Table of Contents

In a busy city like Delhi, managing payroll manually is time-consuming and error-prone. The right payroll software can make a big difference by simplifying the process, ensuring accurate and timely payments to employees, and helping companies handle complex tax rules. Check out our list of top payroll software in Delhi to boost your organization’s growth.

List of Top 8 Payroll Software in Delhi

It’s important to select the right online payroll software that meets the needs of your organization and helps with productivity. Consider finding the best payroll software in Delhi NCR.

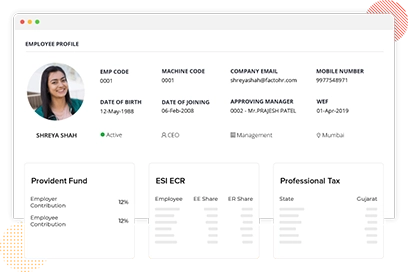

1. factoHR

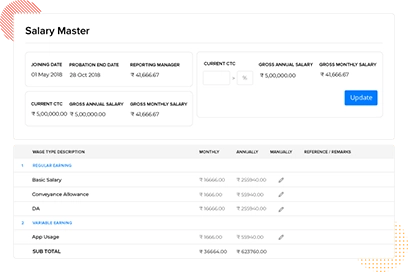

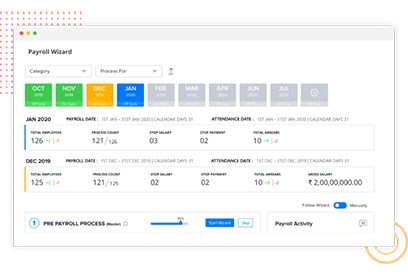

factoHR is a cloud-based payroll software in Delhi NCR. It is suitable for organizations of all sizes, including SMEs, startups and large businesses. The software streamlines payroll process, offers multi-location support, integrates with internal systems, and simplifies salary calculations, statutory compliance, and IT deductions.

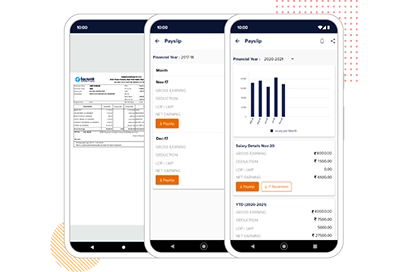

Next-generation mobile app and employee self service provides easy access to employees to view compensation, income tax, and other relevant information on their mobile devices and desktops all the time.

Features of factoHR

| Through ESS portal or mobile app view salary and get a summary of gross earnings. | Download last month’s or year’s payslip in PDF format. |

| Formula-driven rule engine provides freedom to create unlimited earning components. | Wizard-driven salary process for direction at every step. |

| Credit employees’ salaries directly to employees’ bank accounts. | View income tax and compare it with actual deductions. |

| Administering salaries with multiple payroll groups according to employees’ payroll cycle. | Produce different kinds of income tax reports and forms. |

| Compensate according to employees’ performance. | Manage advance and loan management through policy. |

| Configure unlimited salary components. | The off-cycle payroll process allows making all additional payments like bonuses. |

| Retro changes and arrear calculations can be claimed or rectified. | Provides compliance requirements with automatic calculation and ready to file form, report and challan. |

| Schedule reports or mail according to your requirements. |

Pricing of factoHR

FactoHR provides four types of plans with its Payroll for Delhi businesses: Essential, Advance Velocity, Bolster, and Performer. Customers can select a plan that suits their needs and add features such as Face Recognition, Self Onboarding, and a Ticketing System to customize their plan further.

Benefits of using factoHR

- High-level security safeguards critical employee data with encryption at rest, audit trail and precise access control.

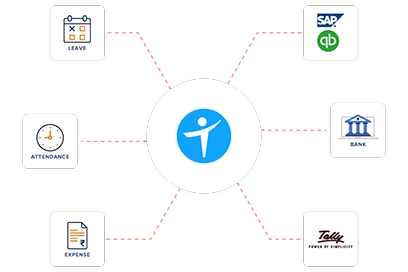

- Plug-and-play integration assures minimal human interventions and guarantees the highest accuracy in data output through its validation engine.

