Table of Contents

In a bustling metro city like Chennai, manual payroll processing can be both challenging and time-consuming. Thankfully, many businesses are embracing Payroll Software in Chennai to streamline their payroll management. With just a few clicks, these innovative solutions effortlessly manage salary calculations, tax compliance, and report generation. By automating these processes, organizations can make informed decisions, minimize errors, and reclaim precious time setting themselves up for success!

To choose the right software, businesses need to evaluate their specific needs, like strong compliance capabilities and cost-effective solutions. Complex tax laws in India are one of the difficulties any organization faces. This makes it difficult for organizations to stay up-to-date with rules and regulations. The software manages multiple statutory deductions and avoids penalties related to payroll. Some of the advantages of the payroll management system in Chennai are enhanced efficiency and accurate processing of salaries. Automating the entire payroll process reduces paperwork and improves overall productivity

List of Top 10 Payroll Software in Chennai

Whether you want to improve your recruiting process or automate your payroll processes, these HR solutions have you covered. Say goodbye to tedious paperwork and welcome to a modern, seamless human resources experience. However, with so many payroll system alternatives available, it can be difficult to select the proper software to satisfy all of your business demands. So, look no further since we’ve done the research for you and prepared a list of the best payroll software in Chennai.

- factoHR

- Zoho payroll

- HROne

- Razorpay Payroll

- Pocket HRMS

- EasyHR

- Paychex

- Wallet HR

- PayCare

- EliteHRMS

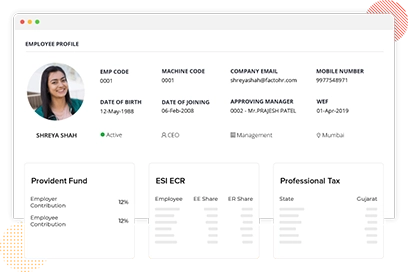

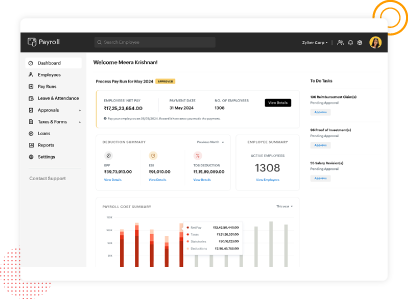

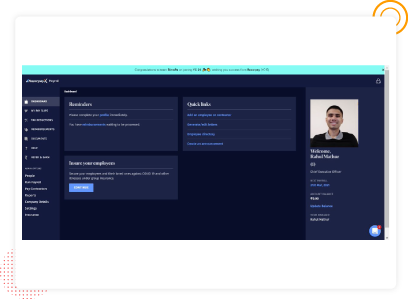

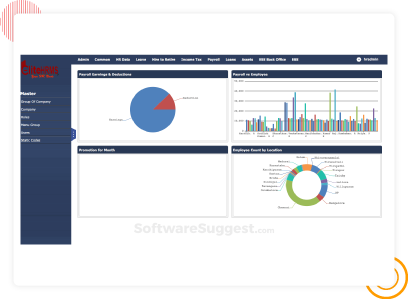

1. factoHR

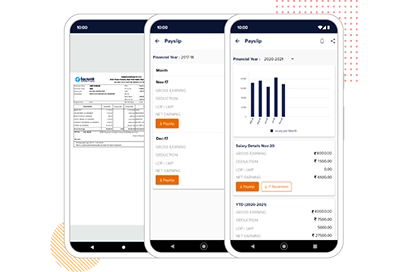

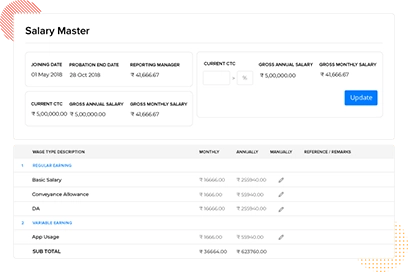

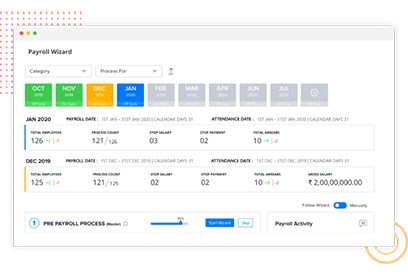

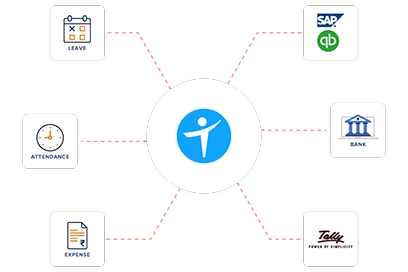

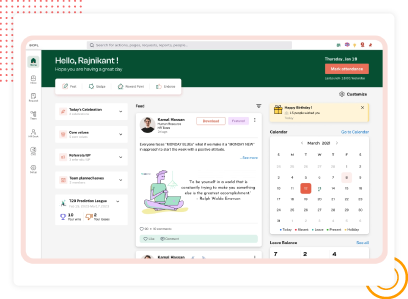

factoHR is a top payroll software in Chennai, featuring intuitive and scalable tools for diverse businesses. It streamlines payroll processes and ensures compliance. With modules like attendance tracking, it helps HR professionals make informed decisions. Key features include loan advances, arrears calculations, direct bank deposits, and comprehensive statutory reports, making it a complete payroll solution.

An employee self-service (ESS) portal allows employees to access their information and make changes without needing HR professionals. They can also download their payslips and IT statements from the web portal or mobile application. factoHR’s payroll software in Chennai helps businesses to scale according to their requirement.

