What is CTC? and How to calculate it?

Download CTC Calculator for Free

Table of Contents

CTC Calculator

| Salary Structure | |||

|---|---|---|---|

| Particular | % / Amount | Monthly | Yearly |

| BASIC + DA | – | – | |

| HRA | – | – | |

| LTA | – | – | |

| UNIFORM ALLOWANCE | – | – | |

| PERFORMANCE BONUS** | – | – | |

| DEDUCTIONS | |||

| PF CONTRIBUTION (EMPLOYEE) (12%) | – | – | |

| PROFESSIONAL TAX | – | – | |

| STATUTORY ADDITIONAL | |||

| PF CONTRIBUTION (EMPLOYER) (12%) | – | – | |

| STATUTORY BONUS (8.33%) | – | – | |

| GRATUITY | – | – | |

| OTHER | – | – | |

| COST TO COMPANY (CTC) | |||

| TOTAL | |||

Employees often get confused about amount of salary organization has commited vs amount they receive in bank. Generally, companies offers a CTC amount to an employee, which different from what you receive in your bank account. HR receives many queries regarding this from new joinee who are just starting their career after completion of college. So in this article, we will try to explain a-to-z, here, starting from CTC meaning to the CTC calculator. So lets get started

What is CTC?

CTC or annual CTC comprises all the expenses, be it utilities, salary, or monetary benefits, which the company spends on its employee. Moreover, CTC in salary is not the employee’s net income; instead, it considers other additional services provided to an employee as livelihood necessities and security. These additional benefits could be allowances, statutory additions, performance bonuses, gratuity, reimbursements, etc.

Keeping the above thing in mind, the calculation formula of CTC structure for any employee would generally go as:

CTC = Gross Pay + Statutory additions (PF + ESI + Bonus)

In the above formula, the statutory additions are the employer’s contributions and not the employee, which we will look into as this article progresses.

However, The confusion between gross salary and basic pay is often caused. The basic pay is the employee’s income before any additions and deductions. In contrast, the gross revenue combines the basic salary, allowances, and performance bonuses rewarded by the company. Here, what is CTC in salary with example is given.

People Also Search

Please select from below options to help us improve our content

Here is an example of an employee’s income with bifurcation showing earnings and deductions before getting into deep.

| EARNINGS (per month) | STATUTORY DEDUCTIONS (per month) | STATUTORY ADDITION(per month) | |||

|---|---|---|---|---|---|

| Basic | 34,000 | Employee Provident Fund (Employee) | 2,520 | EPF (Employer) | 2,520 |

| Dearness Allowance | 3,000 | Professional Tax | 200 | Gratuity | 1,014 |

| House Rent Allowance | 5,000 | ESIC(Employee) | 157.5 | ESIC (Employer) | 682.5 |

| Leave Travel Allowance | 2,000 | Tax Deducted at Source | 2,800 | Statutory Bonus | 1,749 |

| Medical Allowance | 2,500 | ||||

| Bonus | 2,500 | ||||

| Reimbursements | 1,000 | ||||

| Total | 50,000 | Total | 5,677.5 | Total | 6,465.5 |

| Salary = 50,000 per month | |||||

| Net income = 37,857 per month | |||||

| CTC = 56,465.5 per month | |||||

For instance, if a business is on a smaller scale and has fewer employees, the CTC calculations are lower. On the contrary, if the company has a large number of employees, it isn’t easy and is time taking. All these calculations can take days to complete.

Establishing a manual operation at a higher level is not an easy task; instead, implementing payroll management software can make your readings accurate. In addition, it offers a platform to handle multiple and complex CTC structures, lawful adherence, bank integration, loan management, reconciliation reports, and accounting integration.

Gross Salary

The gross salary is the accounting of the Basic income, allowance as provided by the company, and the bonus rewards, which may be paid monthly or annually as decided by the company. The gross income can be calculated from the below-given equation.

