Table of Contents

Timely and accurate disbursement of employee payouts is a critical factor for any business, especially small and medium enterprises (SMEs & MSMEs). However, it is found that the processing of payroll turns out to be a boring activity for every company since it involves the manual calculation of the salaries, taxes, deductions, and benefits involved. In most cases, it adds a layer of complexity that is really not needed. Payroll software will automatically handle these processes, streamline payroll, and leave SMEs free to attend to growth strategies.

Therefore, this guide will help you find the key insights into easing your selection process for the best solutions for your business needs. Knowing the characteristics and functions of the top payroll software for small businesses helps empower your business to succeed by making an informed choice. In this blog, we will provide you with the answers to all the questions related to the best payroll software for SMEs.

Top 10 Payroll Software for Small Businesses to Use in 2026

Considering the specific needs of small and medium enterprises (SMEs) in India, we have listed the top 10 payroll software for small businesses in 2025 with their unique strengths best suited for SMEs in India.

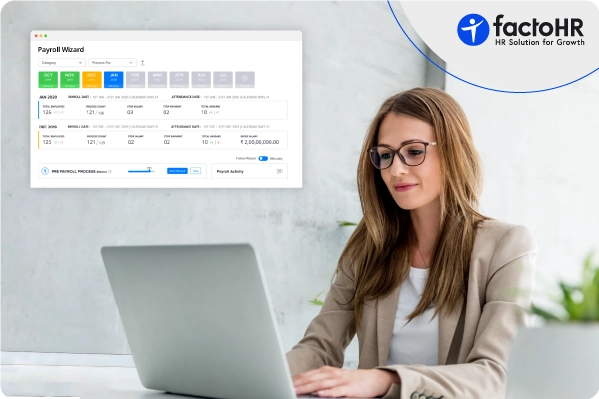

1. factoHR

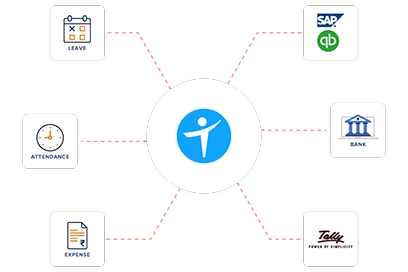

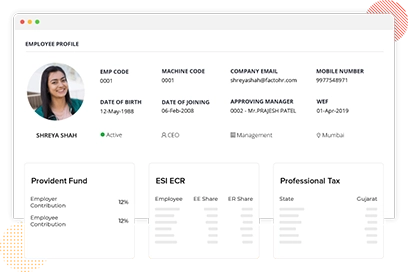

factoHR is the best payroll software for small businesses in India, designed to simplify payroll management for SMEs. Its cloud-based platform handles statutory compliance, payslip generation, and employee self-service efficiently. Integration with internal modules such as attendance, leave, and performance, along with ERP and accounting systems, ensures seamless payroll processing. Additionally, the mobile app enhances accessibility while maintaining strong security and scalability for growing teams.

Features

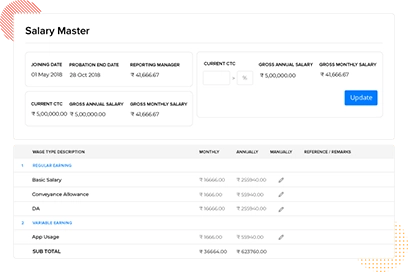

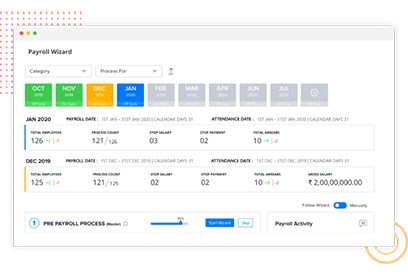

| Payroll wizard guides you through different payroll steps to ensure that you don’t miss anything. | Keeps track of all changes made to attendance and auto-calculates statutory and other payments for the organization. |

| Download statutory forms and allow employees to know IT deductions from the mobile app. | Reports can be scheduled and mailed directly. |

| A performance-linked payroll solution can be used to link employees’ compensation with their goals and KPIs. | ISO accredited and SOC Type 2-certified cloud data centre. |

| The off-cycle payroll process can make all necessary payments that aren’t included in the regular payroll cycle. | Various payroll reports can be built using the custom report builder option. |

