FNF Policy: Process, Rules & Calculation (India)

Download FNF Policy PDF Format For Free

Table of Contents

Navigating employee exits doesn’t have to be a legal headache.

The Full and Final (FNF) Settlement process is often the most complex part of offboarding, involving intricate calculations of unpaid salaries, gratuity, and leave encashment. A single error here can lead to legal disputes and damage your employer brand. This comprehensive guide breaks down the FNF Policy into actionable steps.

Key Takeaways

- Full and Final Settlement (FNF) is the process of paying an employee’s dues when they leave a company for reasons like resignation or retirement.

- FNF policy ensures proper closure of the employee-employer relationship by clearing outstanding payments when an employee exits.

- This guide explains the FNF process, including resignation and termination scenarios under Indian labor laws.

- It covers key components like unpaid salary, along with gratuity and bonuses/deductions.

- Explore the step-by-step FNF in the corporate settlement process for clarity and ease of understanding.

- It provides a standard FNF policy template to help companies design or improve their own policies.

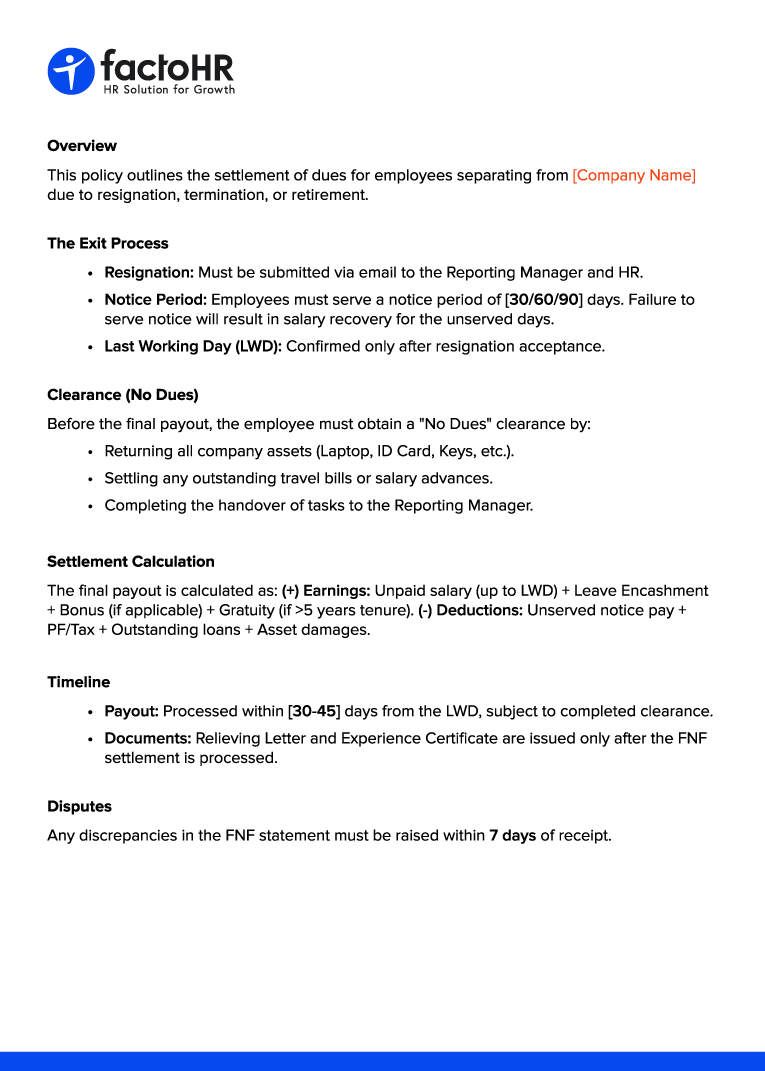

Overview of FNF Policy Template

Companies can use this customizable FNF on company Name for Indian payroll compliance.

Key Components of a Standard FNF Policy

The FNF policy includes multiple components/elements to ensure a smooth and equitable settlement process.

| Component | Taxable? | Exemption Limit |

|---|---|---|

| Unpaid Salary/Bonuses | Yes (TDS) | None |

| Leave Encashment | Partial | Least of: 10 months’ avg. salary, actual, or ₹3 lakh (non-govt.) |

| Gratuity | Exempt | Up to ₹20 lakh |

These are:

Unpaid Salary

Unpaid Salary covers wages for days worked from the resignation date up to the last working day. This component is the core of the settlement process, which includes any arrears and other pending benefits.

Leave Encashment

This includes unused earned/privileged leaves, and tax exemptions may apply for encashment. Companies need to follow their internal policies and laws under the Factories Act, 1948, to know the eligibility and payout.

Gratuity Payments

Gratuity Payments applies to employees with at least five years of continuous service, and its eligibility is verified during the HR clearance process. This statutory benefit ensures long-term recognition and complies with the Payment of Gratuity Act.

Bonuses and Variable Pay

This section includes outstanding performance incentives and statutory bonuses, which are calculated on a pro-rata basis to ensure fairness. Organizations should settle them during the clearance process.

Deductions and Recoveries

Deductions include loans and taxes (TDS on taxable components), and recoveries include unserved notice periods. Some of the statutory calculations, for example, EPF (12% of Basic + DA), are processed separately for transfer/withdrawal to avoid confusion.