Gross salary = Basic salary + Allowances (DA + HRA + LTA + others) + Bonus + Reimbursements

Basic Salary

The basic salary is the income of employees received against the number of days they have worked and their designation. It is the prime part of the CTC (about 30-50%) and paid without any prior additions and deductions. The basic salary of an employee must comply with the minimum wage standards defined by the State government and Industry. The basic provided to the employee is 100% taxable as per the Income Tax Act, 1961.

Net Salary

After all the aggregations and reductions, any employee’s net salary is the final income that an employee receives. In layman language, it is also referred to as the take-home salary. It is calculated formula mentioned below:

Net Salary = Gross Salary – Statutory deductions (EPF, ESIC, Gratuity) – Income Tax (TDS, PT)

The deductions concluded in the above equation are the employee’s contributions for EPF, ESIC, Gratuity, and taxes that helps employees with medical and social securities.

Allowances

Allowances are provided to the employees apart from the basic salary as a financial benefit that applies to various livelihood necessities. These allowances are part of the CTC, and their allocation differs from company to company. Therefore, allowances are taxable unless exemptions are available specified under the Income Tax Act. Based on this, the budgets can be broken down into taxable, non-taxable, and partially taxable.

| TAXABLE | NON-TAXABLE | PARTIALLY TAXABLE |

|---|---|---|

| Dearness Allowance | Salary to the government employee who is posted abroad | Medical Allowance |

| Entertainment Allowance | Allowance for the UN employees | Special Allowance |

| Overtime Allowance | Sumptuary allowances paid to the Judges of High Court and Supreme Court | Conveyance Allowance above ₹19,200 annually |

| City Compensatory Allowance | Compensatory allowances paid to the High Court and Supreme Court Judges | Entertainment Allowance (1⁄5 of the salary or ₹5000, whichever is less) |

| Leave Travel Allowance | ||

| Uniform Allowance | ||

| Meal Allowance | ||

| House Rent Allowance (for employees paying rent) |

Initially known to be Dear Food Allowance, the Dearness Allowance is provided to the public sector employees and the pensioners to offset the price rise. Since DA is provided to compensate for the cost of living, it is varied based on the location where the employee stays. It outlines that DA offered for rural areas is different from that of living in urban areas. There are two types of allowances available: Variable DA and Fixed DA.

Variable DA: This allowance varies in the CTC structure, and it is based on the Consumer Price Index (CPI) defined by the state government.

Fixed DA: the amount of the allowance is fixed in the CTC structure.

For government employees, it is calculated according to the formulas below.

For Central government employees:

DA% = ((Average of AICPI (Base year 2001=100) for the past 12 months – 115.76)/115.76) * 100

For Public sector employees after 01/01/2007,

DA% = ((Average of AICPI (Base year 2001=100) for the past 3 months – 126.33)/126.33) * 100

Where AICPI = All India Consumer Price Index

The amount offered, keeping the above formula in mind, the amount provided is subjected to tax under the Income Tax Act.

HRA is offered to the employees to compensate for the rent they pay for their living. It generally differs according to the city in which they live and their salary.

Employees can only apply for tax exemption if they follow the below considerations:

- Must be a salaried individual

- Must be receiving HRA as a salary element

- Must be living in a rented house

- The rent bills must be in the name of the employee

The amount of tax deduction that employee can claim is the least of the following considerations:

- The actual rent paid – 10% of the Basic

- The HRA as offered by the employer

- 50% of the salary(Basic+DA) for Metro cities and 40% for the employees residing elsewhere

Some important considerations while claiming the tax deduction for HRA:

- You can claim tax if you are staying with your parents and issuing the receipts in their names. However, your parents also need to include the same rent amount during returns filing.

- According to the laws, if you live in a self-owned house, then the minimum amount of the above-specified considerations is taxable.

- Claim by generating the receipts in the spouse’s name is not applicable.

- If the yearly rent exceeds the 1 Lakh limit, it is mandatory to submit the PAN details of the landlord.

