a (Designation) on the (Department’s Name) team and earns an annual CTC of ₹ (xx,xxxx). The employee is engaged on a (Permanent/Contract) basis and has been in service for (X years, X months).

The organization’s PAN is (XXXXXXXXXX) and GSTIN is (XX XXXXX XXXX XZX).

The monthly and yearly salary details are as follows:

| Earnings | Monthly Amount | Annual Amount |

|---|---|---|

| Basic Pay | ₹ xx,xxx | ₹ x,xx,xxx |

| Dearness Allowance (if applicable) | ₹ xx,xxx | ₹ x,xx,xxx |

| Allowances (HRA, travel, or other) | ₹ xx,xxx | ₹ x,xx,xxx |

| Bonus/Incentives | ₹ xx,xxx | ₹ x,xx,xxx |

| Other Benefits/Perks | ₹ xx,xxx | ₹ x,xx,xxx |

| Total Earnings (CTC) | ₹ xx,xxx | ₹ x,xx,xxx |

| Deductions | Monthly Amount | Annual Amount |

|---|---|---|

| Provident Fund | ₹ xx,xxx | ₹ x,xx,xxx |

| Income Tax | ₹ xx,xxx | ₹ x,xx,xxx |

| Professional Tax | ₹ xx,xxx | ₹ x,xx,xxx |

| Other Deductions | ₹ xx,xxx | ₹ x,xx,xxx |

| Total Deductions | ₹ xx,xxx | ₹ x,xx,xxx |

Net Salary (Monthly): ₹ (xx, xxx)

Net Salary (Annual): ₹ (x,xx,xxx)

This certificate is issued upon the employee’s request for submission to (Bank Name) to verify employment and income details for loan processing. The information stated above is true and correct as per the company records.

Sincerely,

Authorized Signatory

Name

Designation

(Seal & Signature)

Sample 2: Income Certificate Format

For smaller organizations or quick requests, a simple salary details format might include just:

(Company Letterhead)

Date:

Income proof certificate

To whom it may concern

This is to certify that (Employee Name and ID) is employed with (Company Name) as (Designation) and is drawing an annual CTC of ₹ (xx, xx, xxx).

The detailed salary structure is as follows:

| Earnings | Monthly Amount | Annual Amount |

|---|---|---|

| Basic Pay | ₹ xx,xxx | ₹ x,xx,xxx |

| Allowances, Perks OR Benefits | ₹ xx,xxx | ₹ x,xx,xxx |

| Total Earnings (CTC) | ₹ xx,xxx | ₹ x,xx,xxx |

This certificate is issued at the employee’s request for the purpose of (purpose). The details provided are true and correct as per our official records.

Sincerely,

Authorized Signatory

Name

Designation

(Seal & Signature)

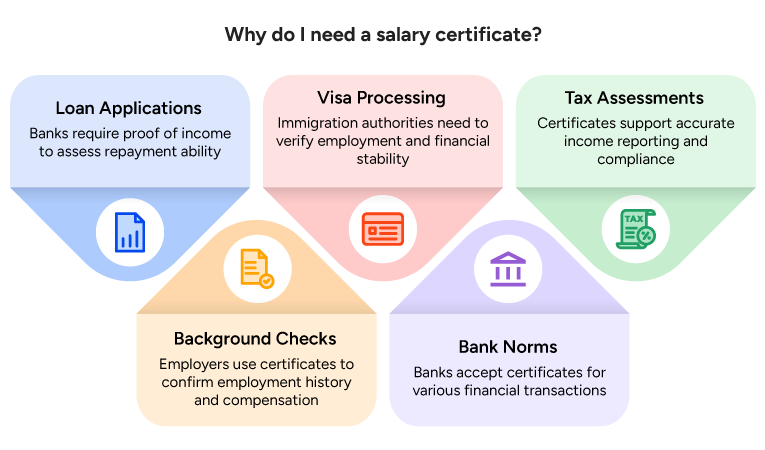

Why do You Need a Salary Certificate?

Banks often ask for proof of income when processing loan requests. So, if a bank like SBI or HDFC can ask for your income certificate as proof of income. Additionally, employers ask for such proof for background verification. Immigration authorities often require similar proof to process a visa.

- Loan and credit card applications: To verify an applicant’s income, banks and other financial institutions request an income proof certificate before approving loans, mortgages, or credit cards.

- Visa processing: Immigration authorities require a salary certificate as proof of employment when applying for work or travel visas.

- Tax assessments: Salary certificates can support income tax filings by providing accurate details of annual earnings and deductions.

- Background verifications: Prospective employers or agencies may use the certificate to confirm employment history and compensation during onboarding.

- Bank norms: Although not legally mandatory, salary certificates are valid in SBI, HDFC, ICICI, and Axis banks.

Internal Processes for Issuing Salary Certificates

The responsibility of issuing a salary certificate is shared between several teams. The process includes key handoff points where responsibility shifts from one team to another. For example, the payroll team prepares the salary details and hands off the draft certificate to HR business partners for review and approval.

Once approved, the certificate is shared with the employee. Recruiters may also be involved when certificates are required during hiring or background checks. Coordination between teams at different points ensures accuracy and compliance throughout the process.

To ensure efficiency and employee satisfaction, many organizations set a service-level agreement (SLA) for issuing salary certificates. This deadline is usually within 48 hours of receiving a formal request.