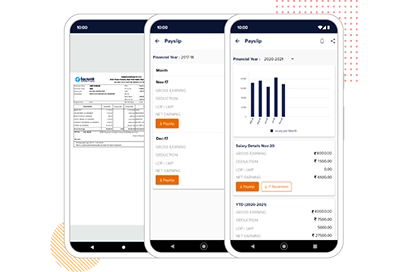

| Provides you with an option to manage employees’ loans and advances, including their policy configuration, calculations, and reports | A mobile app to allow your employees to download their payslips via their smartphones. |

Pros

- Integration with ERP, attendance, leave, and performance modules streamlines payroll and reduces errors

- Mobile app and cloud access improve convenience and accessibility for employees and HR teams

Cons

- Advanced customization may require additional training for HR teams

- HR professionals need time to get used to a multilocation payroll setup

Pricing

factoHR’s base plans start at ₹4,999 per month for up to 50 employees.

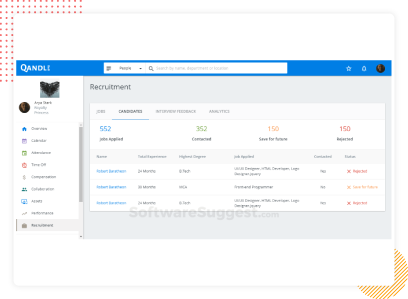

2. Qandle

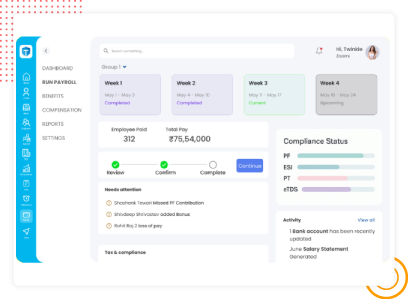

Qandle is online payroll software for medium-sized businesses. It is ideal for SMEs due to its automation, compliance, and integration features. Additionally, the platform is designed to address common SME challenges, such as staying compliant with Indian tax laws (including PF, ESI, PT, and TDS). The software simplifies complex salary structures and reduces manual data entry through automation.

Features

- Automated Salary & Tax Calculations

- Statutory Compliance (PF, ESI, PT, TDS)

- Custom Salary Structures

- Payroll Analytics & Reporting

- Leave & Attendance Management

- Full & Final Settlement

Pros

- Comprehensive suite of tools for payroll management

- Integration with accounting modules

Cons

- Limited advanced reporting features

- Complex setup

Pricing

Pricing typically ranges between ₹49 and ₹129 per employee per month, depending on the plan.

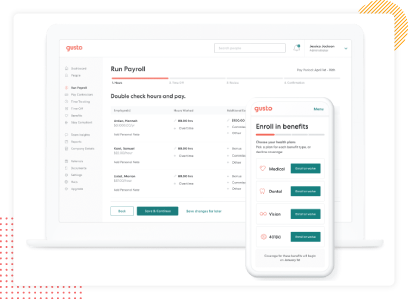

3. Gusto

Gusto is an HR and payroll software designed for Indian startups and growing businesses that simplifies payroll management. Its intuitive interface allows small teams to manage HR tasks efficiently without dedicated HR staff. The platform automates statutory calculations for PF, ESI, and TDS while generating accurate payslips. Moreover, employees can view payroll and leave information through mobile apps, which improves transparency and convenience.