The employee can receive benefits against their travel expenses incurred anywhere in the country and claim a tax deduction. Though LTA is exempted from tax, the use is not applicable in every year of employment. The employee only receives it for two journeys in the block of four years.

Whether self or family travel, an employee can claim the tax deducted on the travel expenses. The family includes immediate parents, spouse, children (exemption available for only two).

Carry forward of LTA:

If one misses availing exemption, one can carry forward one journey to the next block. Under such cases, employees must use the carry forwarded journey in the first calendar year of the subsequent block.

How to claim LTA:

To claim the LTA deduction, the employee must ensure the following factors.

- Ensure the journey dates are marked as Privilege leave

- Filing the necessary documentary evidence and sharing the same after rejoining

- Include form 12BB along with supporting documents and declaration in January

Conveyance allowance helps employees compensate for their transportation to and from their home and office. The allowance offered can be taxable or non-taxable as per regulations outlined by the government’s Income Tax Act. Therefore, the conveyance allowance provided to the employees is entirely different from the Transport allowance.

The limit of tax exemption set on the allowance is ₹1600 per month (₹19200 annually) for the employees, which increases to ₹3200 per month for the orthopedically challenged employees. While the allowance is not subjected to tax for UPSC members.

The company that facilitates transportation for its employees does not necessarily provide a conveyance allowance.

Conveyance allowance offered to the government employee is categorized based on the travel route distance.

| MONTHLY TRAVEL (AVG KM) | JOURNEY BY PRIVATE CAR (Rupees) | JOURNEY BY OTHER MODES (Rupees) |

|---|---|---|

| 201-300 | 1,680 | 556 |

| 301-450 | 2,520 | 720 |

| 451-600 | 2,980 | 960 |

| 601-800 | 3,646 | 1,126 |

| > 800 | 4,500 | 1,276 |

It is the allowance to cover the hospitality chargers of any client, from their food expenses to their hotel stay. The funding provided to the employees is fully taxable, and one can claim it for the least of the following:

- 20% of the gross salary

- Actual allowance as offered by the employer

- ₹5000

Whenever an employee stays after the regular shift hours to meet the targets and project deadlines, he/she can avail of the overtime allowance, which is 100% tax chargeable. The overtime worked by an employee is calculated at a double rate per hour of the employee’s basic salary.

The meal allowance is offered to meet the basic food requirements that can include refreshments, tiffin, or beverages. Accordingly, 100% taxable exemption is available for the food allowance, which is limited to 18000 per annum under section 10 of the Income Tax Act.

CCA is provided to cover the high cost of living and other demands for employees living in a city like Mumbai or Delhi, etc.

As the name expresses, to cover the uniform cost, employees are aided with the uniform allowance, which is fully exempted under section 10 of the Income Tax Act.

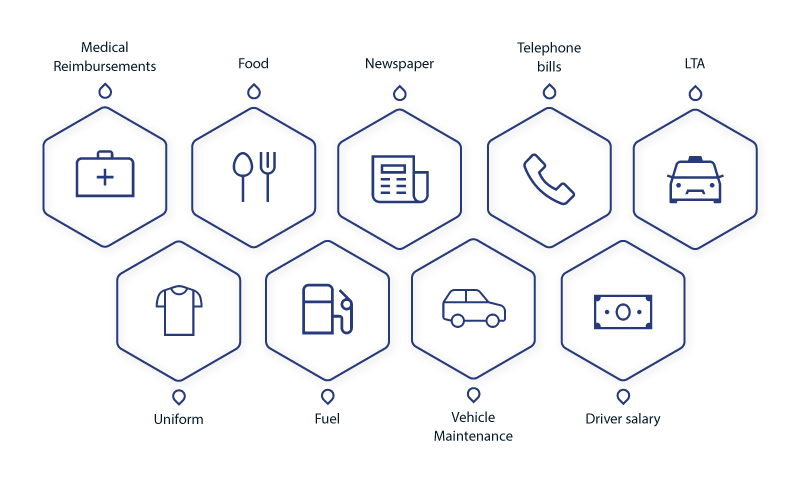

Reimbursements

People often confuse allowances with reimbursements, but they are much different in a real context. Allowances are offered to support the expenses of employees, and they don’t have to take out their own money. On the contrary, reimbursement is the amount repaid by the employer for the expenses incurred by the employee with accurate bills and receipts for validation, thus an essential part of CTC calculation.

