Table of Contents

Mumbai is undoubtedly a city of dreams and is India’s financial centre. From emerging start-up businesses to transnational corporations, every kind of company is located here. The city offers a varied range of job openings in the field of information technology, the tech industry, logistics, sales executives and more. These opportunities attract an influx of talent from every corner of the nation. Managing such talents’ timely salaries becomes a difficult and strenuous task. This is when a need arises for an automated Payroll software to handle such a whirlpool of talents efficiently and with ease. Embracing such automated Payroll software in Mumbai’s competitive job market offers numerous advantages for any organisation looking to attract and retain talent, ensuring smooth payroll processing with data security. It also improves employee satisfaction and contributes to any company’s overall success in this vibrant city of dreams.

In a crowded city like Mumbai, where enterprises and career opportunities are growing on a large scale, the automated solution provides relief. This article will help you in selecting the best Payroll software in Mumbai that meets all the requirements of your organization.

List of the Best Payroll Software in Mumbai

There are numerous Payroll software available in Mumbai. Selecting the right, cost-effective and reliable platform for your organization becomes a task. Well, not to worry. We have listed down a few top Payroll software available in Mumbai.

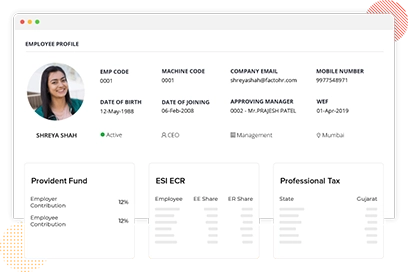

1. factoHR

factoHR is a best cloud-based payroll software in Mumbai, that effortlessly adapts to any business. Whether you’re a large company or an emerging firm, it helps you easily streamline all your HR processes with ease. factoHR provides excellent scalability and enhances the performance of the core HR department. All the complicated tasks like managing payroll calculations, payments, statutory compliances, IT deductions, ESIC, PF, Loan calculations etc., become very facile and reliable to perform with factoHR.

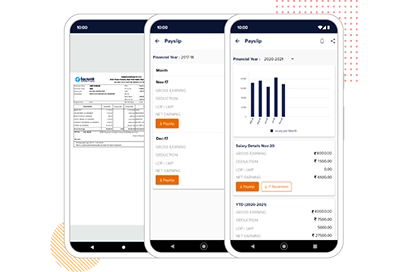

Apart from automated platform, it also provides a factoHR mobile application that helps employees undertake many activities, such as punch-in and out timings, downloading payslips, applying for leave, etc. On top of that, it also simplifies HR tasks with its revolutionary features like an AI-supported chatbot, selfie punch, and geofencing.

Features

| View and download payslips and check YTD income with graphs and monthly breakups through ESS portal. | Retro changes like unclaimed overtime, missed punch, salary revision, unapproved leave or holiday in case of attendance or any compensations can be rectified or claimed. |

| Download statutory forms and check your IT deductions from mobile app. | Statutory compliance is automatically calculated at the time of arrear calculation. |

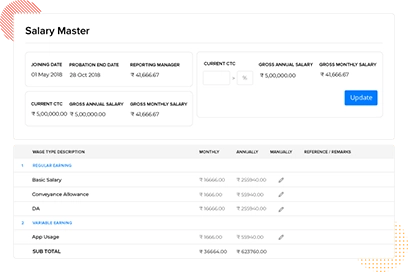

| Configuring salary with any number of salary components with a formula-driven rule engine. | Handling of all statutory compliance like PF, ESIC, EDLI, TDS, etc |

| Configuring Payroll process easily by allowing you to create multiple Payroll groups based on an employee’s salary, calendar assigned, and location. | Generation of various reports and forms like form 16, form 24Q, labour welfare fund report, computes form 5 and form 5A and many more. |

| ISO accredited and SOC Type 2 certified cloud data centre. | Payroll can be linked with a Performance management system where employees’ performance is linked with their goals (OKR) and KPI with their compensation. |

