What is Local Conveyance Policy?

Download Local Conveyance Policy Word & PDF Format For Free

Table of Contents

Conveyance is a conventional word that can mean either the transportation of a person from place to place or the vehicle that does the process. Transport Allowance or Conveyance Allowance is the allowance for the employee’s travel from their residence to their workplace.

The Conveyance Policy is formulated to establish guidance and provisions while traveling from the home to the workplace and back. This reimbursement is usually offered in addition to the basic salary and may or may not be taxable under India’s Income Tax Act (depending on how much the employer is offering). There is no limitation to how much conveyance allowance an employer can offer its employees. In cases where the company provides transportation services to the employee, the Local Conveyance Policy is not necessary. Conveyance allowance can be classified with other allowances like a special allowance.

The Local Conveyance Policy aims to establish guidelines for reimbursement of conveyance expenses incurred by an employee for using Public Transportation/ own conveyance for official use. The Conveyance Policy has been developed to establish guidance and policy while traveling on official business and provide procedures for the approval, reimbursement, and control of travel expenses.

In this policy, you will know the following information.

- The policy applies to all the employees.

- The employees need to keep a receipt regarding the business-related expenses made by him during the local travel.

- The employees are required to follow road safety rules when using their own vehicles for office purposes.

- The procedure and calculation of the reimbursement.

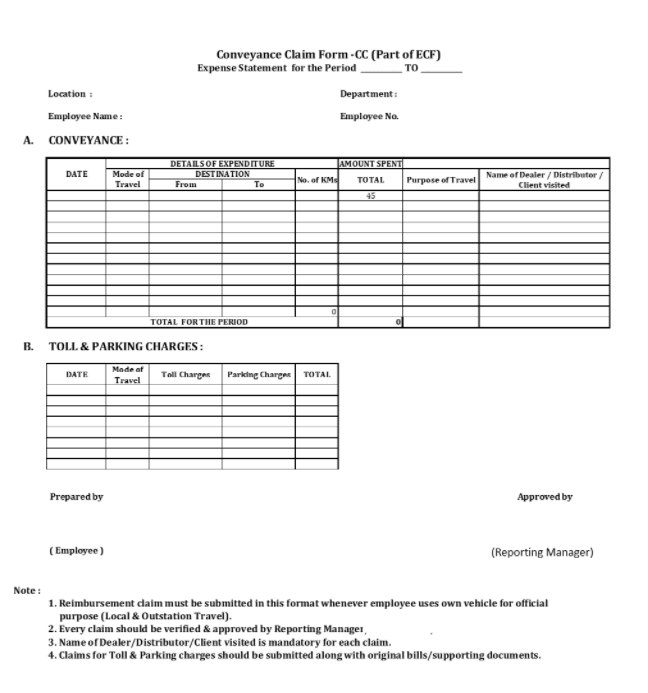

- Local Conveyance Reimbursement Form.

Local Conveyance Sample Policy

The “Name of the Company’s” Conveyance Policy outlines the rules that employees must follow when commuting for official company visits/meetings. It also includes criteria for approval and reimbursement of travel expenses.

Purpose

This policy describes the method and qualifications employees need for travel reimbursement. To meet business needs, the company anticipates employees to travel quickly and comfortably while being cautious with their spending.

Scope

The policy extends to all active employees of the company, regardless of their position and responsibilities.

Guidelines

All field employees who travel for business requirements shall use their own vehicles. Apart from the transportation, employees can also claim toll & parking charges by submitting receipts.

Employees should submit their transportation claim in “Number of days” days as per the Appendix ‘Local Conveyance Claim Form” for reimbursements.

Note: Employees must wear a helmet while using Two-Wheeler, whereas seat belts while using Four-Wheeler for official purposes.

Entitlement

Employees traveling for official purposes will be reimbursed based on the below table. However, this does not apply for travel between home to office & vice versa.

| Mode of Travel | Reimbursement Limit (in Rs. / Km) |

|---|---|

| Four-Wheeler | “Amount” |

| Two-Wheeler | “Amount” |

Exception

Any variations from this policy demand permission from Head HR. Management holds the right to revise or discontinue this policy without a prior message.

Download Our Resource

Appendix