Certain types of reimbursements that an employee can avail of are:

TDS

Tax Deducted at Source is the tax deduction on an employee’s net salary that is considered with salary transfer by the employer. It reduces tax evasion afterward because, anyhow, employees have to submit the tax according to the Income Tax Act.

The tax rates are not similar; instead, it proportionately increase with an increase in annual income. And these rates are refreshed under the new tax regime.

| Income Tax Slab | Existing Regime Slab Rates for FY 20-21 (AY 21-22) | New Regime Slab Rates for FY 20-21 (AY 21-22) | ||

|---|---|---|---|---|

| Resident Individuals & HUF < 60 years of age & NRIs | Resident Individuals & HUF > 60 to < 80 years | Resident Individuals & HUF > 80 years | Applicable for All Individuals & HUF | |

| Rs 0.0 – Rs 2.5 Lakhs | NIL | NIL | NIL | NIL |

| Rs 2.5 – Rs 3.00 Lakhs | 5% (tax rebate u/s 87a is available) | NIL | NIL | 5% (tax rebate u/s 87a is available) |

| Rs. 3.00 – Rs 5.00 Lakhs | 5% (tax rebate u/s 87a is available) | NIL | ||

| Rs. 5.00 – Rs 7.5 Lakhs | 20% | 20% | 20% | 10% |

| Rs 7.5 – Rs 10.00 Lakhs | 20% | 20% | 20% | 15% |

| Rs 10.00 – Rs. 12.50 Lakhs | 30% | 30% | 30% | 20% |

| Rs. 12.5 – Rs. 15.00 Lakhs | 30% | 30% | 30% | 25% |

| > Rs. 15 Lakhs | 30% | 30% | 30% | 30% |

The tax deducted can be filed for returns at the end of the financial year with salary payslip and Form 16 attached to the declaration of the return.

Employee Provident Fund (EPF)

Under the act of Employee’s Provident Fund and miscellaneous provisions act, 1952, both employee and the employer contribute to the fund maintained by the Employee Provident Fund Organization of India (EPFO). The EPF is an income saving scheme that helps employees in the time of unemployment and after their retirement.

The company that employs more than 20 employees is mandated to register with the EPFO, in which every employee contributes. As a result, the interest rate generated by the fund varies in the range of 8-12%.

Employee needs to update their EPF account whenever they change their jobs to stop the hindrance of income saving and contribution.

Under the scheme, both employee and employer contribute 12% to the fund. Still, the percentage contributions for both of them are divided into two funds: Employee Pension Scheme and Employee Provident Funds.

| EPF | EPS | Total Contributions | |

|---|---|---|---|

| Employer | 3.67% | 8.33% | 12% |

| Employee | 12% | 0 | 12% |

Note: If (Basic+DA) exceeds 21000, the EPF is calculated on the same; otherwise, it is estimated on (Gross-HRA)

Here are some of the essential information to be followed while using the EPF scheme:

- After five years of service, the EPF amount is fully exempted from tax.

- If any individual is unemployed after three years, the EPF account will automatically become inactive.

- The employee can withdraw 75% of the fund after the first month and another 25% after the second month from unemployment.

- Individual EPF contributions above 2.5 lakh will have two PF accounts, and the EPF will be taxable effective from April 1, 2022.

Professional Tax

The professional tax applies to each working person, whether doctors, lawyers, CA, CS, freelancers, or other professions. Even the tax calculated is not the same for every state.