Features

| Mobile app for accessing employees’ personal information, like downloading payslips and tax sheets. | Easily configure payroll processes with a formula-driven rule engine. |

| Process salaries with multiple payroll groups according to each employee’s payroll cycle. | Allows organizations to stay up to date on tax laws while meeting compliance requirements. |

| Prevent data duplication and manage data in a centralized management information system. | Provide loans and advancements with auto deduction of the loan amount. |

| The off-cycle payroll process helps make additional payments, such as bonuses and incentives. | Create custom payroll reports and forms with the custom report builder. |

| Fulfill payroll compliance requirements with automatic payroll calculation and file forms and reports. | Process salaries with multiple payroll groups according to each employee’s payroll cycle. |

Benefits

- factoHR’s payroll software in Chennai can streamline payroll processes with a system that’s secure, precise, automated, and fully compliant.

- Integrated payroll process to enhance user experience.

- Audit trail and encryption measures to give top-level security

- Minimize data duplication to ensure highly accurate payroll processing.

- Calculations based on formulas, customizable processes, and the ability to create an unlimited components provide the flexibility.

- Audit trails and encryption measures are used to provide top-level security.

- Allows the workforce to update their information through a mobile application and an employee self-service portal.

- Create multiple payroll groups and configure any number of salary components.

- ISO-accredited and SOC Type 2-certified cloud data centers for security.

- The system meets payroll compliance requirements, such as PF, ESIC, Professional Tax, TDS, EDLI, etc., with automatic calculations and ready-to-file reports, challans, and forms.

Pricing

factoHR offers multiple plans within your budget based on your system requirements. Schedule a demo with us today to know about all the pricing plans.

Best Suited

factoHR solutions are fit for all types of organizations be it small startups or large companies.

2. Zoho payroll

Zoho People is a user-friendly payroll management system that streamlines complicated HR and payroll operations in enterprises. It includes several HR features such as attendance monitoring, payroll integration, performance management, and automated processes. The program is acclaimed for its intuitive UI, configurable capabilities, and easy connection with other Zoho products.

Features

- HR management

- Performance management

- Payroll automation

- AI based integration

- Data and analytics

Pricing

The standard plan starts from ₹800 per month and ranges up to ₹2600. You may choose based on your needs.

Best Suited

It is suitable for small to medium sized businesses.