Features

- Integrated pre-tax benefits

- Paperless paychecks

- Easy cancellations

- Contractor payments

- Payment options for hourly and salaried employees

- Statutory compliance tracking

Pros

- Streamlined payroll and HR processes

- Intuitive interface and easy benefits management

Cons

- Limited payroll analytics

- Lack of customization features

Pricing

Pricing typically starts from ₹4316 per month, depending on the features selected.

4. TankhaPay – Best Payroll Software in India for All Business Sizes

TankhaPay is an advanced payroll and compliance management platform designed to simplify complex payroll operations for businesses of every size, from startups to large enterprises. It offers both automated payroll software and fully managed payroll outsourcing services, giving organizations the flexibility to choose between self-managed or expert-assisted payroll operations.

Businesses can manage statutory compliance, automate salary disbursement, and precisely handle TDS, PF, ESI, and professional tax using TankhaPay’s integrated HRMS. Additionally, the platform easily integrates with modules for expenses, leave, and attendance, guaranteeing 100% accuracy in payroll computations. Automated filings, digital payslips, and real-time dashboards increase compliance accuracy while decreasing human labor.

Its intuitive interface, mobile accessibility, and robust analytics empower HR professionals and CXOs to make payroll faster, transparent, and error-free — all backed by a dedicated support team.

Features

- Fully automated payroll engine with real-time compliance updates

- Integrated HRMS covering attendance, leave, and expense management

- One-click salary disbursement with auto-generated payslips

- Payroll and compliance outsourcing options for end-to-end management

- Statutory filings and intelligent tax computation (PF, ESI, PT, TDS)

- Workflows for custom approval and reporting dashboards

- A committed account manager for deployment and support

- Employees can view paystubs and tax information via a mobile app.

- Scalable for large corporations, MSMEs, and startups

- Secure data encryption and role-based access

Pros

- Provides managed payroll outsourcing services in addition to payroll software.

- Advanced automation of compliance for error-free processing

- A unified HR and payroll experience is ensured with integrated HRMS.

- Committed professional assistance for seamless onboarding and implementation

Cons

- Internet connectivity is required for full cloud functionality

Pricing

Plans start at ₹60 per user/month.

TankhaPay combines expert-led payroll management with a powerful cloud-based HRMS, making it one of the most versatile and scalable payroll solutions for Indian businesses.

5. Rippling

Rippling is a cloud-based payroll software solution for medium-sized businesses, combining payroll and IT management on a single platform. Automation reduces repetitive administrative tasks, which allows managers of Indian SMEs to focus on strategic priorities. The system tracks employee data in real time while ensuring statutory compliance is met. Additionally, analytics offer insights into payroll performance, and the mobile app enables the process to be accessible from anywhere.

Features

- Payment in local currency

- Automated tax filing

- Expense management

- Dedicated mobile app

- Automated document collection to comply with Indian regulations

- Payroll analytics

Pros

- Integration of payroll with HR and IT for improved efficiency

- Complete automation of payroll processes

Cons

- Some compliance features require manual verification

- It can be challenging to set up for beginners

Pricing

Organizations can request quotes based on their specific needs

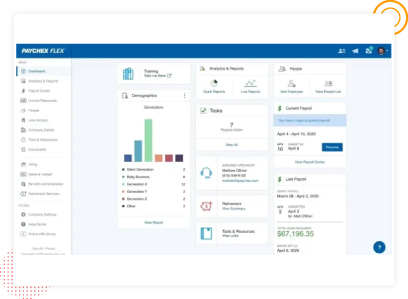

6. Paychex

Paychex is a payroll software solution for MSMEs that manages payroll alongside HR functions for small and medium businesses in India. Its cloud-based platform ensures secure access to employee data from anywhere, while automating leave and attendance management. The system also efficiently handles PF, ESI, and TDS compliance. Additionally, detailed reports provide SMEs with the insights necessary to make informed decisions about payroll and workforce management.