The maximum tax to be paid under this is a maximum of ₹2500 per annum, which is directly deducted from one’s net income by the employer itself. The PT is deducted from the employees’ basic income every month in India. Meanwhile, some states like Kerala, Puducherry, Tamil Nadu, and Tripura deduct professional tax on a semi-annual basis.

Gratuity

Employees can receive a gratuity for the services they have accomplished during their employment period under the Payment of Gratuity Act enacted in 1972. Generally, an employee is eligible to receive gratuity and such incentives after completion of 5 years with an organization. However, employers can provide gratuity in cases like death or disability due to accidents. Therefore, the amount is offered after five years. However, gratuity is still not considered a part of the employee’s CTC as the amount is partially deducted from every month’s salary.

Calculation of Gratuity:

The gratuity offered depends on two factors: the number of years completed and the last month’s drawn salary. It also changes based on whether the employee is covered under the act or not.

For employee covered under the act:

Gratuity = (last month’s salary(Basic+DA) * years of employment * 15)/26

For employees not covered under the act:

Gratuity = (last month’s salary(Basic+DA) * years of employment * 15)/30

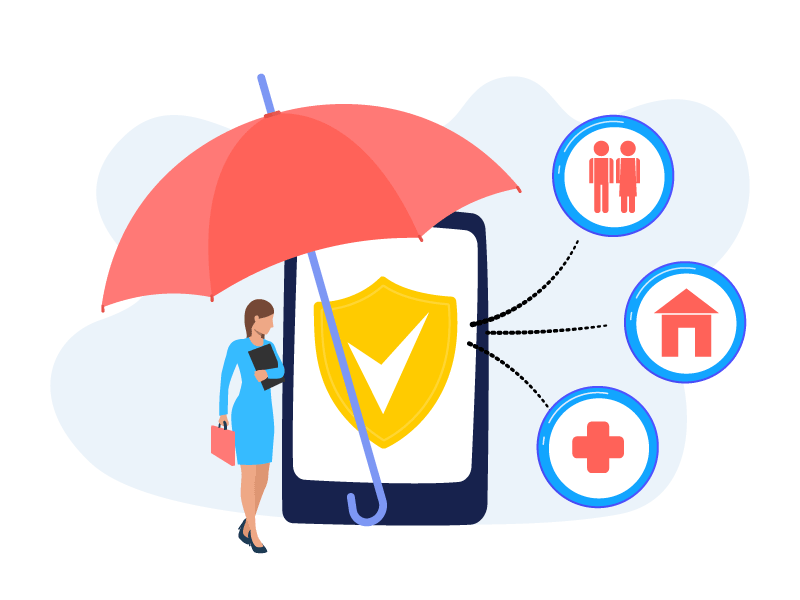

ESI

Employee’s State Insurance is the financial scheme to cover the employees’ social and health security under the Employees State Insurance Act, 1948. An autonomous corporation had also been established called the Employee’s State Insurance Corporation, under the Ministry of Labour and Employment, Government of India.

According to the following percentage, employers and employees contribute towards the ESI fund per the regulations. The contributions made are for the salary (Basic + DA) that is limited to ₹ 21000 per month.

| Contribution | % of Gross pay |

|---|---|

| Employees’ contribution | 0.75 |

| Employer’s contribution | 3.25 |

Under this act, employees receive medical, sickness, maternity, disablement, funeral expenses, and rehabilitation benefits. In addition, employees covered under this scheme can avail of medical treatment for themselves and any dependents with the ESIC-collaborated hospitals and clinics.

Download Free Resource

Ending Notes

The process of calculating the CTC might seem to be overwhelming for the first time. Even if it is not harmful to employees, employers must observe the necessary calculations. The one thing that must be ensured is to create a checklist on what steps to take next. But as you perceive the elements point by point and with the help of technology, it becomes the task of seconds to calculate employees’ salaries.

Grow your business with factoHR today

Focus on the significant decision-making tasks, transfer all your common repetitive HR tasks to factoHR and see the things falling into their place.

© 2025 Copyright factoHR