Labour Law in India (2025–2026): Guide for Employer & Employee

Download New Labour Codes

Table of Contents

On the 21st of November 2025, the government implemented four new labour codes with a series of notifications. For employees, the new labour codes in India provide social security and a number of other benefits. For employers, it helps simplify the compliance structure and avoid legal conflicts.

The new 4 labour codes consolidate 29 labour laws in India 2026 and significantly reform India’s labour laws. You will know about all the updates on labour laws, the four new labour codes, and the changes in effect from November 2025.

What’s inside?

- November 2025 update: what changed?

- The new labour codes in India, including:

- The Code on Wages, 2019,

- Industrial Relations Code, 2020,

- Social Security Code, 2020, and

- Occupational Safety, Health and Working Conditions Code, 2020.

- New labour codes VS old labour laws

- Impact on employers and employees, including part-time employees and contractors, along with benefits.

- Structural and regulatory changes: national floor wages, dispute resolution mechanisms, among others.

What’s Changed in Indian Labour Laws in November 2025

In November 2025, over 29 labour laws were amended and consolidated into four labour codes. Earlier, labour laws in India comprised different laws covering areas of wage and hour law, employee relations, and safety regulations. Now, these different labour laws are subsumed under four codes, which are:

- The Code on Wages 2019,

- Industrial Relations Code 2020,

- Social Security Code 2020, and

- Occupational Safety, Health, and Working Conditions Code 2020.

The New Labour Codes in India 2026

Each of these new labour codes addresses a particular area of regulation.

1. Code on Wages, 2019 (Right to Minimum Wages for Everyone)

Passed in 2019, the Code on Wages regulates areas related to payment of wages, minimum wages, equal remuneration, and payment of bonuses. It provides for a national floor wage in light of the cost of living. It aims to combine wage and hour regulations under a single framework. The Code on Wages repeals four labour laws in India.

*For a list of repealed laws, refer to the table below.

2. Industrial Relations (IR) Code, 2020

The Industrial Relations Code, 2020, modernizes labour law by officially recognizing trade unions at the central and state levels. It also raises the limit for approval for layoffs to 300 employees. Additionally, the act also provides for a skill retrenchment fund and improves women’s representation in the grievance redressal committee.

3. Social Security Code, 2020 (Social Security for Everyone)

This code aims to unify laws related to EPF, ESIC, gratuity, and other social security provisions. Most importantly, it provides for social security to gig and platform workers, contract workers, as well as unorganized workers. It simplifies the registration process by providing for registration through the Aadhar number.

4. OSH Code – 2020 (Right of Security to Workers in all Situations)

The Occupational Safety, Health and Working Conditions Code, 2020, consolidates and replaces 13 laws related to safety regulations and working conditions. The code aims to unify safety standards and establish rules related to working conditions and health. Another objective of OSHWC is to simplify compliance and improve employee welfare.

These four new labour laws repeal a number of old labour laws in India. The table below lists the repealed laws and their corresponding new Codes.

| Old Labour Laws Replaced by New Labour Codes | |

|---|---|

| New Labour Codes 2026 | Law Repealed |

| Code on Wages, 2019 | Payment of Wages Act 1936, Minimum Wages Act 1948, Payment of Bonus Act 1965, Equal Remuneration Act 1976 |

| Code on Social Security, 2020 | Employees’ Compensation Act 1923, ESI Act 1948, EPF Act 1952, Employment Exchanges Act 1959, Maternity Benefit Act 1961, Payment of Gratuity Act 1972, Cine-Workers Welfare Fund Act 1981, BOCW Cess Act 1996, BOCW Act 1996, Unorganised Workers’ Social Security Act 2008 |

| Industrial Relations Code, 2020 | Trade Unions Act 1926, Standing Orders Act 1946, Industrial Disputes Act 1947 |

| Occupational Safety, Health and Working Conditions Code, 2020 (OSH – Code) | Factories Act 1948, Mines Act 1952, Dock Workers Safety Act 1986, Contract Labour Act 1970, Inter-State Migrant Workmen Act 1979, Working Journalists Acts 1955 & 1958, Motor Transport Workers Act 1961, Beedi & Cigar Workers Act 1966, Sales Promotion Employees Act 1976, Plantations Labour Act 1951, Labour Laws (Exemption from Returns & Registers) Act 1988 (partial repeal) |

Official Resource: https://www.pib.gov.in/PressReleasePage.aspx?PRID=2192524®=3&lang=2