- It gives flexibility according to your requirements with a formula-based calculation, process customization and unlimited component creation.

- Users’ experience will be elevated when the payroll system seamlessly integrates with all internal modules such as core HR, attendance tracking, leave management as well as external systems like ERPs and accounting applications.

Cut Costs, Not Corners

Others

Attendance and Payroll for Multiple Entities

Shift Scheduler

Support Through

What Clients are saying about factoHR

Rating & Awards

2. Paychex

Paychex is suitable for small to mid enterprises. It offers a seamless solution to alleviate the time-consuming challenges of payroll processing and tax filing. Its all-in-one system facilitates effortless online payroll management with 24/7 support in just a couple of clicks, automates tax calculations, payments, and filing, and empowers your employees with self-service options. Experience the efficiency and reliability of Paychex for a hassle-free small business payroll experience.

Paychex Features

- Online payroll processing

- Direct Deposit

- Tax Service

- Review Payroll before Payday

3. TankhaPay

TankhaPay is designed to help Indian organisations manage payroll and compliance efficiently. Built with a strong understanding of payroll operations and statutory requirements, it streamlines salary processing, deductions, and regulatory filings. The platform offers a completely digital payroll workflow, minimising errors, reducing paperwork, and ensuring smooth and timely payroll processing each month.

Paychex Features

- Social Security Enrollment: Seamless integration with ESI and EPF for worker benefits.

- Automated Payroll: One-click salary processing with digital records.

- Statutory Compliance: Automatic handling of government-mandated filings and labor laws.

- Attendance & Leave: Simplified mobile tracking for daily wage and monthly staff.

4. EasyHR

EasyHR especially ensures employee satisfaction and legal compliance. With its expertise in payroll management, it understands the intricacies involved and streamlines the payroll solution process, eliminating the need for paperwork and going entirely digital. EasyHR’s software is highly precise, assuring error-free payroll management, thus facilitating seamless and punctual processing every month.

Features offered by EasyHR

- Payroll process

- Employee self-service

- PF and ESIC Compliance

5. EnspireHR

EnspireHR streamlines and simplifies the payroll process for businesses of all sizes. It empowers organizations to efficiently manage payroll tasks, including calculating employee salaries, deductions, and taxes with its user-friendly interface and features. It ensures compliance with ever-changing tax regulations and offers customizable reporting options for in-depth financial analysis. EnspireHR offers seamless integration with other HR and accounting systems, providing a comprehensive payroll solution in Delhi. Its automation capabilities reduce errors and save time, making it an essential tool for businesses seeking precision and efficiency in payroll management.

EnspireHR Features

- Payroll process

- Setup flexible workflow

- Travel and Expenses

- Performance Appraisal

6. Samplex24HRM

Samplex24HRM gives comprehensive payroll software for Delhi with integrated modules for attendance, leave, claims, bonuses, and more. It simplifies salary calculation, leaves, and deduction. The software supports biometric attendance, automates salary calculation, and generates reports effortlessly. It generates payslips and tax-related tasks following government policies. By saving valuable time, it quickly offsets its cost. Users can add unlimited employees, streamlining their business operations and reducing paperwork hassles. Samplex24HRM fosters real-time information access and communication across departments. Accessible on the cloud, it’s affordable and suitable for various industries. It easily handles loans, incentives, and complex payments, offering flexibility and customization.

Features of Sample24HRM

- Generates payroll report

- Biometric device integration

- Calculating salary deductions

- Automated Generation of form 16 and ESIC statements

- Creation of standard reports

7. Pocket HRMS

Pocket HRMS provides efficient and accurate payroll system in Delhi. It streamlines the process with multiple salary structures and automatic calculations. With one-click payroll processing, it provides a detailed overview, ensuring compliance with tax laws. Customized pay slips give quick access to employees, and monthly consolidated entries simplify adjustments for leaves and other amounts. Variable pay, overtime, and attendance integration with devices such as bio-metric or facial recognition apps further enhance its flexibility. Pocket HRMS payroll solution is the go-to choice for businesses looking to manage payroll operations effectively while minimizing errors and ensuring compliance.

