Table of Contents

Bangalore is the Silicon Valley of India, with over 67,000 registered IT companies, and it continues to grow to date. Among these are the best cloud-based payroll software providers present in Bangalore. The reason for the existence of these companies is the growing need to automate payroll functions.

Payroll is an important process for any company to ensure accurate and timely salary payments to employees. Local businesses in Bangalore can scale their operations with some of the top payroll software available. This makes the payroll processing quick and easy for HR teams.

This article will help select some of the best payroll software in Bangalore that fits an organization’s requirements.

List of 10 Best Payroll Software in Bangalore

Many payroll solutions are available in the market, so it is crucial to carefully select software that aligns with an organization’s specific requirements. Get to know the list to find the best and perfect payroll management software for any organization and increase operational efficiency.

- factoHR

- Razorpay Payroll

- Pocket HRMS

- Gizmosys Solutions

- Paychex

- Kredily

- Zoho Payroll

- PionHR

- EasyHR

- peopleHum

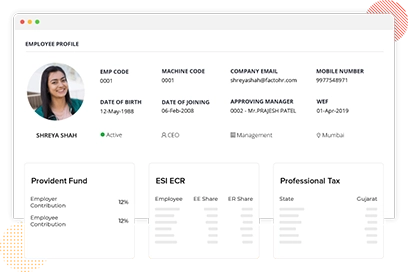

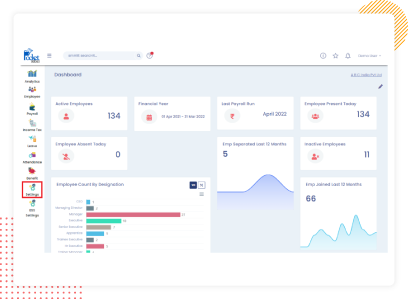

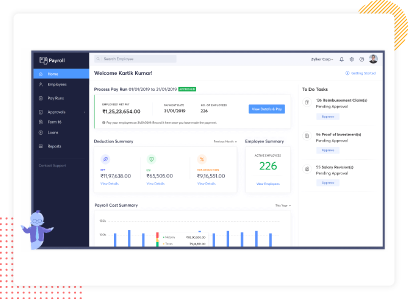

1. factoHR

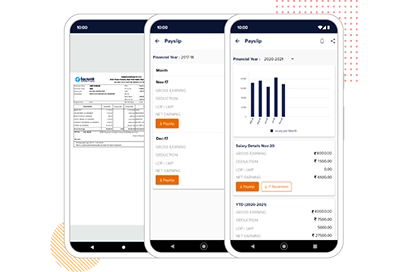

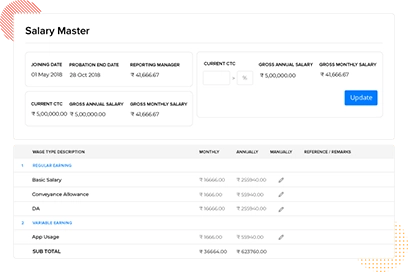

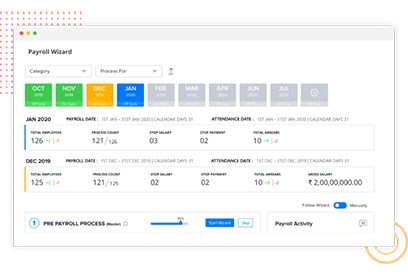

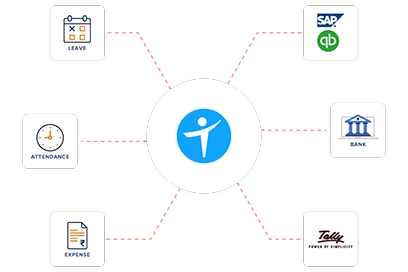

factoHR is a cloud-based payroll software in Bangalore that seamlessly fulfills HR-related requirements of an organization. It simplifies and streamlines payroll processes effortlessly with a single data source. Some features of factoHR’s payroll software include calculating taxes and deductions for payroll processing. The software can generate reports for employees and businesses. Integration with HR and accounting software can simplify processes.