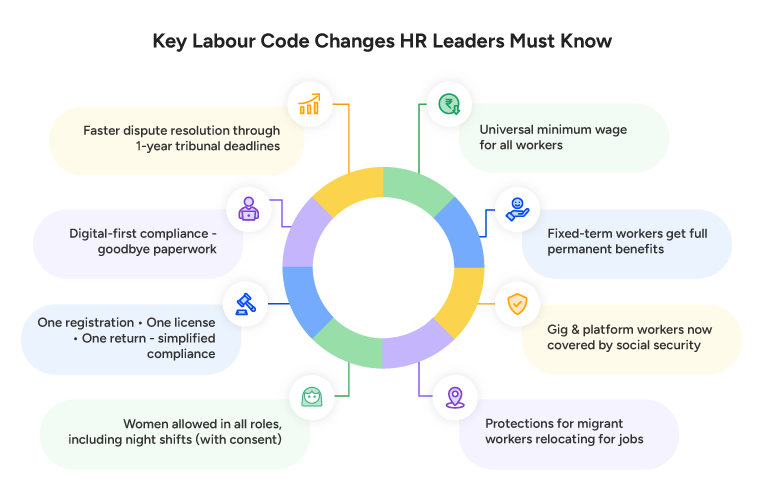

New Labour Codes vs Old Labour System: What Changed?

Indian labour laws are said to undergo a much-needed reform in the areas of minimum wages, social security, and safety. The four new labour codes expand on the old labour system and make some necessary changes to the old labour system. The table below lists some of the important changes from an employee’s and an employer’s perspective.

| 12 Major Labour Law Changes in India | ||

|---|---|---|

| Area of Change | Before (Earlier Law) | After (New Labour Codes) |

| Expanded Minimum Wages | Applied only to scheduled employees. | Covers all the employees with the national floor wage |

| Revised Wage Definition and Take-Home Pay | Different definitions as per state regulations. | A uniform definition of wages covering full-time, part-time, contract, gig, and platform workers. |

| Social Security Coverage | Limited coverage of EPF, gratuity, and ESI. | Extensive coverage of EPF, ESI, and gratuity for all the employees including workers in the unorganized sector. |

| Gratuity Eligibility | Required a minimum of five years of service for all employees. | Only one year of service for fixed-term employees. *The five year rule still applies to full-time employees. |

| Mandatory Appointment Letters | Not mandated for all the sectors. | Mandatory in all the sectors including unorganized sector and audio / visual content creation. |

| Overtime at Double Wages | Overtime was mandatory but rate differed based on sector and state specific regulations. | Mandatory overtime pay at double the rate of wages in all the sectors. |

| Increased Leave Entitlement | Employees were required to work for 240 days to become eligible. | Employees become eligible for annual paid leave after completing 180 days of work in a year. |

| Women Can Work Night Shifts | Generally restricted in all sectors except IT and related sectors. | Can work with their consent in any sector. |

| Work From Home Provision | No specific legal provision. | The codes formally recognize work from home and allow relevant governments to form related rules. |

| Free Annual Health Check-ups | Only mandatory for workers engaged in hazardous processes. | Mandatory for all the employees above the age of 40 years. |

| Timely Wage Payment | Only for employees falling under certain criteria. | All the employees would receive timely wage payment. |

| Commuting Accidents Covered | Coverage based on judicial interpretation and | Universal coverage with uniform definition of a commuting route. |

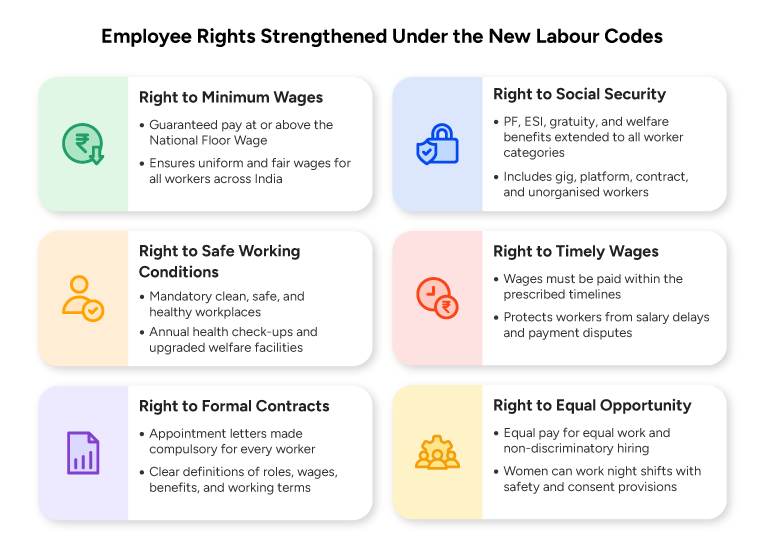

Impact of New Labour Laws on Employees

The four new labour codes significantly improve working conditions, provide for women’s representation and participation, improve wage structure, and cover all the workers engaged in formal or informal work.