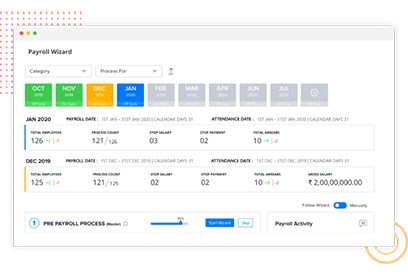

| Follows business continuity standards and allows you to restore your data in case of any system failures. | Wizard-driven salary process guides you through each payroll step. |

| Capable of handling 2000 RPM of varied traffic per application server. | Off-cycle Payroll process feature to make all necessary payments that aren’t part of regular calculations. |

| Allows auto EMI deduction, and employees can request various types of loans. | Custom reports can be built using the custom report builder option by selecting the relevant data source. |

Benefits

- Its top-level security protects critical employee data with encryption at rest, audit trail and fine access control.

- Plug-and-play integration ensures the minimisation of human interventions and ensures the highest accuracy in data output through its validation engine.

- It gives flexibility as per your needs with formula-based calculation, process customization and unlimited component creation.

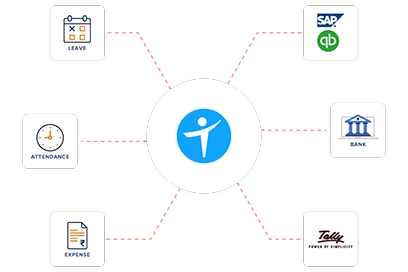

- Users experience a smooth buttery approach as payroll is integrated with all internal modules like core HR, attendance, leave, or expense management and external systems like ERPs and accounting apps.

Cut Costs, Not Corners

Others

Attendance and Payroll for Multiple Entities

Shift Scheduler

Support Through

What People Say About Us

Rating & Awards

2. PayCare

PayCare is a complete HR and Payroll management solution for Mumbai Based Firm. During its setup, it supports you in its various activities, like the payroll application implementation and migrating payroll data. It also helps in setting up screens that allow you to record your company details and create master databases of employees, which include designations, departments, leaves, pay, pay dates, holidays, taxation, credits, deductions, and other things. PayCare Payroll offers a true out-of-the-box experience with initial master and employee data setup.

Features

- Payroll Processing

- Payroll Tax Filing

- Payroll Reporting

- Statutory & Government Forms

- Employee Provident Fund

- Regional Forms & Payslips

3. HRM Thread

HRM Thread is an online and web-based Payroll software provider in Mumbai that is suitable for small and large businesses. This is a very cost-effective software and makes HR management easier by giving simple access, a user-friendly interface and full support. HRM Thread enables you to handle payroll for your business more quickly and effectively with accuracy and data security. It also allows you to generate various salary reports. You can realise the amount of time savings and costs by trusting this payroll software.

Features

- Payroll Processing

- Salary Reports

- Bank Transfer

- Reimbursement Management

- Arrears Calculations

- PF Calculations and Reports

- ESIS Calculations and Reports

- Income Tax Management

- Full and Final Settlement

- Reimbursement and Claim Management

- Online TDS Declaration Management

- Loans and Advance Management

4. Gizmosys Solutions

Gizmosys HRMS Software, which can manage all payroll-related tasks for the HR department with ease and accuracy. It provides a comprehensive service in payroll & Compliance. In this rapidly growing business environment, it provides payroll software and payroll outsourcing services that solve the complexity.

Features

- Configurable Payheads

- Earnings / Deduction / Allowance

- Bonus / Loan / Arrears / Advance

- Upload attendance for LOP / LWP

- One click process payroll

- Audit processed payroll

- Employee self-service to download payslips

- Audit Trails Reports

- Statutory Compliance

- Payroll Reports

5. AddettoHR

AddettoHR is an HRMS and Payroll software in Mumbai that helps you improve HR efficiency with its explicable features. It shortens the gap between HR and employees by reducing complicated tasks and making them possible online. Just like the other software, it helps you to collaborate with multiple data and generate reports. Apart from Payroll, it helps you with tax and expense management and generates reports for the same.

Features

- Biometric Attendance

- In-built Compliance

- Leave Management

- Powerful Integrations

- Employee Lifecycle

- Salary Payment Directly

- Payslips and Reports

6. PeopleHR India

People HR is a very handy and simplified HR software. It gives complete automation and streamlines your payroll processing effortlessly. It is suitable for small businesses to run their payroll efficiently. It provides a robust solution in calculating payroll that is calculating salaries to generate payslips for employees.