Features of Pocket HRMS

- Payroll process

- Payslips

- Overtime calculation

- Payroll reports

- Variable pay

8. TrickyHR

TrickyHR is a payroll solution based in Delhi that simplifies and streamlines an organization’s payroll management. Its user-friendly interface and features make payroll calculations, tax deductions, and compliance with ever-evolving payroll regulations easy. This software seamlessly integrates with time-tracking systems and HR databases, ensuring precise and efficient salary processing. Moreover, TrickyHR enables users with comprehensive reporting and analytics tools, providing invaluable insights into labour costs and financial well-being. Whether running a small startup or a large enterprise, TrickyHR enables individuals to manage payroll with accuracy and confidence, ultimately saving time and reducing errors.

TrickyHR Features

- Salary process

- Statutory deductions

- Reimbursement management

- Arrear calculation

- Income tax management reports

9. Humi

Humi’s comprehensive platform optimises payroll processes, reducing data entry errors and duplication. It assures precise payroll calculations. During payroll runs, it automatically calculates deductions and generates detailed tax compliance reports. Employees can utilize self-service features to access their digital pay stubs on Humi’s platform or mobile app, complete with deduction breakdowns and vacation balance information. They can also update personal information, reducing administrative queries. With unlimited pay runs for flexible scheduling ,record-keeping and reporting, Humi provides an error-proof payroll solution.

Features provided by Humi

- Payroll register

- Payroll tax reports

- Salary process

- Off-cycle payroll

Below is a list of the main features that a Payroll Software for Delhi should have:

The payroll management system streamlines the process of managing employee compensation, including salary calculations, tax deductions, and payment distribution. Here are some essential features of this software.

1. Employee Data Management

Online HR and payroll serves as a centralized database for employee information. It facilitates HR and payroll administrators to securely store and manage crucial details such as employee names, addresses, contact information, contact numbers, and banking details.

2. Salary Calculation

Calculating salary is one of the core functions of the HR department. Implementing an automated software reduces the chances of human errors and ensures consistent and accurate payroll processing. It calculates the factors like working hours, leaves, salaries, overtime, and bonuses or commissions.

3. Employee Self-Service

Employees can access their pay stubs, tax forms, and other payroll-related information in employee self service. It enables employees to manage finances, reduces administrative tasks for HR, and reduces the burden of HR.

4. Compliance Management

Staying compliant with labour laws and regulations is essential. The automated software assists with this by automatically applying relevant tax laws and labor regulations, reducing the risk of non-compliance and associated penalties.

5. Reports

Payroll System also generates a variety of reports to help businesses gain insights into labor costs, trends, and payroll expenses. These insights assists in decision making and financial planning.

6. Integration

Integration is essential for enhancing efficiency, accuracy and compliance in managing employee compensation, ultimately benefiting both employees and the organization.

Conclusion

In Delhi’s rapidly changing business landscape, reliable and efficient payroll system is now more crucial than ever. Many companies are now considering Payroll Management Solutions because manual processing can be time-consuming. These software are meant to automate and simplify payroll management, offering numerous benefits. Implementing a payroll management system in Delhi is a strategic choice as it enhances efficiency. factoHR is the best payroll software in Delhi. Schedule a free demo and experience seamless payroll management.

FAQs

What Is Payroll System?

Payroll system is a cloud-based software that manages and automates the complex responsibility of employees pay cycle.

What Benefits Can You Get From Using the Payroll Software in Delhi?

The payroll software in Delhi offers increased efficiency, improved accuracy, compliance made easy, advanced employee self-service, and better reporting and analytics.

Best Payroll Software for Delhi?

Reputable payroll solution providers prioritize data security by implementing features such as encryption, access controls, and regular backups. The best payroll software options for Delhi are factoHR, PocketHRMS, and EasyHR.

How Easy Is It to Implement a Payroll System?

Most payroll systems are relatively user-friendly and offer assistance or tutorials. The complexity of implementation depends on your business’s size and needs.

© 2026 Copyright factoHR