Payroll Fraud: Types & Prevention Tips for 2026

Table of Contents

Imagine that this Year, a Company Faces a Significant Loss, Compared to the Sharp Profit Recorded Last Year. Due to this, the Company Temporarily Paused Paying Bonuses to the Employees. According to the Investigation, More than 15 Ghost Employees were Registered in the Payroll Software. the Company Took this Issue as an Opportunity to Strengthen Payroll Controls and Improve Verification Protocols.

According to research, businesses lose 5% of revenue each year due to fraudulent activities.

For example, if your company’s topline is ₹1,000 Cr, then ₹50 Cr is potentially at risk. Yet, many companies overlook this risk or fail to appreciate its magnitude fully.

In this blog, you will learn about the different fraudulent payroll possibilities and how to implement payroll fraud prevention.

What is Payroll Fraud?

An individual or entity trespasses on the security wall of the payroll system to gain a monetary benefit. Fraudulent activities are often carried out discreetly to undermine the company’s financial stability. The company suffers reputational damage, and stakeholders are affected. Therefore, this results in a loss of investor confidence.

Employers have direct access to the payroll system, making them more likely to tamper with it. They can manipulate the timesheets, take unapproved bonuses, and create ghost employees to pay them, indirectly shifting money to their accounts.

Most payroll fraud occurs due to a lack of payroll audits, inadequate internal controls, and the misuse of power. Employees often find loopholes in payroll security and attempt to exploit them for personal gain. Companies need to implement payroll fraud detection software to prevent the risk of monetary loss.

What are the Types of Payroll Fraud Schemes?

To ensure payroll compliance, it is crucial to understand the mechanisms by which payroll fraud occurs. Let’s explore the possible fraud schemes.

Ghost Employees

Ghost employees are non-existent people registered in the company’s payroll system. The company has not hired these employees. Through these employees, fraudulent activities are performed, such as diverting money to their accounts and inflating work hours.

Timesheet and Overtime Fraud

Timesheet fraud refers to employees inflating their working hours to gain personal benefit. Generally, employees themselves are part of this fraud. The goal of timesheet fraud is to receive an overtime bonus and cover up hours that the employee did not work.

When employees clock in and out of work on behalf of another employee who is late or absent, it is referred to as buddy punching. This type of fraud is practiced in small organizations. Due to these frauds, performance reports are inaccurate, and HR professionals are unable to make correct decisions. Moreover, paying overtime bonuses to undeserving employees can lead to increased employee dissatisfaction.

Employee Misclassification

Misclassifying employees is a sneaky method to cut costs. The employer intentionally classifies the employee as a contractor to avoid paying unemployment taxes, income taxes, employee provident fund contributions, and employee insurance premiums. Employee misclassification is commonly observed in small to medium-sized organizations.

For example, a finance consulting company hires five full-time analysts. To avoid employee expenses, the company lists these employees as independent contractors in its payroll system. However, the nature of their responsibilities classifies them as employees under labor laws.

Expense Reimbursement Fraud

It is difficult for HR professionals to identify expense reimbursement fraud. The employee can engage in reimbursement fraud by submitting false claims, duplicating receipts, or intentionally inflating expenses.

These frauds, if not identified on time, spread easily. For example, if a person falsifies a reimbursement claim, they may influence their colleagues to engage in similar misconduct. In this way, the employees misuse the provided benefits. This can harm the organization’s reputation and foster a toxic culture.

Third-Party Payroll Scams

Cyber attacks are potential threats to payroll software security. Fraudsters can breach payroll security in two ways. The first one is a W-2 scam, a type of phishing attack that steals employees’ information from the payroll or HRMS system. The second is payroll diversion, which diverts the salary of an employee’s account to the fraudster’s account.

Duplicate Payment Fraud

Duplicate payment fraud results in financial loss for the company. The same payment is made twice to an employee or vendor. The fraudster tweaks the date and amount slightly and claims the money has not been credited yet, although this is a false claim. When the financial data is not stored properly, stakeholders can take advantage of the loophole.

Moonlighting or Sick Leave Fraud

Moonlighting or Sick Leave fraud is becoming common nowadays. Employees receive a salary from two different organizations. They falsely claim sick leave by providing fake health reports to work for another organization. These practices incur a reasonable cost to the company unless strict action is taken.

Advances and Loan Fraud

Sometimes, the company gives an employee an advance on their salary or a percentage of it for urgent needs. The following month’s salary is compensated accordingly. The fraud happens when the advance salary is not intentionally recorded. Therefore, there are no payroll deductions from the next salary. These types of fraud affect a company’s profit and loss account.