- National floor wage: Employees will receive sufficient wages and will be able to improve their living standards.

- Social security: Gig, platform, unorganized, and part-time employees will also receive the same benefits in EPF and ESI as full-time employees.

- Extensive coverage: Earlier, labour laws only covered full-time and, to some extent, contract employees. Now, the new labour codes recognize workers across all sectors, including the unorganized sector.

- Equal representation: Women can also participate equally in any work, including night shifts. The grievance redressal committee is also required to include women representatives.

- Working hours: The Occupational Safety, Health and Working Conditions Code 2020, reduces the daily working hours from 9 hours to 8 hours.

Impact of New Labour Laws on Employers

For employers, the new labour laws simplify compliance. However, they also affect salary structure and employee classification.

- Compliance: A unified process for returns and registration would reduce compliance burden.

- Wage and salary structure: Employers will need to reconsider their wage structure, as the code on wages introduces the concept of a national floor wage.

- Payroll and payment of wages: Establishments will need to pay wages on time to all employees. So, employers will need to have sufficient cash flows.

- Workplace safety and health: The OSHWC code introduces a number of safety regulations, including mandatory health check-ups. So, employers will need to revisit their benefits administration policies.

- Employer-employee relations: Provisions in the IR code provide for mandatory notice before strikes. This can be beneficial for employers as they would have time to reschedule projects.

Types of Workers Who Get Benefits Under the New Labour Law

There are eleven categories of workers that benefit from the four new labour codes, including full-time, part-time, contract, gig, and platform workers.

1. Full-Time Employees

Codes that cover them: Code on Wages, Social Security Code, OSHWC Code, Industrial Relations Code

Benefits

- Unified wage rules ensure predictable salary, overtime, and bonus calculations.

- Stronger social security coverage, including PF, ESIC, gratuity, and maternity benefits.

- Safer workplaces with mandatory welfare facilities and health monitoring.

- Greater job clarity through defined service conditions and dispute mechanisms.

2. Contract Workers

Codes that cover them: Code on Wages, Social Security Code, OSHWC Code

Benefits

- Standardized wage rules regardless of contractor engagement.

- Coverage under PF/ESIC is determined on the basis of the establishment and contractor registration.

- Mandatory safety, sanitation, and welfare facilities at contractor-managed sites.

- Clear responsibility is placed on the contractor and principal employer.

3. Fixed-Term Employees

Codes that cover them: Industrial Relations Code, Code on Wages, Social Security Code

Benefits

- Same pay and working conditions as permanent staff for the contract’s duration.

- Access to key statutory benefits, including gratuity on a pro-rata basis.

- Predictable terms of engagement through written fixed-term agreements.

- Social security benefits are available throughout the contract period.

4. Gig Workers

Codes that cover them: Social Security Code

Benefits

- Dedicated social security framework designed for gig-based work.

- Accident, disability, and health-support schemes are funded through the government and aggregators.

- Registration-based access to welfare benefits without traditional employment relations.

- Digital registration for access to future schemes.

5. Platform Workers

Codes that cover them: Social Security Code

Benefits

- Access to platform-specific welfare plans (health, social insurance, risk cover).

- Aggregators are required to contribute a percentage of turnover toward welfare funds.

- National and state-level welfare boards for improving scheme implementation.

6. Daily-Wage & Unorganised Sector Workers

Codes that cover them: Social Security Code, Code on Wages

Benefits

- Minimum wage and floor-wage protection across all categories of casual work

- Digital enrolment into unorganised-worker welfare programs

- Access to health, life insurance, skill-building, and construction-worker welfare schemes

- Access to state-level support

7. Women Workers

Codes that cover them: Social Security Code (maternity), Code on Wages, OSHWC Code

Benefits

- Expanded maternity and nursing benefits and childcare facility access, where mandated.

- Equal wage protection and gender-neutral job classifications. Permission to work night shifts with safety, transport, and consent requirements.