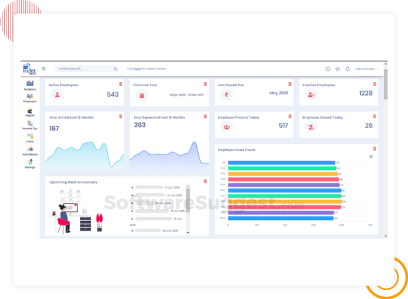

3. HROne

HROne is one of the Best Payroll Management Systems In Chennai that automates and streamlines key HR procedures, simplifying the employee lifecycle from hiring to retirement. It includes a variety of modules such as recruiting, workforce management, payroll, attendance, and performance management, as well as automated processes, mobile accessibility, and system interfaces. HROne seeks to increase HR efficiency, save time, and cultivate a more engaged and productive team.

Features

- Automated workflow

- Mobile access

- Scalability

- Report and analytics

- Easy integration

Pricing

The plan costs ₹85 for each user for a basic plan. Based on the additional needs, the plan price may increase.

Best Suited

It is suitable for all types of organizations to streamline their payroll processes.

4. Razorpay Payroll

Razorpay is one of the Best Payroll management system. It is a complete, automated payroll and compliance software that helps Indian businesses speed salary processing and other associated duties. It manages everything from salary computations and deductions (including TDS, PF, ESI, and PT) to pay stubs and statutory compliance filings. The program also includes an employee self-service site and connections with a variety of HR and accounting systems.

Features

- Automated payroll processing

- Statutory compliance

- Easy payroll processing

- Mobile employee service portal access

- Leave management system

Pricing

The price plan ranges from ₹2499 a month to ₹5499 based on the package chosen.

Best Suited

It can be easily used by all small to big organizations.

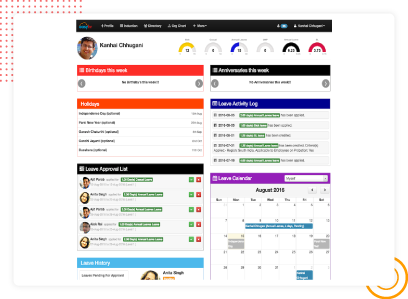

5. Pocket HRMS

Pocket HRMS is revolutionizing HR and payroll! With fully digitized payroll processing, seamless attendance tracking, and efficient digital onboarding, all accessible from any device, it empowers HR professionals to manage remote teams effectively. Experience the convenience and efficiency that Pocket HRMS offers and elevate your payroll operations with confidence!

Features

- Mobile access

- Staff management

- Expense and payroll management

- Cloud based platform

- Customization based on needs

Pricing

The basic plan costs ₹2999 for 50 employees and ranges up to ₹4499 per month. Organizations can add additional employees at ₹100 per employee every month

Best Suited

It can be used by many organizations, small to medium sized.

6. EasyHR

easyHR simplifies even the most complex payroll tasks through an integrated configuration panel that syncs with other modules, such as leave and attendance management systems. Its user-friendly interface fully automates all aspects of payroll processing, freeing up valuable time for the HR department. Designed to operate efficiently across various types of organizations, easyHR offers a holistic solution for employees through its Employee Self-Service module. Organize the payroll process with the best payroll software for accurate tax deductions and payments every payday.

Features

- Multiple Pay Options

- Run Payroll on the Go

- Customize Earnings and Deductions

- Analytics and Reports

- Resource Center

- Employee Self-Service

Pricing

easyHR Offers Three Customized Pricing Modules Tailored to an Organization’s Needs. for Exact Pricing, Businesses Can Contact Them Directly.

Best Suited

easyHR is a Good Fit for Small and Medium-Scale Businesses.

7. Paychex

Paychex is a Payroll software company in Chennai that simplifies payroll processes by effortlessly merging employee data with HR and benefits information. The service also features a complimentary Paychex Flex mobile app, offering immediate access to vital payroll information, such as upcoming pay dates and amounts, which enables remote management and administrative ease. Whether you prefer to take an active role using its intuitive online platform or work in tandem with its specialized payroll experts, Paychex provides tailored solutions to meet an organization’s specific needs.

Features

- Mobile Application

- Compliance Management

- Time And Attendance Tracking

- Tax Filing Services

- Multi-State Payroll

- Customizable Reporting

Pricing

Organizations Can Obtain a Customized Pricing Module from Paychex Tailored to Their Specific Requirements.