An employee self-service portal or mobile app allows employees to mark their attendance, download payslips, and request leave. With factoHR, experience outstanding scalability and boost the efficiency of the core HR department. It simplifies the management of complex tasks like salary calculations, payment processing, statutory compliance, IT deductions, ESIC, PF, and loans, making them effortless to handle. factoHR provides a reliable and straightforward solution for these critical functions.

Features

| View salary and get a summary of gross earnings. | Download last month’s or last year’s payslip in PDF format. |

| Select a payslip format that suits your organization’s needs. | Deposit employees’ salaries directly to their bank accounts. |

| View projected income tax and compare it with actual deductions. | Process salary with multiple payroll groups according to employees’ payroll cycle. |

| Generate all kinds of income tax reports and forms. | Configure unlimited salary components. |

| The off-cycle payroll process helps in making additional payments like bonuses. | Fulfill payroll compliance requirements with automatic payroll calculation and file forms and reports. |

Advantages

- It reduces the overall time spent on manual calculations, like taxes and deductions.

- Also, the HR department’s workload is minimized as payroll-related tasks are simplified.

- The chances of human errors are reduced with the implementation of payroll software.

- Employee satisfaction is enhanced as accurate and timely compensation is received.

- The software can automatically update tax rates and compliance requirements.

- Avoid penalties related to incorrect filings with proper compliance with rules and regulations.

- Employees can access pay slips and other tax documents from an ESS portal.

- factoHR’s payroll security measures protect employees’ sensitive data from unauthorized access.

- It can accommodate new employees and multi-state labor laws as the business scales.

Pricing

factoHR’s pricing is typically per employee per month, starting at ₹69 for the core plan and increasing to ₹119 for the ultimate plan, billed monthly for each additional employee. Bangalore organizations can choose plans based on features and size.

Best Suited

factoHR is an ideal choice for organizations of all sizes in Bangalore—whether a company is running a startup, is a growing SME, or a large enterprise. Any company looking to simplify and automate payroll processes to stay compliant and scale easily can benefit from factoHR.

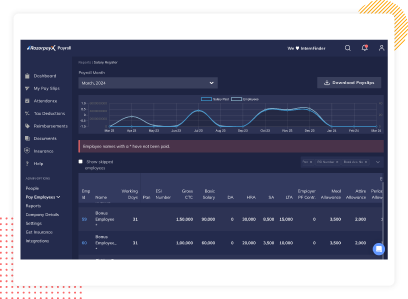

2. Razorpay Payroll

Razorpay is a fintech company with a comprehensive suite of products and services. It is one of the leading providers of cloud-based payroll management software. The software service enables salary management and statutory compliance.

Features

- Automated Statutory Compliance for complex government laws

- On-demand customization to match business requirements.

- Integrates with over 45 HR platforms, including Oracle HCM and Darwin Box.

- Offers compliance for 30 states without filing errors

Pricing

Razopay Payroll offers three plans: Prime (for up to 20 employees, ₹2,499), Elite (for up to 100 employees, ₹5,499–₹8,499), and Enterprise (for 100+ employees, custom pricing) for its customers.

Best Suited

Suitable for businesses like startups and SMEs, especially those with contractor-based employees.