- Improved workplace hygiene, privacy, rest facilities, and welfare amenities.

8. IT, Remote & Knowledge Workers

Codes that cover them: Code on Wages, Social Security Code, OSHWC Code (as applicable)

Benefits

- Consistent wage calculations for bonuses, PF, and allowances.

- Eligibility for social security when engaged through covered establishments.

- Flexibility under standing-order models for remote and hybrid work setups.

- Duty-of-care standards for employer-managed workspaces or designated remote hubs.

9. Factory & Industrial Workers

Codes that cover them: OSHWC Code, Social Security Code, Code on Wages, Industrial Relations Code

Benefits

- Strict hazard-management rules and safety controls for manufacturing and industrial sites.

- Welfare amenities like canteens, rest areas, medical rooms, and protective equipment.

- Annual medical checks, working-hour standards, overtime rules, and shift safeguards.

- Clear industrial-relations procedures for disputes, layoffs, and re-skilling.

10. Apprentices & Trainees

Codes that cover them: Industrial Relations Code, Code on Wages, Social Security Code

Benefits

- Recognised classification with protected training terms and regulated stipend.

- Defined training hours and structure for skill-building.

- Access to select welfare measures and safety protections inside establishments.

- Safeguards against misuse of “trainee” status.

11. Audio/Visual Content Creators (Audio-Visual Workers)

Codes that cover them: OSHWC Code (dedicated chapter), Code on Wages

Benefits

- Mandatory written contracts stating wages, timelines, safety terms, and dispute process.

- Registration of each engagement with the designated authority.

- Clear rules for working hours, safe studio/production conditions, and welfare facilities.

- Secure electronic wage payments for transparency and auditability.

Structural & Regulatory Changes under the New Labour Codes

National Floor Wage

Section 9 of the Code on Wages, 2019, empowers the Central Government to fix a National Floor Wage after consulting with the Central Advisory Board. This wage acts as a mandatory minimum threshold across India, ensuring no state fixes a minimum wage below this limit.

Gender Neutrality

Section 3 of The Code on Wages, 2019, prohibits discrimination in wages and recruitment. Additionally, section 42 of the OSHWC code removes employment restrictions on women by allowing them to work on night shifts with their consent.

Inspector-Cum-Facilitator System

Section 51 of the Code on Wages, 2019 establishes the ‘Inspector-cum-Facilitator’, replacing the traditional, punitive ‘Inspector’ role with one that primarily advises employers on compliance issues. The facilitator promotes a culture of voluntary compliance and transparency through a web-based inspection scheme and electronic records.

Mechanisms for Dispute Resolution

Section 46 of the Industrial Relations Code, 2020, mandates a statutory Grievance Redressal Committee (GRC) for fast, internal resolution of industrial disputes in larger establishments. Clear time limits are set for conciliation and judicial proceedings, ensuring quick resolution of conflicts.

Simplified Compliance

Section 130 of the Code on Social Security shows that the new framework replaces 29 complex, overlapping Central Labour Laws with four comprehensive Codes. This simplification is achieved by standardizing compliance forms, reducing the total number of registers required, and encouraging the electronic filing/maintenance of all records.

National OSH Board (Occupational Safety & Health)

Section 21 of the OSHWC Code, 2020 mandates the Central Government to establish a National Occupational Safety and Health Advisory Board to advise the Government on safety, health, and working conditions. This advisory body is responsible for monitoring standards, recommending research, and framing rules.

Social Security Board

Section 6 of the Code on Social Security, 2020, establishes a National Social Security Board to advise the Central Government on formulating and monitoring welfare schemes. This focus is primarily on unorganized workers, gig workers, and platform workers. The Board is central to extending comprehensive social security coverage, including health, life, and disability benefits, to these previously excluded categories.