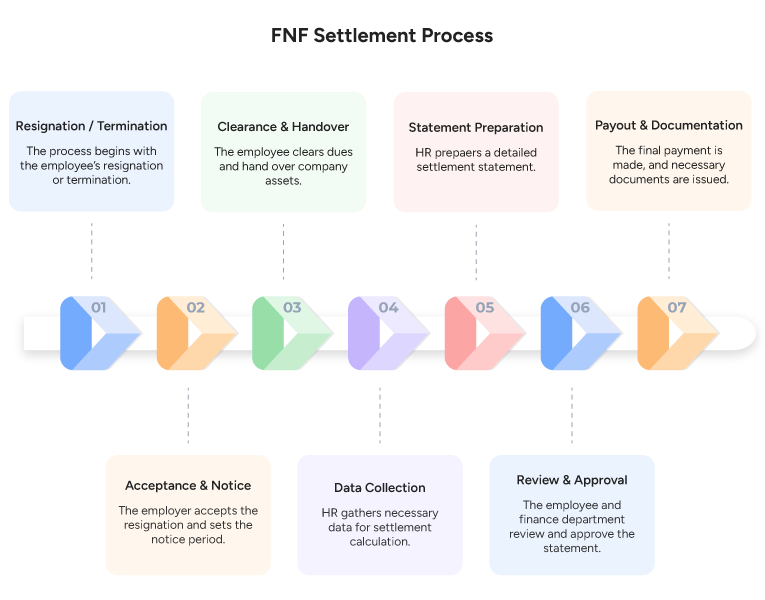

Step-by-Step FNF Settlement Process

Every organization has its own structured, full and final settlement process. Some of the basic steps are mentioned below:

Resignation or Termination

The process starts when an employee submits a written resignation or faces termination.

Acceptance and Notice Period

Once the resignation is submitted, the employer issues an acceptance letter. This letter includes the number of notice days an employee needs to serve the notice period.

Clearance and Asset Handover

This step includes clearances from multiple departments, for example, IT and HR. Asset handover includes returning company assets, like a laptop or ID.

Data Collation and Calculation

HR professionals compile data from various sources, like attendance, leaves, gratuity, encashments, bonuses, and calculate deductions, which include loans and taxes.

FNF Statement Preparation

When the calculations are made, HR teams prepare a detailed FnF settlement letter for an employee to review. This statement includes all key components and needs verification from an employee.

Review, Approval, and Agreement

Once the statement is verified by an employee, it goes for finance approval.

Payout and Documentation

The last step is to make the final payment through bank transfer, and a relieving certificate is issued.

Conclusion

Organizations should understand that a well-planned full and final settlement policy ensures all employee dues are paid transparently and on time. The dues should be paid to maintain employees’ trust by providing clear breakdowns of payments.

FNF policy is an important practice in HR, which helps ensure all the financial and administrative aspects are completed when an employee exits. When compliance with legal laws and regulatory requirements is maintained, companies can address issues and ensure a fair settlement.

💡 HR Resource: Need to draft the settlement email? Check out our ready-to-use FNF Letter Templates & Word Formats to communicate dues professionally.

FAQs

What is the Full Form of FNF?

FNF full form is Full and Final Settlement, which is the process of clearing all outstanding financial dues when an employee exits a company. It can be through resignation or termination.

How to Calculate FNF?

The calculation of the FNF process is done by adding unpaid salary and other outstanding dues, for example, bonuses and reimbursements. After the deductions like taxes and loans are calculated, the final amount is derived.

What are the Common Challenges in FNF Settlement?

Some of the common challenges include:

- Calculation discrepancies from complex salary structures

- Delays due to documentation issues

- Disputes over tax deductions or missing allowances

What is Included in the Full and Final Settlement Amount?

There are multiple components included in the full and final settlement amount. They are:

- Unpaid salary for the final month

- Leave encashment for unused leaves

- Gratuity (for 5+ years service)

- Bonuses and incentives

- Pending reimbursements

- Provident fund transfer or withdrawal

- Taxes and loans

- Notice period compensation

How is Leave Encashment Calculated in FNF?

Leave encashment is calculated as:

Formula: Basic Salary + Dearness Allowance per month / 30 × Unused leave days.

For example, with ₹1,20,000 basic salary and 45 unused days:

- Calculation: 1,20,000 / 30 * 45 = ₹1,80,000

How Should Company Property be Returned?

Employees who are exiting the firm should return all company assets, for example, laptops. Employers can issue demand letters with deadlines, providing details regarding property descriptions and consequences for non-compliance.

When Will the Final Settlement be Processed?

Final settlement is processed on or soon after the last working day. Organizations should make the payment by the 7th-10th of the following month for components like leave encashment.

What is the New Time Limit for Full and Final Settlement in India?

Under the new Labour Codes, effective November 2025, full and final settlement of employees must be completed within two working days of the employee’s last working day.

Can a Company Withhold FNF if I don’t Return the Laptop?

In case a company asset, like a laptop, is not returned, the company cannot withhold FNF for the same. They can deduct or recover the expenses legally if specified in contracts or policies. Also, note that if an employee fails to return a company asset, it is a criminal offense under the Companies Act.

Can an Employer Deduct Salary for an Unserved Notice Period?

Yes, employers can deduct from salary if notice period is unserved FNF (up to one month under the Delhi S&E Act if applicable).

What Legal Action Can I Take if My FNF is Delayed?

In case of delay in FNF, employees can file claims under the Payment of Wages Act for recovery of dues along with interest. Note that the court can direct payment with penalties, and disputes may arise for delays beyond 30-45 days.

Is Gratuity Mandatory in FNF?

Gratuity is mandatory in FNF for employees with 5 years of continuous service (or 4 years 10 months under the Payment of Gratuity Act). It is payable within 30 days and calculated as:

Last Drawn Salary / 26 × 15 × Years of Service

Is a Full and Final Settlement Taxable?

Yes, FNF components like salary and bonuses are taxable with TDS deducted under the Income Tax Act 1961. Gratuity and certain leave encashments can be exempted.

Transform your HR operations with factoHR today

Choose a perfect plan satisfying your business demands and let factoHR handle all your HR’s tasks efficiently.

© 2026 Copyright factoHR