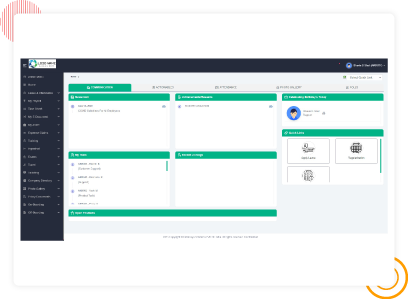

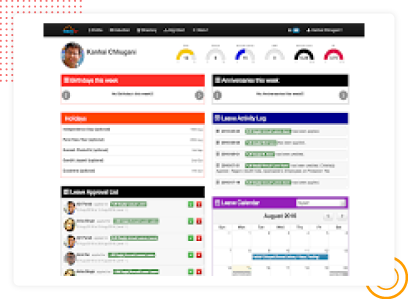

3. Pocket HRMS

Pocket HRMS can help automate all HR and payroll-related operations. An employee self-service (ESS) portal enables employees to access their information from anywhere, leveraging the latest cloud technology. HR professionals can accurately process payroll with Machine Learning-based smHRT payroll software. Customized payroll settings also help with precise calculations.

Features

- Quick overview of payroll information.

- Payroll for multiple ventures can be managed.

- Smooth exit with automated gratuity calculations

- Analytics and reporting

- Integrate with attendance and leave management modules.

Pricing

Pocket HRMS pricing starts at ₹2,999 per month for 50 employees or fewer. For each additional employee, the cost is ₹60 extra. Companies can also obtain custom quotes tailored to their specific requirements.

Best Suited

Pocket HRMS is the ideal solution for companies of all sizes that require automating their payroll processes and ensuring compliance across various industries.

4. Gizmosys Solutions

Gizmosys Solutions is a user-friendly payroll management system for HR and payroll-related tasks. It can also track and automatically calculate all statutory deductions, such as PF, ESI, professional tax, and TDS. Some of the necessary reports can also be generated without any additional work. It can easily integrate with systems like accounting and payroll for accurate payroll processing.

Features

- Loan/Advance/Arrears calculation

- Employee self-service to download payslips

- Salary approval

- TDS/PF/PT calculation

- Compare processed payroll with the previous month

- Audit trail reports and other 20+ payroll reports

Pricing

Gizmosys Solutions provides various plans, with their basic plan starting from ₹2,000 per month. More advanced plans offer additional features.

Best Suited

It is ideal for SMEs and large enterprises looking to streamline their payroll processing.

5. Paychex

Paychex is a well-designed payroll software that simplifies the payroll processes. The software can monitor taxation rules and regulations to maintain compliance. It offers a comprehensive payroll solution that streamlines online processing, automates tax administration, and provides benefits administration. Paychex includes integration with third-party systems, like attendance and accounting software. This helps HR professionals save time and cost.

Features

- Online payroll process

- Direct deposit

- Employee self-service portal

- Reporting and analytics

- Employment and income tax verification service

Pricing

Paychex offers three different pricing plans tailored to each organization’s specific requirements, with custom quotes available for each plan.

Best Suited

It is most suitable for small to medium-sized businesses.

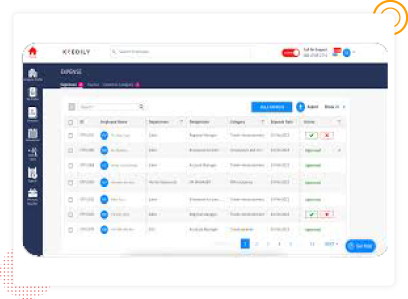

6. Kredily

Kredily is a free payroll software in Bangalore with no limits on the number of employees that can use it. It enables businesses to utilize customized configurations for salary processing and allows for the addition of as many salary components as required. It offers automated and integrated compliance features, as well as instant salary transfers, for organizations of all sizes.

Features

- Ensures timely overtime payments

- Smoothly manages the shift schedules

- Automatically calculates tax and deducts it from the salary

- Accurately calculates salary and automatically distributes payslips

Pricing

Three Pricing Models: Free forever, Professional (₹1500/ month roughly), and Enterprise (Pricing not mentioned explicitly).

Best Suited

Best suited for startups and small to medium enterprises.

7. Zoho Payroll

Zoho Payroll offers a range of payroll management services, designed to streamline payroll processing. It provides automated salary calculations and manages statutory compliance. Moreover, it offers an employee self-service portal, allowing employees to manage their data.