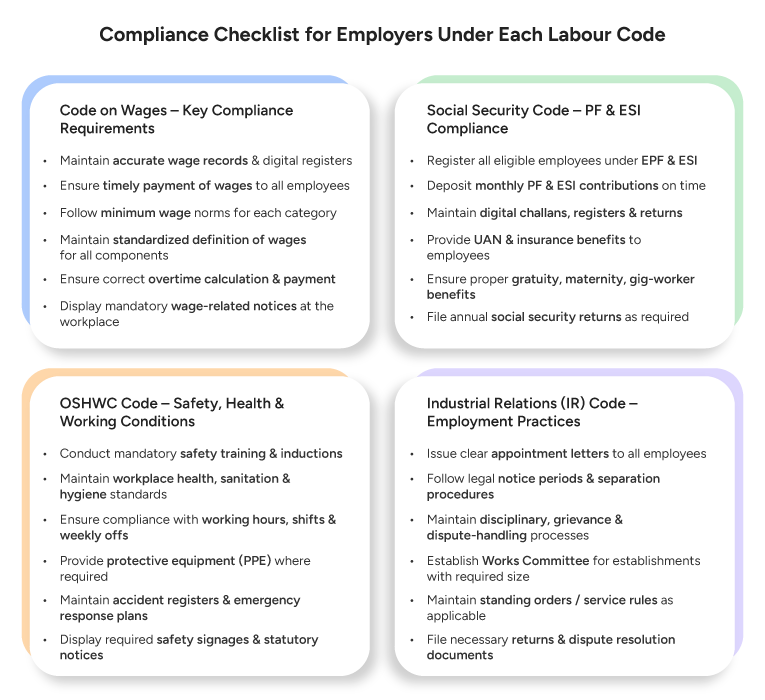

Employer Compliance Checklist

This is a checklist for improving compliance with the four new labour codes.

- Update employment contracts, as the new labour laws provide a number of new employee benefits and change criteria related to old benefits.

- Review salary structure, as national floor wage replaces minimum wage rates.

- Ensure proper wage breakup, as wage components like ESI and EPF are necessary to include even in the payslips of contract and gig workers.

- Ensure timely wage payment: even platform workers and contractual employees are entitled to timely wage payment under the new labour laws in India.

- Maintain employee records online: a unified process for registration is digital. So, storing employee records digitally can help improve efficiency.

From Compliance to Care: Redefining Worker Experience in India

The new labour laws in India not only improve compliance but also improve employee welfare. Provisions like unified processes for returns simplify compliance. Mandatory health check-ups improve employee health and well-being.

Additionally, social security coverage for gig, platform, unskilled, and contract workers can improve their living conditions. Mandatory appointment letters for all the workers, including content creators, ensure that employment is formalized, and all the workers receive benefits introduced under the four new labour codes.

FAQs

How do the New Labour Codes Affect Employers in India?

Manpower costs rise as at least 50% of CTC must count as “wages,” increasing PF, gratuity, and other benefits. Compliance is simpler with single registration, unified returns, and retrenchment approvals now required only for 300+ workers.

What are the Key Labour Law Changes for Employees in 2026?

Workers, including gig, platform, contract, and fixed‑term staff, get extended social‑security coverage, mandatory appointment letters, timely wages, equal pay, and safe night shifts for women. Fixed‑term employees qualify for gratuity after one year.

How does the Minimum Wage Rule Change under the New Labour Codes?

The national floor wage prevents states from setting minimum pay below a baseline, standardizing wages across sectors. Coverage now extends to all workers, including informal and gig employees.

How Can Employers Simplify Compliance under the New Codes?

The 29 old laws are consolidated into four codes, reducing complexity. Employers now need one registration and a unified annual return, cutting paperwork and streamlining compliance.

What are the Penalties for Non-Compliance with Labour Laws in 2026?

Minor procedural lapses are mostly decriminalized, with fines replacing jail for first-time breaches. Serious violations like unsafe conditions or non-payment of statutory benefits still attract heavy penalties.

How do the Labour Code Changes Affect Contract and Temporary Workers?

Contract and fixed‑term workers now get benefits similar to permanent staff, including social security, leave, and medical cover. Fixed-term employees are eligible for gratuity after one year, and gig/platform workers are formally covered under social security.

Are there any Regional Differences in Implementing the New Labour Laws 2026?

Labour is a concurrent subject. While central laws set minimum standards, states must enact rules individually, so some provisions vary regionally until state rules are finalized.

How Can HR Teams Prepare for the New Labour Law Compliance Requirements?

HR teams must reconfigure payroll to meet the 50% wage rule, update contracts and job descriptions for fixed-term or gig workers, issue mandatory appointment letters, and implement digital compliance and reporting systems.

What are the Updated Gratuity Provisions under New Labour Laws in India 2026?

Fixed-term employees qualify for gratuity after one year instead of five. The redefined wage base increases payouts, ensuring higher gratuity payments when employees exit.

Grow your business with factoHR today

Focus on the significant decision-making tasks, transfer all your common repetitive HR tasks to factoHR and see the things falling into their place.

© 2026 Copyright factoHR