Features

- Support to maintain employee records

- Access to employee history

- Automated statutory compliance

- Loan management

- Leave and attendance integration

- Comprehensive features for end-to-end salary transfers

Pros

- Flexible payroll management with cloud-based access

- Comprehensive reporting features

Cons

- Comprehensive reporting, but limitations in generating custom reports

- Complex interface

Pricing

Provides different pricing arrangements based on personalized quotes

7. EmployeeVibes

EmployeeVibes is suitable payroll software for India’s small and medium-sized businesses (MSMEs), simplifying payroll calculations and generating accurate reports. It also automates statutory compliance and tax calculations, reducing manual effort. The platform provides analytics to help business owners monitor payroll performance and make informed decisions. Furthermore, its configurable interface supports efficient management of salaries, allowances, and employee records, while mobile access ensures HR processes remain convenient.

Features

- Custom salary templates

- 7-step payroll process

- Loans and advances management

- Autogenerated payslips

- Investment declarations and proof submission

- Tax calculation and compliance automation.

Pros

- Automated tax calculation

- Configurable features

Cons

- It can be difficult to manage payroll in multiple locations

- Learning curve for beginners

Pricing

Provides customized plans based on the specific needs and size of a business

8. ADP

ADP is an HR and payroll software solution for Indian small businesses, helping automate salary processing and ensuring compliance with Indian labor laws. Moreover, it simplifies PF, ESI, TDS, and professional tax calculations while ensuring timely payouts. Employees can also view payslips and leave records through mobile apps. The system scales easily as the business expands.

Features

- Mobile app for payslip access and leave tracking

- Customizable payroll and compliance reports

- Automated compliance with PF, ESI, TDS, and professional tax

- Direct deposit to employee bank accounts and payroll card options

- Integration with attendance and biometric systems

- Scalable modules

Pros

- Accurate calculations for payroll and compliance management

- Customizable reports and detailed insights

Cons

- Initial setup can be complex

- Customization can slow down the software

Pricing

Pricing varies based on headcount, business location, service packages, and specific needs.

9. Patriot

Patriot acts as payroll management software for small businesses, designed for simple salary management and statutory compliance in India. It also automates PF, ESI, TDS, and professional tax filings while supporting direct deposit. Small business owners can manage employees with minimal effort. Additionally, reporting provides clear insights into payroll and deductions.

Features

- Guided payroll setup.

- Printable payslips.

- Compliance support.

- Employee portal.

- Payment processing for contractors and freelancers.

- Integration with accounting software.

Pros

- Faster processes and minimal errors in compliance.

- Easy-to-use for nontechnical professionals.

Cons

- Basic reporting that may not be sufficient for detailed audits.

- Limited customization.

Pricing

Pricing generally starts from ₹748 per employee, depending on the plan.

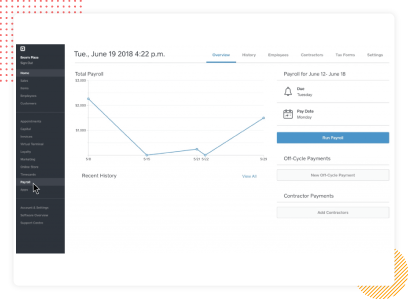

10. Square Payroll

Square Payroll is software designed for small businesses’ payroll needs, helping automate salary payments for both hourly and full-time staff in India. Moreover, it calculates statutory deductions such as PF, ESI, TDS, and professional tax automatically. Contractors can be paid instantly. Mobile access also allows payroll management anywhere, saving time for small business owners.

Features

- Automatic tax calculation

- Integration with attendance

- Payment options for contractors and freelancers

- Mobile-friendly payroll processes

- Transparent pricing arrangements

- Time tracking for hourly employees

Pros

- Features for managing hourly staff

- Automated processes

Cons

- Limited advanced features compared to local competitors

- Firms can find it difficult to work with complex payroll structures

Pricing

Pricing typically starts from ₹3082 per month per person, depending on the plan.