Features

- Stress-free data migration.

- Systematic employee exit management.

- Option for customizing deductions.

- Completes pay runs in a click.

Pricing

It offers four pricing plans: Free (up to 10 employees), Standard (₹1,000), Professional (₹3,000), and Premium (₹4,000).

Best Suited

It is suitable for startups and small to medium-sized enterprises (SMEs). Moreover, it is easy to transition for companies using the Zoho ecosystem.

8. PionHR

PionHR offers automated payroll software that simplifies complex payroll processes and saves time. It removes obstacles while paying employees and makes payroll efficient and error-free. This user-friendly software makes it easy for users to navigate its features. PionHR integrates with other HR tools, providing a unified approach to human resource management. It automates routine tasks and offers real-time access to payroll data. The payroll software releases the administrative burden on HR departments, allowing them to focus more on strategic activities.

Features

- End-to-end payroll

- Integration with other internal modules

- Compliance management

- Employee/Staffing Outsource

- Other compliance

- Fully customisable payroll

Pricing

PionHR payroll pricing starts at ₹6,999, which includes its payroll and leave features. The next tier, at ₹9,999, provides payroll and biometric features. The highest tier, priced at ₹11,999, offers complete payroll and HRMS features annually for 150 employees.

Best Suited

It is ideal for startups and medium-sized companies seeking scalable payroll and HR solutions.

9. EasyHR

EasyHR offers payroll solutions that allows organizations to automate payroll and tax calculations. The software for payroll helps enhance employee satisfaction and reduce errors. Employee documents can be managed from a single platform, which helps keep records organized. Their reimbursement module allows HR professionals to make the process quick and accurate for settlement. It also has a mobile app to track the workforce’s attendance in real-time.

Features

- Employee self-service.

- Flexible approval workflows.

- Store pay slips and other important documents securely.

- Easy time tracking.

Pricing

Easy HR offers three plans tailored to different business needs: Starter, Growth, and Enterprise, all of which feature payroll automation and compliance. Pricing details can be requested after a free trial.

Best Suited

It is best suited for medium to large enterprises seeking to streamline their payroll processing with automated compliance.

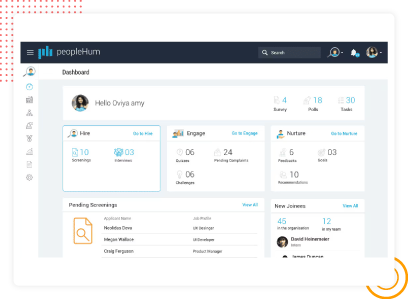

10. peopleHum

peopleHum is a user-friendly payroll management software designed to simplify HR processes. The software helps organizations to focus and manage their workforce more effectively. It also ensures accuracy and proper compliance, which makes business operations smooth. The system features various functionalities designed to enhance overall efficiency. The cloud-based payroll software streamlines some of the most complex tasks and offers customization options.

Features

- Proper compliance management.

- Employee self-service

- Data protection and privacy.

- Insights and analytics.

- Integrated with the attendance and payroll system.

Pricing

peopleHum payroll pricing starts at just $2 per employee per month. The plans can also be customized according to the modules and features chosen by the company.

Best Suited

peopleHum suits any business, from startups to large enterprises, seeking dependable, automated payroll and compliance solutions.

Compare the Best Payroll Management Software

| Software | Integrated Payroll | Leave Management | Mobile App | Generates Paysilps | ESS | Expense Management | Payroll Reports |

|---|---|---|---|---|---|---|---|

| factoHR | |||||||

| Razorpay Payroll | |||||||

| Pocket HRMS | |||||||

| Gizmosys Solutions | |||||||

| Paychex | |||||||

| Kredily | |||||||

| Zoho Payroll | |||||||

| PionHR | |||||||

| EasyHR | |||||||

| peopleHum |

Why You Need Payroll Software in Bangalore?

