What is Payroll? Complete Guide to Payroll Management in India

Download Payroll Guide for Free

Table of Contents

If you are not an expert, you might find payroll boring, frustrating, and complex. However, every business owner must deal with payroll one day or another because it is one of the most significant organizational expenses. Any miscalculation or mistake in its process may be fatal to your business financially and to your employees morally.

In this guide, we have explained the payroll process step-by-step so you can feel confident while processing payroll and complete the process in less time. We have also covered the basics of payroll calculation in India, including gross salary, deductions, and net pay. The guide also explains the importance of statutory compliance for various contributions like ESI, PF, TDS, etc.

What is Payroll?

In dictionary terms, payroll is defined as the complete list of employees and the salary paid to them by the company. Payroll is defined as the entire process of paying salaries to employees including preparing a list of employees, tracking working hours, calculating wages, distributing payslips, filing statutory dues, etc.

There are many steps to be performed in the backend that require different departments to work in sync to do the salary calculations. Mistakes in any steps due to their complexity may introduce errors and delays in the entire process. However, with proper process standardization and an automated system you can streamline your entire operations to eliminate all mistakes and reduce completion time.

How is Payroll Calculated in India?

The payroll in India can be calculated using the following formula.

Net Pay = Gross Salary – Gross Deduction

Where,

Gross Salary = Basic salary + HRA + DA + Allowances + One-time payment/incentive (Reimbursements, Arrears, Bonus, etc.)

Gross Deduction = Professional Tax + Employees’ State Insurance + Public Provident Fund + Income Tax + Insurance + Leave adjustments + One-time deduction (Loan recovery)

To learn in-depth about CTC various salary components, read our blog on How to calculate the CTC structure.

What are the different stages in the Payroll Process?

Calculating the payroll of employees is definitely one of the challenging tasks for any organization due to the number of steps and components involved in it. While some steps are repeated in every cycle, some are only one time. Therefore, you must pay undivided attention to these steps to ensure the correctness and accuracy of the outcome. In addition, you must keep yourself updated with the latest statutory and tax laws to ensure 100% payroll compliance.

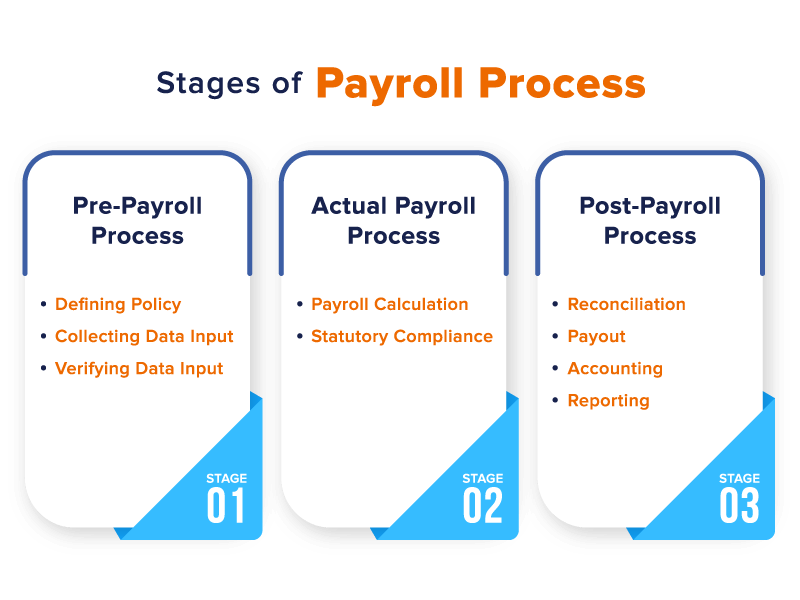

Broadly, the payroll process can be divided into 3 stages – Pre-payroll, Actual payroll calculation, and Post-payroll. Let’s understand each step one by one.

Stage 1 – Pre-Payroll Process

In the first stage, you usually configure policy, define components, and gather payroll inputs from all sources. It is further divided into the following steps.

Defining Policy

The first and foremost thing in any payroll process is to define various policies for attendance, leave, benefits, and payroll policy. These include all the elements and factors that monitor to decide an employee’s salary. To standardize the process, the policies should be pre-approved by the management. Moreover, as policy changes are less frequent, the step is not required to perform repeatedly in every cycle. Nowadays with the help of online payroll software, you can configure various policies and multiple salary structures for employees based on your requirements.

With a digital system, you can configure various policies and create multiple salary structures for employees by choosing unlimited earning and deduction components based on your requirements.