5 Reasons Banks Reject Salary Certificates.

Your employees might have faced situations where banks reject their salary certificates, despite including all the relevant details. This could be due to five reasons:

- Using round figures instead of exact CTC figures, or inconsistent font styles.

- Mismatch with bank statements.

- High debt-to-income ratio (low take-home salary compared to deductions or liabilities).

- Frequent job changes, even with a high salary.

- Incomplete documentation.

How to Request a Salary Certificate with Tips

To request a salary certificate, the employee should send a formal email to the authorized person(Employer, HR, or Finance head). The request should state the purpose, such as a bank loan, visa application, or tax filing, and specify the expected timeline to avoid delays

Once the request is submitted, the HR team will obtain the necessary approvals and signatures and prepare the document. The employee can collect the income certificate in physical or digital format, depending on the company policy.

Sample Email Template: To Request a Salary Certificate

Subject: Request for Salary Certificate

Dear (Authorized Person’s Name),

I request the issuance of an income proof certificate for (state purpose). Kindly include details for the period (MM/YYYY) to (MM/YYYY).

I would appreciate it if the certificate could be issued within (X days), as per company policy.

Thank you.

(Your Name)

(Employee Code)

Difference between a Salary Slip and a Salary Certificate

Here are some key differences between the two:

| Feature | Salary Certificate | Salary Slip |

|---|---|---|

| Purpose | It is official proof of employment and income. | It provides a monthly breakdown of the employee’s pay. |

| Frequency | The company issues a salary certificate on an employee’s request. | The salary slip is issued every month along with the salary. |

| Details | It is more detailed, including CTC, gross and net salary, company details, employee and employment details. | It is more concise and includes detailed month-wise earnings and deductions. |

| Use Cases | It is helpful for employees to provide background verification when applying for a loan, visa, or other legal formalities. | It is basically for employee record-keeping and tax filing. |

Read also: Need monthly slips? Try our Automated Salary Slip Generator.

Common Mistakes and Best Practices

Avoid common mistakes when generating a salary certificate, such as:

- Missing authorized signature or company seal,

- Mentioning Incorrect salary figures,

- Forgetting to include employee details such as designation and contact information, and

- Sending an outdated company address or logo.

Some best practices to follow when issuing a salary certificate include:

- Using a standard salary certificate format,

- Proofreading the mail before sending it to the employee,

- Verifying salary figures, and

- Storing documents digitally for accessing in real-time and record-keeping.

Automate Salary Certificate Generation

For large teams, it can be difficult to manually manage payroll and issue salary certificates. factoHR can help you with this, as it integrates data and prepares ready-to-share reports. It can also help you in –

- Integrate payroll, attendance, leave, and tax data into one centralized system.

- Easily configure multiple CTC components for precise salary breakdowns.

- Choose from 200+ customizable templates to align with your branding and regional formats.

- Use advanced reporting tools, including scheduled builders and ready-made reports for quick audits.

- Generate payslips and certificates in multiple languages to support diverse teams.

- Share certificates securely via an Employee Self-Service (ESS) portal for instant employee access and downloads.

We offer factoHR, a payroll solution that generates compliant, efficient certificates. Interested in seeing it in action? Try our free demo today.

Frequently Asked Questions about Salary Certificates in India

Where are Salary Certificates Used in India?

Employers issue salary certificates on employee requests. They serve as official proof of income, employment status, and salary details for loan applications (e.g., home/personal loans), visa processing, tax filing purposes, background verification, and other financial or immigration needs.

How Long is a Salary Certificate Valid for Financial Applications?

There is no fixed legal expiry, but most banks, financial institutions, and visa authorities prefer recent certificates, typically issued within the last 3–6 months, to ensure current and accurate income details. Some accept up to 1 year, depending on the requester.

Is a Salary Certificate Mandatory for Loan Approval in India?

Yes, a salary certificate for a home loan in India is mandatory. Most banks and financial institutions in India require a pay certificate to assess an applicant’s repayment capacity and verify their employment details before approving a loan.

How do I Get a Salary Certificate from My Employer?

Send a formal request via email or letter to HR or the payroll department. Clearly mention the purpose (e.g., loan/visa) and the period required (e.g., current salary or annual). Many companies process it quickly upon request.

Can Salary Certificates be Issued for Contract or Internship Stints?

Yes, employers can issue them for contract, temporary, or internship positions. The document should clearly state the employment type, duration, and any relevant terms to avoid confusion during verification.

What are the Key Components of a Salary Certificate?

It typically includes the company’s name and address, employee’s full name, designation, employee ID, date of joining, current salary breakdown (gross, CTC components, deductions like PF/TDS/ESI), net salary, an official declaration, authorized signature, date, and company seal/stamp for validity.

Is a Salary Certificate Mandatory in India?

No, but required upon request for specific purposes, such as loans/visas.

What is the Difference between a Salary Certificate, a Salary Slip, and Form 16?

Salary slip/payslip: Monthly breakdown of earnings, deductions, and net pay (internal use).

Salary certificate: Formal summary of employment and income (often annual/current) for external purposes like loans/visas.

Form 16: Annual TDS certificate from the employer showing total salary paid and tax deducted (mainly for income tax filing/ITR). Banks sometimes accept Form 16 + slips as alternatives.

Modernize your HR tasks with factoHR today

Experience the digitalization of everyday business activities with factoHR's modern and compatible solutions for every need.

© 2026 Copyright factoHR