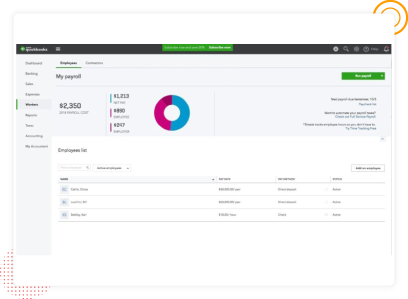

11. QuickBooks

QuickBooks Payroll is a software solution designed for small businesses to handle their payroll, combining payroll and accounting functions. It also automates salary processing with statutory compliance for PF, ESI, TDS, and professional tax in India. Direct deposits are fast, and business owners can generate custom payroll reports quickly. Moreover, it helps maintain accurate financial records for better decision-making.

Features

- Suite of tools for GST management

- Automated payroll compliance

- Same-day salary transfers

- Benefits management

- Custom reports

- Cloud-based access for remote teams

Pros

- Intuitive bookkeeping features

- Same-day salary processing

Cons

- Advanced features can be overwhelming for beginners

- Difficult to integrate outside the QuickBooks ecosystem

Pricing

Basic plans start from ₹1673 for three months per person, depending on the plan.

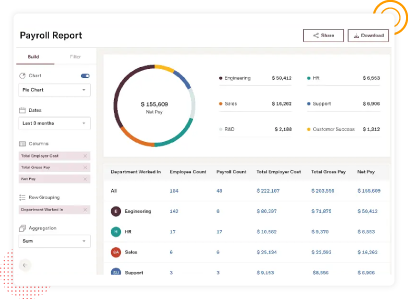

Evaluate and Choose the Best Payroll Software for SMEs & MSMEs

We have compiled a table that includes key details for the 10 best payroll software for small businesses in India. Explore the table, and choose a vendor based on features and client reviews.

| Must-Have Features in Top Payroll Software for SMEs & MSMEs | Rating | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Software Name | Compliance & Tax Management | Self-Service & Mobile Access | Salary Structure Customization | Customer Support & Training | Security & Data Privacy | G2 | Capterra | ||||

