Payroll Reconciliation

Table of Contents

What is Payroll Reconciliation?

Payroll reconciliation checks payroll processing to ensure employees are being paid accurately. Accuracy and reliability are paramount in payroll processing. It verifies that the ledger entries and payments being sent out are correct, reflecting the actual compensation of employees and all withholdings from their paychecks in all of the company’s bookkeeping records.

Although the payroll process may seem tedious and repetitive, it’s crucial for completing taxes, tracking business spending, and paying employees on schedule. As a result, careful monitoring is needed to ensure everything runs smoothly each month. Payroll software in India can significantly simplify and streamline this process, minimizing errors and saving valuable time for your payroll team.

How to do Payroll Reconciliation?

The organisation should do this by comparing the payroll for the current period to the payroll listed in the ledger. Both of these sets of figures ought to add up. Only this can guarantee that payments are being made properly.

Why Payroll Reconciliation is so important?

During the reconciliation procedure, the organisation’s financial accuracy is revealed. A timely and accurate payroll system will help the business build closer relationships with its staff.

Therefore, the payroll reconciliation procedure is crucial for a number of reasons:

- Helps to keep accurate records up to date

- Assures proper payment of employees

- Ensures easy compliance and tax filing

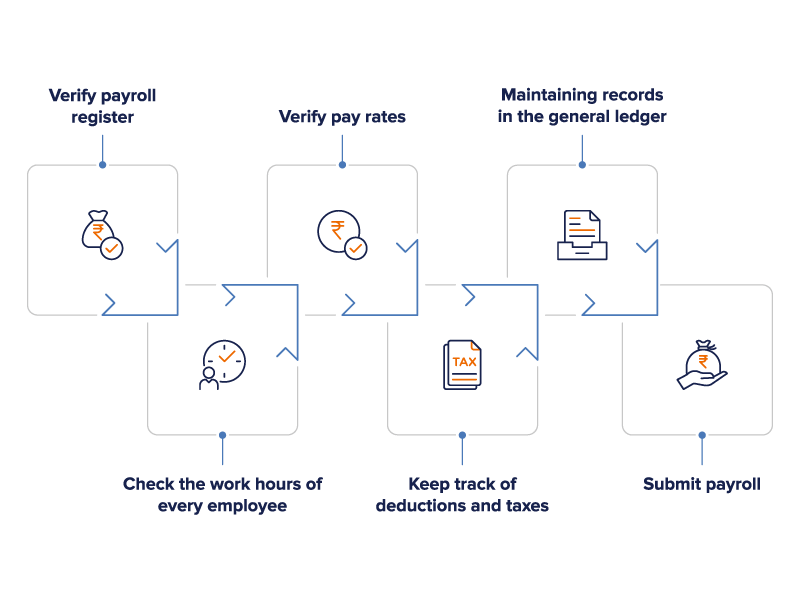

Payroll Reconciliation Procedure

Even if the entire procedure seems overwhelming, once it is divided into the following 6 parts, it becomes much more manageable:

1. Make sure that the payroll register appropriately displays wages and hours

Prior to each pay month, a reconciliation must be performed to guarantee that no incorrect amounts are paid. Three sets of records must be in alignment with one another for this to occur. Those are:

- Payroll Register – It displays the total number of working hours, salary, and deductions for the employee.

- Attendance and Time Records – This is the data kept for the duration of each pay period and the whole tenure of each employee’s employment.

- Pay Scales – The pay rates of different categories of employees should be maintained accurately so that they can be pulled up for reference at any point of time.

2. Verify attendance information

Verify the attendance information by comparing it to the number of hours each employee has put in. Sick days, overtime, holiday pay, and other costs should all be included because they gradually affect the salary.

3. Check pay rates

Keep current records of employee titles, new hires, promotions, pay rate changes, and so forth. This will establish how much each employee must be paid throughout the specified time frame.

4. Observe your tax deductions and payments

Some kinds of deductions that must be made, include those for Medicare, income tax, worker compensation benefits, and loans. Each year, the rate of deductions and withholding taxes is subject to change. Accurate record keeping is essential, and each deduction must be documented separately.

5. Keeping books up to date

Entire organisation’s assets, liabilities (both employer and employee), income, and expenses can be found in the general ledger. All of the organisation’s financial transactions must be recorded in the ledger. Payroll reconciliation is aided by having an updated ledger.

6. Submit Payroll

Payouts to all employees can be issued once all the data has been confirmed and reconciled. Additionally, statements must be created in accordance with the regulations to account for taxes and amounts withheld.

Best Practices for Reconciling Payroll Accurately

Setting right any errors made without reconciliation is well worth the effort, despite the reconciliation procedure being somewhat drawn out. Here are a few pointers to make sure the procedure goes smoothly:

1. Ensure payroll staff is coached well

To ensure that the process is carried out without a hitch, the organisation must make sure that the payroll staff is adequately coached. In order to guarantee that all of the financials are accurately accounted for, a check and balance mechanism should also be in place.

2. Ensure employee classification is done properly

If employees are not classified correctly, there could be a significant increase in payroll processing problems. Processing payments for different categories of employees based on their salaries, working hours, taxes, and other expenses differs significantly.

3. Asses end of financial year reconciliation

While payroll reconciliation happens frequently during the year, having a year-end plan in place is a smart idea. To identify differences, faults, and areas for development, the current year’s statements can be contrasted with those from the previous year. This will make it possible to implement a more precise and effective procedure the following year.

4. Decide on important performance indicators (KPI)

Setting up accountability for the upcoming year is a smart idea throughout the year-end reconciliation process. KPIs will make it easier to monitor process changes after incorporating suggestions and learnings from the previous year. Some of the elements that need to be taken into account are:

- Time required to fix mistakes

- Total mistakes as a share of all payroll deductions

- Total processing time for reconciliation

5. Think about automating payroll

The entire procedure should be automated because it reduces mistakes and increases efficiency. Additionally, as the organisation expands, managing the entire process manually gets more difficult. Some contemporary software aids in the integration with accounting software, enabling real-time comparison of transactions.

6. Run reports before paying employees

Organisations usually carry out reconciliation after employee payments have been made. However, the ideal time to complete it is a few days before payday. This saves the company time and effort and is required to correct any mistakes after compensation. Even payroll services have a reporting option that is quite beneficial to businesses. It’s quite helpful to keep data like the payroll register, deductions, summary, and cash requirements on hand.

7. Make a list for payroll reconciliation

Making such a checklist will operate as a ready reckoner throughout the reconciliation process and also act as part of a checklist for educating the payroll personnel.

8. Be dependable

Among all of them, this is arguably the most crucial. The optimal time to perform payroll reconciliation is right before each pay period, as opposed to quarterly or yearly. Despite an increase in frequency, this work is completed in a lot less time overall. It is crucial to have the ability to identify mistakes as soon as they occur.

Also available is our complete guide to payroll management which can help you in better understanding the payroll process.

Payroll reconciliation is not as much of a burden as compared to setting things right after the money is paid out and losses incurred. Keeping up with reconciliation throughout the year is the best way to keep the entire process hassle free and compliant.

Grow your business with factoHR today

Focus on the significant decision-making tasks, transfer all your common repetitive HR tasks to factoHR and see the things falling into their place.

© 2024 Copyright factoHR