Best Suited

Paychex is a Good Fit for Small to Medium-Sized Enterprises.

8. Wallet HR

Wallet HR is among the Best Payroll Software Solutions that aims to revolutionise your HR and Payroll services by fully digitising payroll processing, attendance, digital onboarding, and HR operations. It allows your staff to access their information from any device. All of this may be accomplished using the newest cloud and mobile technology. This is an automated payroll software in Chennai that gives you a platform for handling remote workforce efficiency as an HR professional using any device and any number of employees.

Features

- Payroll management

- Integration

- Customized reporting

- Salary calculations and management

- Data analytics

Pricing

The price of the software is based on the organizational needs, contact the company for more details.

Best Suited

It can be used by all organizations based on their needs.

9. PayCare

PayCare is one of the Payroll software companies in Chennai that provides an all-inclusive payroll management solution for any organization. Some of the tasks include implementing the payroll application and transferring existing payroll data. The system also helps with configuring interfaces, allowing companies to input information and establish comprehensive employee databases

These databases can include various details, like job titles, departments, leave allowances, salary information, payment schedules, holiday lists,tax information ,credits, and deductions. PayCare Payroll delivers a genuine plug-and-play experience, complete with initial setup of master data and employee information.

Features

- Payroll Processing

- Payroll Tax Filing

- Payroll Reporting

- Statutory & Government Forms

- Employee Provident Fund

- Regional Forms & Payslips

Pricing

To find out the Prices of the Plans, Organizations Can Contact PayCare directly.

Best Suited

Medium and Large Businesses are a Good Fit for PayCare.

10. Elite HRMS

EliteHRMS is one of the best payroll software solutions, it increases the entire administration of payroll procedures. The program may provide payroll-related data such as payment ledger summaries and reconciliation reports, allowing you to make more informed decisions. Employee self-service and mobile applications improve people management efficiency. The program offers strong security and compliance controls that enhance transparency.

Features

- Employee Management

- Employee Self-Service

- Compliance Management

- Benefits Administration

- Analytics And Reporting

- Integration Capabilities with the Attendance System

Pricing

To find out the Prices of the Plans, Organizations Can Contact eliteHRMS directly.

Best Suited

Small and Medium Businesses are a good fit for eliteHRMS.

What are the Key Advantages of Using Payroll Software in Chennai?

Using payroll software in Chennai provides multiple benefits. Some of these benefits are mentioned below:

Automated Payroll Processing

Payroll management software simplifies payroll processing and deduction calculations. This helps HR professionals to focus more on other important HR-related tasks and reduce errors.

Compliance with Chennai Labor Laws

The software helps organizations to stay informed about Chennai labor laws and regulations. All the latest regulations are taken into consideration to calculate salary and tax deductions, which reduces the risk of penalties.

Multi-Location Salary Management

Many enterprises are located in multiple regions and have remote work arrangements to enhance flexibility in work. A strong payroll software in Chennai helps with managing various salary structures and different tax laws.

Statutory Reports Generation

Payroll software provides reports on payroll and insights for decision-making. Payroll summary reports and tax reports are some of the types of reports an organization needs for proper employee management.

Audit Trail & Data Security

Payroll software provides security measures to protect employees’ information from unauthorized access and breach. All the monetary transactions are stored in a single platform, which maintains transparency and accountability.

Mobile App Support

A mobile attendance app helps with tracking attendance and leave management of the workforce. This also allows employees to update their information without needing HR professionals

Final Verdict

Payroll software in Chennai is a vital solution for organizations seeking to streamline their complex HR processes. Managing payroll calculations and statutory compliance with the latest laws are some of the advantages of the software. With proper tax deductions, companies can reduce the risk of manual errors. Integrating third-party systems with payroll software helps centralize data.

factoHR makes managing your essential HR operations, like payroll and personnel data, a breeze! It’s a wonderfully cost-effective solution tailored to meet all your HR management needs. With factoHR, you truly have the best payroll system at your fingertips, ensuring smooth operations for your company’s success! It can help you manage your personnel more efficiently, regardless of the size of your company. Schedule a free demo with FactoHR now and learn more about it!

© 2026 Copyright factoHR