Understanding Salary Structure in India

Download CTC Calculator for Free

Table of Contents

Whether you are an HR professional or someone contemplating a job offer, understanding the salary structure in India will help you in making the right decision. The terms in a salary slip can be confusing and most people avoid understanding the salary structure until they need to apply for a loan or credit card. However, this may not be a smart way to manage personal finances.

Benefits of Understanding Salary Structure

Understanding your salary structure can help you in:

- Evaluating and comparing job offers

- Understanding what component of your salary is forced savings (EPF, etc)

- Minimising your tax liabilities by understanding applicable deductions.

Frequently Used Terms Relating to Salary Structure

This blog aims to give an overview of what components constitute salary, what will be the cost to the company and what will be the take-home salary. You will also learn about other applicable allowances. Before we dive into salary structure in India, here are some frequently used terms that one should know to understand how the company looks at salary and how an employee does.

Cost to Company: Cost to the company (CTC) is the money the company would spend on an employee. CTC helps companies in budgeting for their annual spending. It contains all kinds of expenses that the company would spend for the employee to be productive and is not limited to their salary. Examples of such additional expenses are furniture/laptop, expenses per head of shared resources like office rent, performance bonus, allowances, etc. To know the complete list and how CTC is calculated, see here. It also has a useful CTC calculator.

Take Home Salary: For an employee, knowing the take-home salary is important to manage personal finances. Take-home salary is the money that would be paid after the deduction of statutory savings and taxes.

Allowances: Most of the allowances are tax-free or attract less tax. While allowances like HRA are applicable to most people, other allowances are dependent on the type of job. For some, even HRA is required because they live in their own house. For example, conveyance allowance may not be applicable to everyone. So, choosing and agreeing on applicable allowances will help in tax savings.

Gross Salary: Also referred to as gross pay, gross salary is the sum of basic salary and all the allowances received by the employee as defined by the company and applicable government rules.

Net Salary: It is usually referred to as take-home pay or net pay and salary in hand. This is the amount the employee receives after statutory deductions and tax deductions.

The Revised Code on Wages 2019

The revised code is likely to be implemented from this July (2022).

The fundamental change is the limit on the allowances set by the new rules. All allowances put together should not exceed more than 50% of the salary package. This in turn will impact the calculation of Basic and PF components. An increase in basic salary will attract more tax. Increased PF component is beneficial in the long term as the money saved with PF is tax-free. On the other hand, employees’ take-home salaries will be reduced.

There has been quite a buzz about the new wages code. Like everything else, there are arguments in favour as well as against the new regulations. Critics say that this arrangement will only benefit the government as it will have more money both in taxes and PF that could help close the fiscal deficit.

With this background, let us dive into the components of the salary structure.

A Detailed Breakup of Salary Structure in India

A typical salary structure in India includes the following components :

Earnings:

- Basic Salary

- HRA (House Rent Allowance)

- LTA (leave Travel Allowance)

- Applicable Allowance

- Performance Bonus

Statutory deductions in the form of:

- PF (Provident Fund) Contribution by Employee

- Professional Tax

- TDS (Tax Deducted at Source)

- ESIC (Employees’ State Insurance Corporation)

Statutory additions in the form of:

- PF (Provident Fund) Contribution by Employer

- Gratuity

Let’s take a look at each of these components in detail:

Basic Salary

This is the base component of the salary before applying any taxes or adding any other allowances and benefits. As per the new regulations, this cannot be less than the minimum wage for the job as defined by the local state governments and cannot be less than 50% of the total salary package. Many allowances and taxes are calculated as a percentage of basic salary.

HRA (House Rent Allowance)

This allowance is to enable employees to find suitable rented accommodation. This cannot be more than 50% of the basic salary. The tax exemption on HRA is the lowest amount out of the following:

- Actual HRA received

- 50% of (basic salary + DA) for those living in metro cities

- 40% of (basic salary + DA) for those living in non-metro locations

- Actual rent paid should be less than 10% of basic salary + DA

Note that HRA cannot be availed by employees living in their own houses.

LTA (Leave Travel Allowance)

Like other allowances, the LTA is tax exempted. LTA can be availed twice in a four-year block by the employee for seld and family members too. This allowance is made available for domestic travel to encourage tourism in the country. In most organizations, LTA can be claimed by submitting transport bills of the travel.

Note that food and other expenses are not covered in the allowance.

Applicable Allowance

Depending on the organisation and nature of work, various allowances may be provided for the employee to discharge their duties. Examples of such allowances are DA (dearness allowance to offset inflation), medical allowance, overtime allowance, etc.

Performance Bonus

A bonus is a variable component of the salary that depends on the performance of the company, the department and the employee. It is a way of sharing profits if the company did well and recognising employee contribution for the additional revenue.

EPF (Employees’ Provident Fund)

In India, 12% of the basic salary is contributed by both the employee and the employer to this social security scheme mandated by the Government of India. The returns upon maturity do not attract any taxes. While EPF is mandatory, the Personal Provident Fund (PPF) is voluntary. Contribution to PPF too can be made by the employee on his/her own to benefit from tax exemptions and often earn higher interest rates than banks.