Features

- Salary Structure Management

- TDS Declaration

- Salary, Loan and Recovery

- Automatic TDS Calculation and Form 16

- Payroll Generation

- Payroll MIS

- Compliance Documents

7. Opportune HR

Opportune HR works on a collaborative approach and is built on strong business ethics. It is a cloud-based payroll software in mumbai that allows you to process payroll with accuracy and precision. This software ensures consistency in all payroll features and is highly configurable software in terms of payroll taxation and compliance. It also offers payroll outsourcing services for which they have a professional team and trained HR personnel.

Features

- Accurate Payroll

- Generate Pay Register

- Publish, Release and Hold Salaries

- Arrears and Increment Computation

- Employee Investment Declaration

- Loans and Advances Computation

- Full and Final Settlement

- Variable Adhoc Payment

- Taxation and Compliances

8. easyHR

EasyHR eases out any type of complex payroll processing task by providing a configuration panel that integrates with other modules like leave and attendance management systems. It is very simple to use and provides complete automation to all payroll processing tasks thus saving time for the HR department. It works efficiently for all kinds of organizations and provides a comprehensive solution to the employees with its ESS module.

Features

- Payroll Components

- Loans / Overtime / Arrear Management

- Tax Declaration

- Salary Disbursement

- Payroll Reports

- Full and Final Settlement

9. OfficeNet

OfficeNet comes to the rescue in terms of difficult and complex processing of payroll as there is an increased demand for workforce in this era of globalization. It is a technology-driven automated system that is available locally and globally with a single employee database. It allows you to run payroll smoothly and adheres to full compliance requirements. It keeps you updated on tax laws and ensures productivity and accuracy.

Features

- Payroll Processing

- Accurate Salary Computation

- Payroll Reconciliation

- Automated Payroll Inputs (reimbursements/loans/advances)

- Customized Payslips

- Statutory Reports

- Extensive Excel Output

10. Pion HR

PionHR is a cloud-based software that is best known for its AI-driven business solutions. It provides automated and AI-powered HR processes which not only result in clean, error-free reports but also save businesses time, money, and manpower. You can also take advantage of features like a smooth ESS portal, payroll management, and leave management. Consider choosing PionHR if you’re looking for features like AI-driven talent management, simplified hiring procedures, and automated onboarding tools.

Features

- Dynamic Salary Processing

- Arrear and Variable Payment

- Bank Advice

- FNF

- Provident Fund (ECR Generation, KYC, etc)

- ESI

- Other Compliances

- Income Tax

- Salary Reports

Navigating Payroll Software Options for Mumbai Businesses

Here are a few pointers to look out for when you are looking for the best-fit payroll software for your mumbai based organization

1. Your Needs

Understand the requirements of your organization for processing payroll. Consider the number of employees, and the unique features like tax calculations, loan advancement, arrears calculations, generating reports, etc. while buying the software.

2. Budget

Look out for the best options available in the budget goal you have set. There is no need to buy very costly software if there are limited employees to manage. Also, check if the software provides scalability and grows with your organisation.

3. Security

As you need to store employees’ sensitive data while calculating payroll, you must ensure the software adheres to adequate security measures and compliance standards to protect this information.

4. Ensuring Compliance

If you are a legal entity, you must report the employment data of your employees to the state and central government. Ensure that the software is fully compliant to avoid any legal charges.

5. Integration

You will need the real-time data of employee leave, attendance and performance to calculate payroll accurately. If you’re using software, integration of internal modules with the payroll system is a must. It prevents data duplicity and allows you to maintain a single source of truth.

6. Advanced Features

If you are a large organization, you can look for some advanced features the software offers, like an ESS portal, arrear calculation, loan management and performance-linked payroll solution.

In Conclusion

In short, robust software provides you ample benefits which include efficiency of the HR department, provides data accuracy, remunerating employees timely, ensuring compliance with laws, and enhanced data security. All in all, it saves time and cost for HR. Implementing digital platform helps you increase the overall efficiency of your organisation and eases out the payroll management process. These best 10 payroll software in Mumbai will simplify the life of HR significantly and get ahead of the frustration caused by manual payroll processing.

© 2025 Copyright factoHR