Collecting Data Input

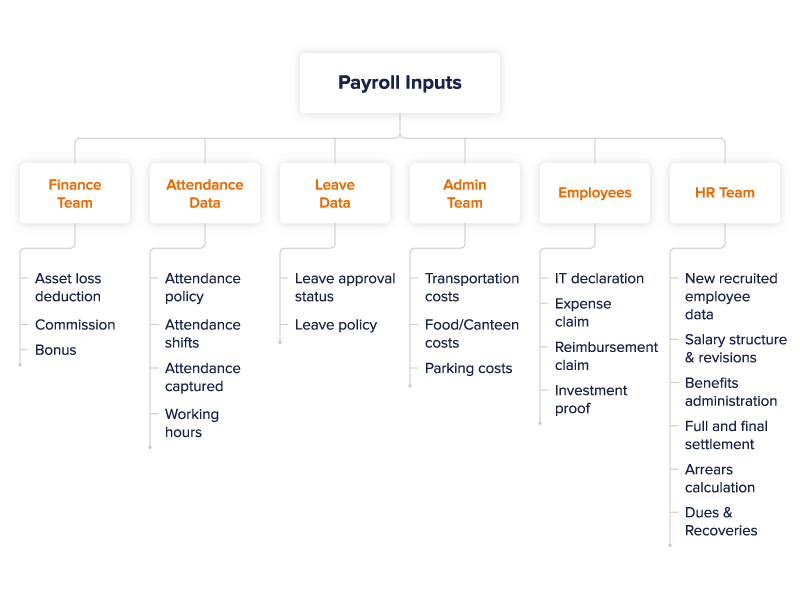

The next step in the payroll process is to collect all the data required to calculate employee salary from different departments and managers, which includes information about attendance, leave, performance, salary revision, loan recovery, transportation costs, income tax details, etc. If the organization is large, the volume of this data will be huge, and collecting and processing it manually can be quite an overwhelming task. However, with integrated payroll solution like factoHR, data flows between various modules seamlessly without any human intervention this will help you accomplish the task more efficiently.

Verifying Data Input

Once all the data is collected, you need to double check them for accuracy and if it complies with regulatory laws or not. If data size is large you need to use various statistical methods to double check. As a part of data verification you also need to check the count of active and inactive employees. This step is a crucial and proactive step to reduce errors, improve accuracy in payroll processing. If this step is done properly it will make the calculation a cinch task.

Stage 2 – Actual Payroll Calculation

After all the data inputs are collected and validated, the actual payroll process begins. In this process, salary of an employee is calculated based on income and deduction components, deduction components can be either statutory or non-statutory.

Payroll Calculation

In this step, you have to feed all the data collected in previous steps into the payroll system or excel sheet. The final output of this process is addition and deduction components for each employee based on attendance, leave, statutory laws and many other factors. Usually, an excel-based method can be error-prone as verification and reconciliation of data become difficult and time-consuming as organization grows.

Statutory Compliance

Statutory compliance in HR means adherence to the regulatory laws formed by the government. During payroll calculation itself, you need to ensure that all statutory deductions are made as per the laws and amount submitted to authorities. These rules are generally common across India but some rules like professional tax typically differ from state to state, and non-adherence to them may be financially harmful to businesses.

The most important laws that Indian companies follow to get their payroll right are,

- Employees’ State Insurance Fund (ESI)

- Provident Fund (PF)

- Tax Deducted at Source (TDS)

- Professional Tax (PT)

- Gratuity

To make this article short, we have avoided describing the above mentioned laws in depth here. You can easily go and explore more about these laws in our Complete Statutory Compliance Guide Blog.

Stage 3 – Post-Payroll Process

Without reconciliation, payment, accounting and reporting the process of salary payment can not be concluded for any organization.

Reconciliation

Once the actual payroll calculation stage is completed, you need to reconcile the current month payroll data with previous month payroll data to verify its accuracy. In a broader sense, payroll reconciliation is to ensure that data needs to be processed are included like new joinee, salary revision, other income and deduction amounts and data to be not considered are excluded like left employees, suspended employees etc. at the time of input. Most commonly, the following details should be checked during reconciliation.

- Past employee count vs Current employee count

- Past working hours vs Current working hours

- Past vs current statutory & non-statutory deductions

- Past Salary Amount vs Current Salary Amount

- Past Over time hours vs Current Over time hours

- Past Employee leaves vs Current Employee Leaves

Payout

This step is also known as releasing payroll. Once the salary is calculated and reconciliation is done, you have to make payment to the employees. Organizations typically adopt various methods including cash, cheque, or bank transfer to make payment. Usually, organizations deposit salary into an employee’s bank account through a bank transfer. For this you need to prepare a bank funding file and give it to your bank to carry out transactions. This funding file generally requires a bank ID, account number, salary total, etc., based on the type of bank. But with the factoHR you can eliminate all this hassle and directly transfer salaries into employee’s bank accounts without leaving the platform.

Accounting

Once payment to the employee is made you need to do accounting for the same. Payroll accounting is the process of recording these transactions as a company’s expense, this includes employee’s earnings, deduction of taxes, etc. Cloud based application generally offers built-in integration with third party accounting platforms, ERPs etc

Reporting

Reporting is to track and analyze underlying trends in any HR process in order to identify business risks and improve decision-making. Similarly, departments like HR and finance may require reports like department-wise employee cost, salary reconciliation reports, etc., after you have completed the monthly payroll.