Professional Tax

This tax is levied by state governments barring the UTs and some states. It is usually a fixed amount to the tune of Rs. 2500 per year and may slightly vary state to state. As of date, the states that impose this direct tax are Karnataka, Bihar, West Bengal, Andhra Pradesh, Telangana, Maharashtra, Tamil Nadu, Gujarat, Assam, Kerala, Meghalaya, Odisha, Tripura, Madhya Pradesh, Jharkhand, Sikkim and Mizoram. The employer is expected to deduct the tax from employees’ salaries every month and pay the amount to the commercial taxes department of the state government.

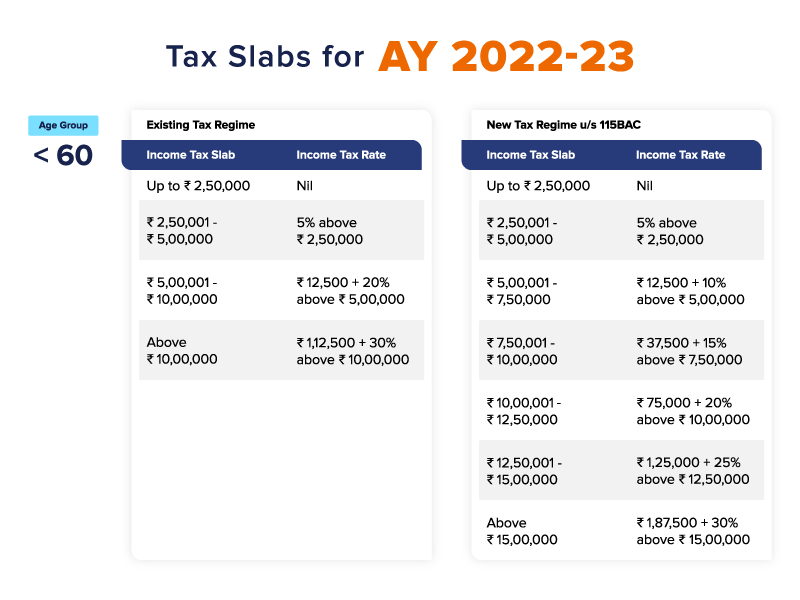

TDS (Tax Deducted at Source)

Based on the income tax guidelines, tax is calculated on the salary of the employee and paid to the government. Employees receive their salary post this deduction. Income tax guidelines and slabs are reviewed by the finance ministry every year during the budget session. If there are any changes, they are communicated to all relevant authorities and companies. The prevailing slabs and tax rates for calculating TDS are as follows (here we are showing tax applicable for persons aged less than 60) taken from the govt website:

ESIC (Employees’ State Insurance Corporation)

This insurance scheme is applicable to all employees earning a gross salary of less than Rs. 21,000 per month and if the company has more than 10 employees (it is 20 employees still in some states). Currently, the employer and employee have to contribute 3.25% and 0.75% respectively of the wage.

Where the employee is earning less than or equal to Rs.137 on a daily basis, the employee need not contribute. However, the employer still has to contribute in these cases too.

This insurance covers medical, disability and unemployment situations.

Gratuity

Gratuity is a lump sum amount paid by the employer to the employee as a token of appreciation for the services the employee rendered to the company. This amount is paid when the employee is leaving after 5 years of employment, at retirement or during a layoff. Gratuity is also paid by the employer in cases where the employee becomes disabled for work or to the nominee/next of kin when the employee dies while still employed.

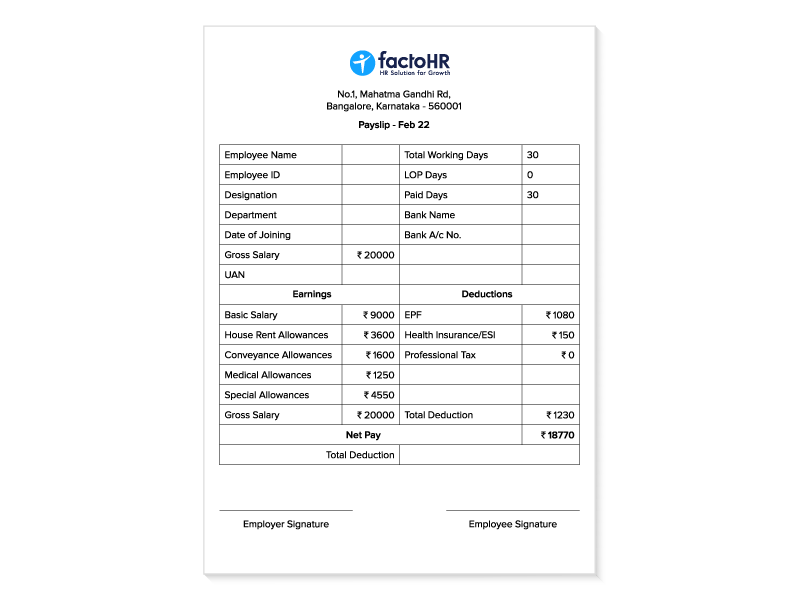

Here is a sample payslip that a company provides to employees on a monthly basis. This has the components that are discussed above:

It is important for salaried employees to understand their salary structure so that they can save and invest wisely. From an HR perspective, it’s crucial to understand the salary structure as the entire payroll budget is linked to these aspects. Whether you are making offers to prospective candidates, giving hikes to existing ones, or even planning cost cutting, understanding the various components of a salary will help you calculate the overall impact.

Grow your business with factoHR today

Focus on the significant decision-making tasks, transfer all your common repetitive HR tasks to factoHR and see the things falling into their place.

© 2025 Copyright factoHR