How to Prevent Payroll Fraud? (Best Practices)

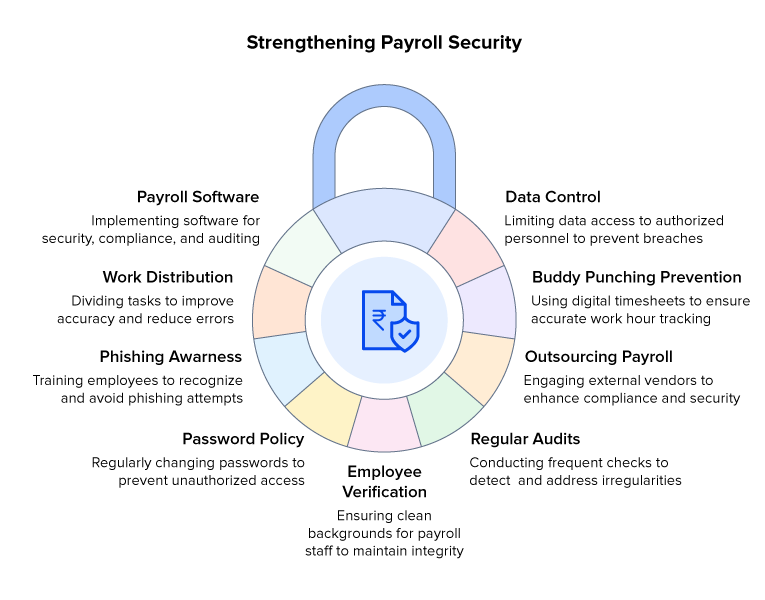

Although payroll fraud cannot be eliminated, strict measures can be implemented to strengthen payroll security. Also, clear and robust payroll policies minimize the risk of fraud.

Data Control

Data accessibility to various stakeholders promotes transparency, but also increases the risk of data breaches. To ensure security, payroll data should be limited to authorized stakeholders.

Prevent Buddy Punching

Utilize digital or electronic timesheets to eliminate the risk of fraudulent work hours. This will help the HR department analyze work hours accurately.

Outsource Payroll

When a system is outsourced, the probability of fraud decreases because it ensures payroll compliance and payroll audits. The outsourcing vendor is accountable for protecting data from cyberattacks.

Payroll Audit

Conducting strict, regular payment audits will help detect unusual activities and enable immediate action.

Employee Verification

Ensure that the background of employees who handle payroll data is clean. It means ensuring that the employee was not involved in any misconduct in the past. A negative employee record can harm the company’s reputation in the market.

Password Change Policy

Change employee passwords every 2-3 months to prevent data breaches. This precaution will protect the company from losing important information.

Avoid Phishing Attacks

Educate and train employees to identify phishing emails and prevent attacks. These types of attacks can be harmful to both the employee and the organization.

Work Distribution

To improve payroll accuracy, precise work distribution is necessary within the payroll process. For example, if one person processes salaries, then the other should work on the accounting of salaries.

Payroll Software

Implement payroll software to ensure payroll security, compliance, tax compliance, and audit.

Choosing Payroll Software with Advanced Fraud Prevention

Payroll frauds are rising at the same pace as the number of startups. It poses a threat to the organization’s financial aspect and damages the company’s reputation. Therefore, fraud mitigation should be the highest priority for any business. When selecting a payroll software, ensure it meets the following criteria.

AI Detection

Artificial intelligence (AI) plays a crucial role in detecting fraud. AI can detect unusual activities at the earliest, allowing for immediate action to be taken. AI mitigates the risk of payroll fraud and enhances operational efficiency.

AI studies patterns, behavioral trends, and anomalies to counter fraud activities, such as ghost employees, third-party scams, and expense reimbursement. Manually detecting these frauds will take longer. Therefore, AI proactively monitors payroll functions.

Biometric/MFA

Biometric authentication and multi-factor authentication eliminate buddy punching and time fraud. Moreover, it prevents unauthorized personnel from accessing data, thereby mitigating the risk of internal fraud and data breaches. Therefore, this technology saves the company from financial losses.

Audit Logs

Audit Logs are one of the crucial components of a payroll system. The purpose of audit logs is to track and record every action and change made within the payroll system. These logs note and record details such as who performed a specific action, what was done, when it was executed, and the location or device from which it was initiated. It provides a transparent view of time-stamped user activity, ensuring accountability for every action performed on the system.

Compliance Tools

These tools ensure that the payroll aligns with all relevant laws and regulations of the respective country. They help with complex tax calculations, send timely reminders, and generate regulatory reports. Therefore, they help an organization avoid legal risks and penalties.

factoHR ticks all of these boxes. It is one of the leading payroll software solutions. It protects the payroll system from external and internal fraud. Moreover, it automates the repetitive tasks, improving the accuracy of payroll operations. Therefore, factoHR’s AI payroll automation software is the ideal choice for your unique business requirements.

Conclusion

Payroll fraud is a growing threat—but with the right tools, it can be prevented. Modern payroll software equipped with AI-powered fraud detection, biometric or multi-factor authentication (MFA) security, and audit logs can significantly reduce an organization’s financial risk.

Don’t rely on technology alone; combine smart software with clear policies and regular employee training to build a fraud-resistant payroll environment that protects both your people and your profits.

Grow your business with factoHR today

Focus on the significant decision-making tasks, transfer all your common repetitive HR tasks to factoHR and see the things falling into their place.

© 2026 Copyright factoHR