As a payroll expert, you have to discover relevant information from the payroll data to prepare and share reports. Some organizations may spend hours carrying out this task, but with a cloud payroll solution, generating custom reports is a matter of seconds.

What are the various methods to Run Payroll?

Payroll can be calculated using different methods like Manual, Outsourcing, and using Software.

Manual Payroll Management

The manual method of computing salaries comprises two types itself, Pen-paper and Excel-based payroll management. Startups or organizations with limited employee count normally opt for these methods. Here, as a payroll officer, you have to use standard templates with mathematical formulas to run payroll. Despite being a zero-expense method, it has quite serious limitations like human errors, chances of data duplication, hard to add/remove employees’ data, and ensuring changing compliance laws.

Outsourcing

Outsourcing is providing an external firm to manage all your payroll requirements. As per the pay frequency, the organization shares employee data like attendance, leave, reimbursements, claims, and other ad-hoc data with the outsourcing agent. They not only compute employee salaries but also ensure that all the regulatory laws are met.

Organizations typically choose this option when they don’t have a special payroll professional or do not want to hire one. However, a major disadvantage of this method is organizations may risk transparency and control over one of their top expenses.

Payroll System

A payroll system is an exciting cloud-based software solution that streamlines the entire payroll process for organizations while ensuring compliance with legal standards. By investing in the top payroll management software in India, you can tackle the challenges of traditional methods head-on! This software boasts a flexible rule engine, allowing you to easily create various components and tailor your policies to fit your unique needs.

With seamless integration capabilities, the payroll system minimizes the time spent collecting inputs from different sources and teams. Many include an advanced mobile app and self-service features, empowering employees to download their payslips and conveniently access important information whenever needed. Get ready for a smoother, more efficient payroll experience!

What are the challenges of Payroll Management?

As a payroll officer, you may find the process very tiresome and time-consuming. Regardless of the organization’s size, here are some of the major challenges.

Ensuring Compliance

Organizations in India are mandated to follow certain statutory laws like PF, TDS, ESIC, PT, etc., during their payroll processing. Not only the deduction, filing, and reporting are different for each law, but their rules are also different for different states. Moreover, mistakes and delays in remitting taxes may be harmful to the business.

Coordination between Multiple Teams

The inputs for salary processing are obtained from multiple teams like HR, finance, managers, and employees. As a payroll professional, you need to rush around and get the right information at the right time to pay salaries without any time delays.

Habit of Legacy Methods

Methods like pen-and-paper and spreadsheets feel more familiar and comfortable to use. Thus many organizations tend to use these methods in their initial steps of business. But as easy as they look and sound, mistakes can happen much quicker. Additionally, you have to hire a special person for these methods.

Lack of Data Security

To process salaries, organizations require confidential information of the employee like Aadhaar number, PAN number, bank account, etc. If organizations are using legacy methods to manage payroll, employee information can be compromised, misused, or misplaced.

What are the Benefits of a Payroll Management Software?

The payroll processing steps mentioned above help organizations understand and perform the process in an efficient way. Managing these steps manually can be troublesome, but with the right technology, you can streamline and simplify complex and repetitive tasks. Here are the top benefits a payroll management solution can offer you.

Improved Efficiency

The payroll team in any organization spends endless hours processing accurate salaries and thus ends up reducing their overall efficiency. But with software like factoHR, organizations can perform the process in a few minutes without spending much time collecting inputs and performing clerical calculations, improving their overall process efficiency. Additionally, efforts in maintaining and organizing excel sheets can be reduced gradually.

Seamless Integration

Compared to the conventional methods, a modern payroll management system offers you integration with internal modules like attendance, leave, travel, and performance. Due to this, data from these modules flow seamlessly to simplify the salary calculation. In addition, the solution also integrates with third-party ERPs and accounting software so that you can perform the post-payroll stage efficiently.

Effortless Scalability

As organizations experience business growth over time, managing people and processes becomes a challenge. An e-payroll system is capable of scaling whenever your business expands, making your organization future-ready.

Ensured Compliance

The software helps you stay compliant with all the statutory laws like PF, ESIC, LWF, PT, TDS, etc., and is regularly updated, so you never have to worry about any frequent changes happening in the laws. Moreover, it also helps you generate required forms and documents to ensure proper statutory filing.

Self-Service Model

With the intuitive mobile app and self-service approach offered by payroll providers, you can empower employees to submit their IT declaration proofs, download payslips, submit reimbursements, regularize attendance, and much more anytime, anywhere. This provides the convenience and independence in accessing the information at their fingertips.

About factoHR Payroll Solution

factoHR is a cloud-based payroll management system that provides secure, accurate, and compliant payroll processing. It integrates with internal and external systems to automate end-to-end tasks and reduce your burden. The platform is built to adapt to every complex business requirement and make the organization future-ready.

Grow your business with factoHR today

Focus on the significant decision-making tasks, transfer all your common repetitive HR tasks to factoHR and see the things falling into their place.

© 2025 Copyright factoHR