Local Compliance with the Karnataka Shops & Establishments Act.

The minimum wages in Karnataka vary according to the skill level and the zone. It ranges between approximately ₹15,000 and ₹21,000. Companies like factoHR adjust the payroll in accordance with the minimum wage policies.

Reduce Manual Errors and Increase Efficiency

Payroll software providers in Bangalore offer advanced features to minimize human errors and enhance efficiency.

GST, PT, and TDS Handling Support

Payroll software automatically calculates taxes and generates related reports to ensure timely filings, reducing the risk of penalties.

Advantages of Online Software

Bangalore has a strong ecosystem of entrepreneurs and investors. This helps startups set up their businesses in the area. Payroll software in Bangalore offers various advantages to businesses, like optimizing payroll operations and maintaining proper compliance. The key benefits are listed below.

Payroll Automation

The system automates and simplifies tax deductions and salaries by using advanced payroll software. It also reduces errors and offers customization options for various businesses in Bangalore.

Direct Deposit

Organizations can streamline their payroll process through direct deposits. This eliminates the necessity for physical paper checks, resulting in cost savings on administrative tasks.

Data Security

The payroll software employs security measures, such as encryption, precise access controls, and regular data backups. This helps protect employees’ sensitive information from fraud.

Employee Self-Service

Employees can access their payroll details and tax documentation. It helps maintain transparency and reduces the need for frequent HR inquiries.

How to Choose the Best Payroll Software for Your Organization

Efficient and accurate payroll management in Bangalore is essential for businesses of all sizes. The following factors will help any organization choose the best payroll solutions.

Identify Your Needs

Before choosing any payroll software in Bangalore, it’s essential to list your requirements and expectations based on your current practice, business type, workforce strength, and company size.

User-Friendly Interface

Ease of use is also one of the most important factors when choosing a payroll system, as it can dramatically increase efficiency and smooth the adoption process. To compare whether an application has an intuitive interface, consider comparing it with modern smartphone applications, where users can easily navigate all the functionality and learn to operate it independently

Scalability

Choose payroll companies in Bangalore that can flexibly accommodate your business’s growth, especially if you anticipate expanding your workforce in the future.

Integration Capabilities

Incorporating other systems, such as accounting or HR tools, is crucial for guaranteeing flawless collaboration with the payroll management system. Integration is necessary to ensure seamless operations and protect against data entry errors.

Future Updates and Support

The software provider should consistently release updates to keep the system in compliance with ever-changing tax laws and regulations.

Customization

Evaluate whether the software offers the flexibility to be tailored to your unique payroll processes and reporting requirements.

Conclusion

In Bangalore’s fast-changing and dynamic environment today, the need for efficient payroll software is the most important aspect. Considering the complexity and time taken in manual payroll, most companies prefer a payroll management system. The software solution not only automates but also simplifies the complexities associated with payroll management.

Considering the complexity of payroll, it is essential to utilize a payroll solution in your organization, as it reduces the HR department’s workload. This is where factoHR’s payroll management software can come in handy.

factoHR features a unique interface and intuitive design. The software is a good fit for businesses of all sizes as it allows them to manage payroll tasks effectively while ensuring compliance. Schedule a demo to know more!

Can I manage employee payroll remotely in Bangalore?

Yes, it is possible to manage payroll functions from anywhere in the world in Bangalore. This can be achieved by using cloud-based payroll software or outsourcing payroll services. These services automate payroll processing by providing accurate calculations and ensuring compliance with local and international labor laws

Which is the Best Payroll Management System in Bangalore?

For businesses in Bangalore, several payroll solutions are available for selection. It depends on the requirements, number of employees, scalability, and cost. Some of the options topping the list are:

- factoHR

- Zimyo

- Darwinbox

- SpineHR

- Zoho

© 2026 Copyright factoHR