| factoHR | 4.6/5 | 5/5 | |||||||||

| Qandle | 4.3/5 | 4.4/5 | |||||||||

| Gusto | 4.5/5 | 4.5/5 | |||||||||

| Rippling | 4.6/5 | 4.5/5 | |||||||||

| Paychex | 4.2/5 | 4.3/5 | |||||||||

| EmployeeVibes | 4.6/5 | 4.7/5 | |||||||||

| ADP | 4.3/5 | 4.2/5 | |||||||||

| Patriot | 4.5/5 | 4.6/5 | |||||||||

| Square Payroll | 4.4/5 | 4.3/5 | |||||||||

| QuickBooks | 4.3/5 | 4.4/5 | |||||||||

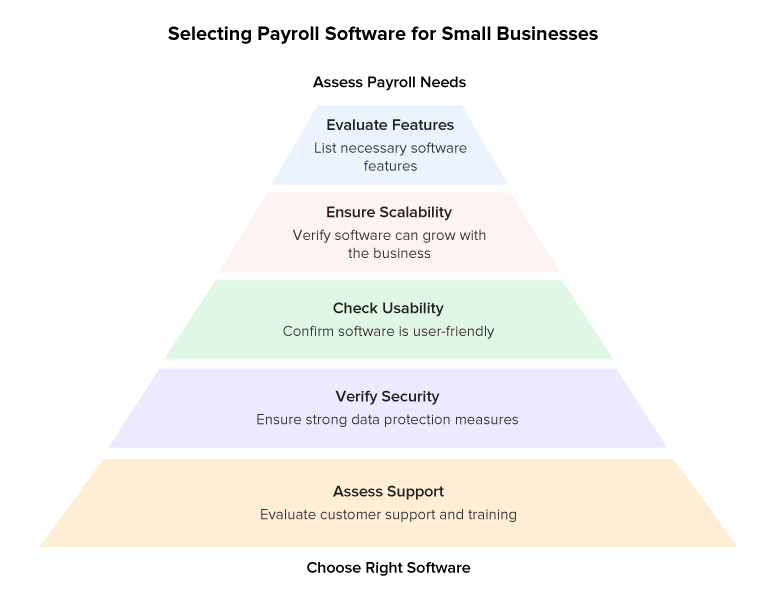

Choosing the Right Payroll Software for Small Businesses

Here are a few steps to help you make an informed choice regarding choosing the right payroll software for your organization:

Assess Your Needs

Begin by identifying your organization’s specific payroll needs. Consider factors like the size of your workforce, your industry’s compliance requirements, and any unique payroll processes you have in place.

Features and Functionality

Make a list of features you require in payroll software for SMEs. Common features include automated tax calculations, employee self-service portals, customizable pay structures, and integration with accounting or HR systems.

Scalability

Ensure your SME payroll software helps grow your business. Choose software that can adapt according to the future needs of an increasing number of employees.

Easy to Use

The software should be intuitive and user-friendly. Complex interfaces can lead to errors and decreased productivity. Look for an SME payroll software solution that simplifies payroll processes.

Security

Payroll data contains sensitive information. Ensure the software provides strong security measures such as data encryption, multi-factor authentication, and regular security updates.

Support and Training

Check what kind of customer support the payroll software provider offers. Also, assess the availability of training resources and user guides to help your team effectively use the software.

Customization

Consider whether the software allows you to set up payroll, fine-tune payslip formats, reports, and other features to match your organization’s branding, functional, and non-functional requirements.

Conclusion

Choosing the best payroll software for small businesses can be highly beneficial. With factoHR, you can streamline administrative tasks, automate payroll calculations, and ensure compliance with regulations. The software is designed to be user-friendly, allowing you and your team to focus on core operations. factoHR’s payroll system features are specifically tailored to meet the needs of SMEs and MSMEs, helping your business achieve its growth goals. Schedule a demo today to see how factoHR can benefit your business.

FAQs

What is the Best Payroll Software for Small Businesses?

factoHR’s payroll software is India’s best and a strong contender, offering the most advanced features for SMEs in India. It provides a fully loaded suite, including automated calculations, statutory compliance, intuitive user interfaces, and integrations with popular accounting software. In most cases, the best would depend on your specific needs, as there is no ideal solution.

What are the Key Benefits of Using Cloud-Based Payroll Software Instead of Manual Payroll?

The cloud-based payroll software offers several benefits, including alleviating the burden of a cumbersome process. By automating calculations, ensuring compliance with the law, and providing a convenient, easy-to-use system for employees to access payout information, you can overcome the challenges of manual payroll, allowing your team to focus more on core business activities and growth strategies.

What Features Should Indian SMEs Look for in Online Payroll Software?

When selecting online payroll software for small and medium enterprises (SMEs) in India, it’s essential to prioritize key features that ensure compliance and efficiency. Look for software that offers automated PF, ESI, and Income Tax calculations, as well as integration capabilities, tax compliance, and payroll compliance.

How Much does Payroll Software Typically Cost for SMEs in India?

Pricing for the payroll system may vary for certain features, the number of employees, and other factors. factoHR provides transparent pricing information for the product on their website. Budget, the feature set you need, and scaling requirements, among other factors, could influence your decision.

What Mistakes Should You Avoid when You Buy Payroll Software for a Small Business?

Here are the five mistakes that you should avoid when buying payroll software for a small business. –

- Do not select all the features. Select only required features.

- Only apply necessary customizations. Too many customizations can be complex.

- Avoid selecting software with a complex or difficult interface.

- Lastly, opt for a solution that focuses on local compliance with labor and tax regulations.

© 2026 Copyright factoHR